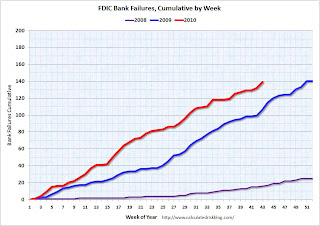

Well, I think that the FDIC won´t close any bank today, so that gives us a grand total of 157 bank closures on 2010.

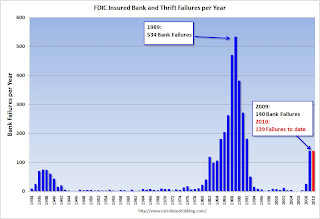

Review of the 2010 Bank Failures and Their Effects on DepositorsThis year ended with 157 bank closures which was 17 more than failed last year. The number bank failures grew considerably when the financial crisis began in 2008. The number of failures went from 3 in 2007 to 25 in 2008. It's hard for me to remember the days before 2008 when bank failures were rare.

Depositors with large savings have a little less to worry about in terms of bank failures. The FDIC $250K coverage limit became permanent when the Dodd-Frank Wall Street Reform and Consumer Protection Act became law in July. This same coverage limit also applies to NCUA-insured credit unions.

The higher coverage limit was nice, but it didn't make a difference for the vast majority of bank failures this year. In these cases the FDIC was able to find buyers for the failed banks that assumed all regular deposits.

Large Banks That Failed

One thing that changed quite a bit from 2009 was that most of this year's failures were small banks with assets under $1 billion. In 2009 we had large regional banks like Colonial, Guaranty and BankUnited that failed. All had assets over $12 billion. The largest bank that failed in 2010 was Westernbank Puerto Rico which had $11.94 billion in assets. The largest bank based on the mainland that failed was Amcore Bank, N.A. which had $3.8 billion in assets. It's interesting to note that Puerto Rico had both the largest and second largest bank failure of 2010. R-G Premier Bank of Puerto Rico which had $5.92 billion was the second largest. The three Puerto Rican bank failures cost the FDIC Deposit Insurance Fund (DIF) an estimated $5.28 billion.

Below is a list of all the banks with at least $1 billion in assets that failed in 2010. The list is sorted by size. The total number of these banks is 23. As I was making the list I noticed the vast majority of these failures occurred in the first half of the year. Only 4 banks with at least $1 billion in assets failed in the second half of the year.

1. Westernbank Puerto Rico, Mayaguez, PR - $11.94 billion

2. R-G Premier Bank of Puerto Rico, Hato Rey, PR - $5.92 billion

3. Amcore Bank, N.A., Rockford, IL - $3.8 billion

4. La Jolla Bank, FSB, La Jolla, CA - $3.6 billion

5. Frontier Bank, Everett, WA - $3.50 billion

6. Riverside National Bank of Florida, Fort Pierce, FL - $3.42 billion

7. Midwest Bank and Trust Company, Elmwood Park, IL - $3.17 billion

8. TierOne Bank, Lincoln, NE - $2.8 billion

9. Eurobank, San Juan, PR - $2.56 billion

10. First Regional Bank, Los Angeles, CA - $2.18 billion

11. ShoreBank, Chicago, IL - $2.16 billion

12. CF Bancorp, Port Huron, MI - $1.65 billion

13. Hillcrest Bank, Overland Park, KS - $1.65 billion

14. Advanta Bank Corp., Draper, UT - $1.5 billion

15. Horizon Bank, Bellingham, WA - $1.3 billion

16. Community Bank and Trust, Cornelia, GA - $1.21 billion

17. Charter Bank, Santa Fe, NM - $1.2 billion

18. Broadway Bank, Chicago, IL - $1.2 billion

19. Premier Bank, Jefferson City, MO - $1.18 billion

20. City Bank, Lynnwood, WA - $1.13 billion

21. Columbia River Bank, The Dalles, OR - $1.1 billion

22. Crescent Bank and Trust Company, Jasper, GA - $1.01 billion

23. Appalachian Community Bank, Ellijay, GA - $1.01 billion

http://www.depositaccounts.com/blog/2010/12/review-of-the-2010-bank-failures-and-their-effects-on-depositors.htmlI for one, think that the magic printing trick is not going to work so well next year and we will see this number climb higher.

"I learned long ago, never to wrestle with a pig. You get dirty, and besides, the pig likes it."

George Bernard Shaw

“You can ignore reality, but you can't ignore the consequences of ignoring reality.” Ayn Rand