Moody's downgrades $64 billion of U.S. muni debt

http://www.reuters.com/article/2012/06/ ... AK20120622

THE Muni Thread (merged)

Re: THE Muni Thread (merged)

mattduke wrote:Moody's downgrades $64 billion of U.S. muni debt

http://www.reuters.com/article/2012/06/ ... AK20120622

Notice the timing (Moody's bank downgrades)? You're supposed to comment when making such a post, per the COC, as I understand it. My comment is that the first sentence of this article (in bold) says it all. I quote it here:

Reuters wrote:

Moody's Investors Service on Friday cut ratings on $64 billion of municipal bonds, including debt owed by 1,675 local and state governments, because the obligations rely on 15 global banks the Wall Street credit agency sees as less steady.

I'm not sure which is the chicken and which is the egg, but it sure seems like the global banking system's implications for the global economy are more and more frightening. Meanwhile the politicians do little of substance...

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: THE Muni Thread (merged)

The Chapter 9 filing allows Stockton, a city of 292,000, to suspend payments to creditors while it seeks court approval for a plan that balances its revenue with its debt. The budget for the fiscal year beginning July 1 calls for defaulting on $10.2 million in debt payments and cutting $11.2 million in employee pay and benefits under union contracts that could be voided by the bankruptcy court.

Remember, nobody saw the Muni crash coming.

http://www.businessweek.com/news/2012-0 ... protection

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: THE Muni Thread (merged)

Residents of Moberly, Mo., got a shock last year when they discovered that their city had guaranteed $39 million in bonds, sold by an independent authority, to help a Chinese company build a plant to make sucralose, an artificial sweetener.

The project fell apart in a matter of months, and residents learned that they had been misled about the company’s track record in China — and that they were now expected to make the bond payments.

But municipal bond market participants say they were shocked, too, by how quickly the city of about 14,000 would walk away from a solemn promise to guarantee the debt payments through 2025, the life of the bonds.

http://www.nytimes.com/2012/06/26/busin ... o-pay.html

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: THE Muni Thread (merged)

San Bernardino’s interim city manager recommended Tuesday evening that the city file for bankruptcy protection, saying it may not be able to make payroll over the next three months.

"We have an immediate cash flow issue," Andrea Miller told the mayor and seven-member City Council.

And now, San Bernadino. Sell Muni Bonds!

http://latimesblogs.latimes.com/lanow/2 ... -says.html

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: THE Muni Thread (merged)

The City of Compton, a city of 93,000 people located on the outskirts of Los Angeles, must decide by September 1 whether to seek bankruptcy, according to its two most senior financial officials.

Such a move would see it join a growing number of deficit-hobbled California cities that have used the filing to restructure onerous debt loads.

Another one bites the dust. Many, many more to come.

http://news.yahoo.com/city-compton-may- ... 55526.html

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: THE Muni Thread (merged)

And now Buffet is bailing out of his Muni exposure.

http://online.wsj.com/article/SB1000087 ... 04118.html

http://online.wsj.com/article/SB1000087 ... 04118.html

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: THE Muni Thread (merged)

So did investors actually buy $39 million in bonds based on a guarantee by a "city" of 14000?mattduke wrote:Residents of Moberly, Mo., got a shock last year when they discovered that their city had guaranteed $39 million in bonds, sold by an independent authority, to help a Chinese company build a plant to make sucralose, an artificial sweetener.

The project fell apart in a matter of months, and residents learned that they had been misled about the company’s track record in China — and that they were now expected to make the bond payments.

But municipal bond market participants say they were shocked, too, by how quickly the city of about 14,000 would walk away from a solemn promise to guarantee the debt payments through 2025, the life of the bonds.

http://www.nytimes.com/2012/06/26/busin ... o-pay.html

Facebook knows you're a dog.

-

Keith_McClary - Light Sweet Crude

- Posts: 7344

- Joined: Wed 21 Jul 2004, 03:00:00

- Location: Suburban tar sands

Re: THE Muni Thread (merged)

Somnolent Moody's awakens to warn muni bondholders of the obvious.

http://hosted.ap.org/dynamic/stories/U/ ... 7-19-12-49

http://hosted.ap.org/dynamic/stories/U/ ... 7-19-12-49

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: THE Muni Thread (merged)

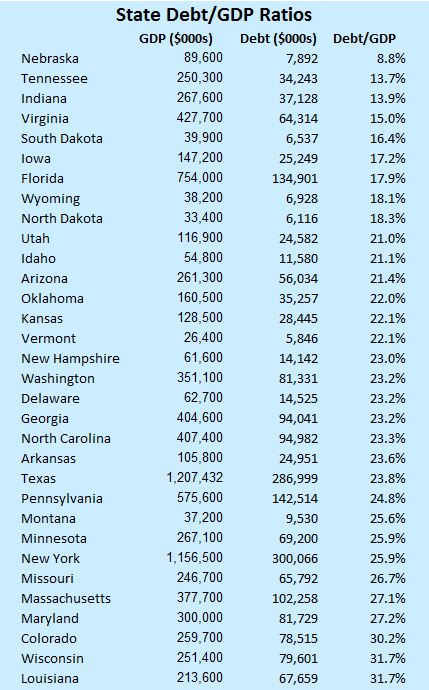

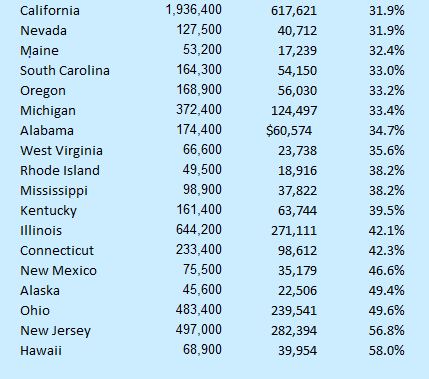

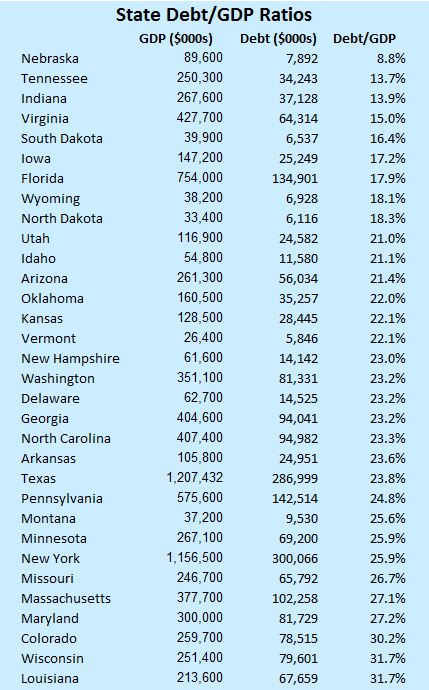

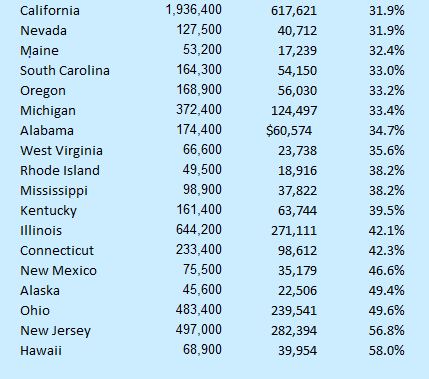

There's no State Debt thread so I thought I'd post this here. It's an article about State's debt and ranks them as a percentage of the State's GDP.

-

dinopello - Light Sweet Crude

- Posts: 6088

- Joined: Fri 13 May 2005, 03:00:00

- Location: The Urban Village

Re: THE Muni Thread (merged)

US state debt hits 4 trillion. That's 4 million million. Buy gold.

http://in.reuters.com/article/2012/08/2 ... ZT20120828

http://in.reuters.com/article/2012/08/2 ... ZT20120828

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

92 posts

• Page 5 of 5 • 1, 2, 3, 4, 5

Who is online

Users browsing this forum: No registered users and 9 guests