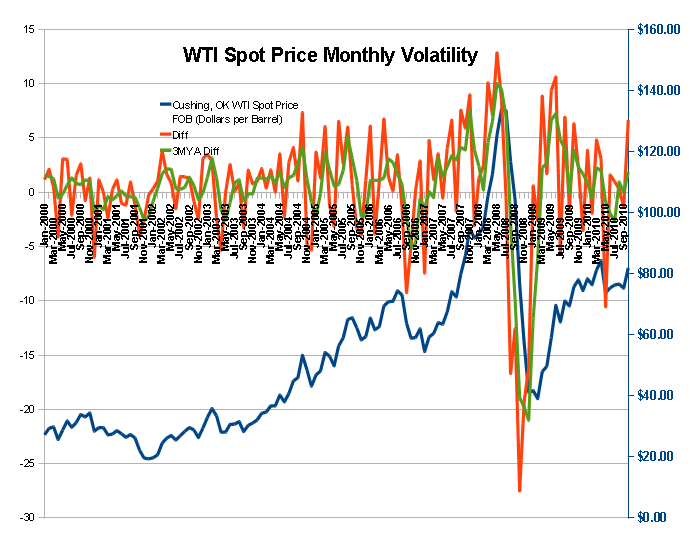

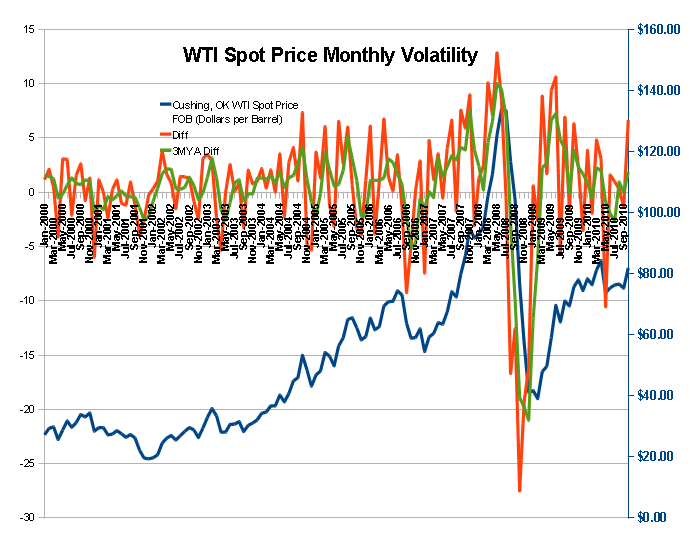

TheDude wrote:SeaGypsy wrote:The main factor most got wrong is the relative lack of volatility.

So we're headed back to a new normal of ca. $90/bbl? With a steady creep up to ca. 4x that figure? Or?

I like the volatility profile here - looks like a truncated volcanic crater, the most famous example being Crater Lake, formerly Mount Mazama. And we know how that thing

wrapped up its career. It isn't extinct, either - you still have hot springs on the bottom of the lake.

Depends whose money you are using. Margins look like remaining tight; leverage is likely to eat up profits on short trades. On the other hand probably the best investment in the world right now would have to be a tanker of oil hauled up in a demurage free port with a 3rd world crew and a bit of oversight. I'm only half joking.

Metaphoricly speaking;

I am working on a design for a very personalised yacht.

The design fits under the heading of 'proa' or outrigger.

Overall speed is dictated by the length of the main hull under a ratio of 1/17; it is designed like a knife, a piercer. It is the engine of the vessel; where the outrigger is much shorter and designed to plane alongside the main hull like a surfboard. Latteral traction is almost all in the main hull, but it is controlled from the smaller planing hull.Too close together, not enough leverage for stability, too far apart, impossible to control due to drag leverage. The whole thing is dependent on rigging. It can sail in either direction and steered by sail position relative to the wind, without a rudder.

Functionally this kind of alignment is what's being strived for; with Asia providing the momentum and European/ American bankers planing alongside.

The oil nations are the ropes holding the whole thing together.

I personally think the whole gig is rigged.

Barring a black swan event (impossible either way); the controlled jacking of prices will continue at about double the pace of inflation in the $USD.

So, yes, $90 is the new normal.