The Earth is not running out of oil and gas, BP says

Re: The Earth is not running out of oil and gas, BP says

The game called Industrialism is very simple: Either you are conquering the world or someone is conquering you. Industrialism can never pay for itself so the entire notion of economics is of no importance.

Deindustrialisation (the notion that the carbon atom is detrimental) is suicide...simple as that.

I expect solar and wind will always be the "cheapest" and the "cleanest"...whatever that means...simply because the organizers (international banking cabal) of the losing team don't want you to know you are on the losing team.

The goofs at BP are bankrupt...aka they aint conquering any longer. What would you like them to say: "We're dead meat boys and girls"....lol.

Deindustrialisation (the notion that the carbon atom is detrimental) is suicide...simple as that.

I expect solar and wind will always be the "cheapest" and the "cleanest"...whatever that means...simply because the organizers (international banking cabal) of the losing team don't want you to know you are on the losing team.

The goofs at BP are bankrupt...aka they aint conquering any longer. What would you like them to say: "We're dead meat boys and girls"....lol.

Outcast_Searcher is a fraud.

- StarvingLion

- Permanently Banned

- Posts: 2612

- Joined: Sat 03 Aug 2013, 18:59:17

Re: The Earth is not running out of oil and gas, BP says

ennui2 wrote:Considering that oil is currently cheap, peakers really should be more on the defensive, not just laying back in their chairs and scoffing at predictions like this while they preach to the converted.

I agree that if PO doesn't get us first, AGW will, though, so there's really no way out of this vice. Pick your poison.

I'm no expert, but I don't think cheap oil disproves peak oil. There was a period where the pundits called it peak cheap oil, but they were wrong to equate peak oil with expensive oil. I understand peak oil to mean maximum rate of production, which implies that oil will be abundant at the peak. The definition of oil production has been modified to make it seem like there is more oil production than there was, but I don't think natural gas liquids or dilbit is really the same as oil. The mere existence of vast hydrocarbon stores does not disprove peak oil either, because most hydrocarbon deposits will never be produced under any circumstances. I also don't see PO as any kind of crisis on par with AGW. PO simply means we are closer to the end than the beginning of the petroleum age as new production fails to equal depletion decline. Oil prices will fall if people reduce demand, and there is lots of room for demand to fall simply due to reduced waste and available alternatives. Also, a surplus or glut of only a few percent in supply causes a disproportionate change in price. I don't see any reason to be defensive.

If we address AGW, then oil will become cheap due to falling demand, unless production is curtailed. If the lower price induces demand, this will make it more difficult to reduce emissions. It is not a matter of "picking your poison" because we have already chosen and the only issue is how bad will it get.

I said above that I wondered whether the shale and tar sand oil actually add anything to available useful oil and we see the "glut" getting larger as shale and tar sand activity drop off, so I do wonder if that is not in part a reason for the glut.

- kanon

- Lignite

- Posts: 251

- Joined: Fri 24 Oct 2014, 09:04:07

Re: The Earth is not running out of oil and gas, BP says

If I am understanding correctly, BP assumed a price level of $100 a barrel for oil(plus whatever price natural gas and coal were back when oil was that high). They also cautioned that lower prices like today's environment would effect the numbers. They are using the definition "proved reserves" which does take price into consideration.

BP Technology OutlookWhen analyzing costs, we use data from the period when oil prices were around $100 per barrel, and show how technology could reduce costs relative to this benchmark. Clearly, other deflationary forces are at play in the lower-oil-price environment – and these can and should be differentiated from the technology signal in this publication.

On the supply side, technology has helped the energy industry discover more oil and gas than society has consumed. Proved oil reserves, for example, now stand at more than twice the level they were at in 1980. Key technologies driving this phenomenon include advances in seismic imaging that enable geologists to pinpoint subsurface reservoirs more accurately, and new techniques to improve oil recovery that prolong production from reservoirs.

The Earth is not running out of oil and gas, BP saysthe global proved fossil fuel resources could increase from 2.9 trillion barrels of oil equivalent (boe) to 4.8 trillion boe by 2050

Proven reservesProven reserves, also called proved reserves, measured reserves, 1P, and Reserves, are business or political terms regarding fossil fuel energy sources. They are defined as a "Quantity of energy sources estimated with reasonable certainty, from the analysis of geologic and engineering data, to be recoverable from well established or known reservoirs with the existing equipment and under the existing operating conditions." These terms relate to common fossil fuel reserves such as oil reserves, natural gas reserves, or coal reserves.

Operating conditions includes operational break-even price, regulatory and contractual approvals, without which these items cannot be classified as proven and are usually classified into probable. Price changes therefore can have a large impact on classification of proven reserves. Regulatory and contractual conditions may change, and also affect proven reserves amount.

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5023

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: The Earth is not running out of oil and gas, BP says

Peak oilers do not need to be defensive at all!

Peak oilers do not need to be defensive at all!Considering the population trends and the human propensity to live better if possible it will be impossible to maintain current living standards even if all existing oil fields ceased to decline and all irregular means (such as fracking tight shale) are fully developed. The population is the push and the decline of oil fields is the shove and when it comes together the pain and deaths will be beyond imagination.

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: The Earth is not running out of oil and gas, BP says

k - Exactly with respect to needing a price assumption to predict future reserves. Which is exactly why the slip in "resources" as a sub for reserves. Also why the jump back to 1980 to talk about reserves: in the last 12 months the amount of proven reserves has declined dramaticly as result of the oil price collapse. They also overplay the new tech card: all those advances since 1980 existed before the shale boom. Some tweaking but the shales could have been horizontally drilled and frac'd in 2002. But they weren't because the price of oil was too low.

And about that $100/bbl assumption: that's 2014 dollars. Are they using $100/bbl in their 2050 prediction or are they inflating that price by then? Remember the record high $35/bbl oil price in 1980, when adjusted for inflation, would be more than $110/bbl in 2014 dollars.

IMHO their words are no more then a very transparent effort to convince the public (i.e. potential stock holders) that the situation isn't exactly what it is. As has been said before: If you can't impress them with the facts fhen dazzel them with bullsh*t. LOL

And about that $100/bbl assumption: that's 2014 dollars. Are they using $100/bbl in their 2050 prediction or are they inflating that price by then? Remember the record high $35/bbl oil price in 1980, when adjusted for inflation, would be more than $110/bbl in 2014 dollars.

IMHO their words are no more then a very transparent effort to convince the public (i.e. potential stock holders) that the situation isn't exactly what it is. As has been said before: If you can't impress them with the facts fhen dazzel them with bullsh*t. LOL

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: The Earth is not running out of oil and gas, BP says

For technology, I don't think they were claiming the technologies/techniques were newly invented, just improved. Their tone seems more like evolutionary advances, not revolutionary. Ex: seismic imaging has been around for a long time but what we have today is better than what we had 35 years ago. Would you agree with that?

I would assume they were using inflation adjusted dollars. As for the jump back to 1980, I assume they did that because they wanted to look at what happened in the last 35 years to give them some perspective on what the next 35 years might look like. EIA numbers show world proved oil reserves more than doubling from 1980, going from .6 trillion to 1.6 trillion. Crude Oil Proved Reserves

However I suspect a good chunk of the proved reserve growth since 1980 was not because of any new discoveries or price changes but was instead politically motivated by OPEC's quota system. I would downgrade OPEC reserves by .3 - .4 trillion barrels. However even with this revision, world proved oil reserves still about doubled from 1980-2014.

The most significant change to the oil and gas resource base in the past decade has been the development of production from shale and ‘tight’ (or low-permeability) rocks, particularly in the US. Estimates of shale resources, not only in the US but around the world, have more than doubled the total estimated volumes of oil and gas in place globally with development potential. New technology has been central to enabling the oil and gas industry to find and produce new sources of hydrocarbons. Advances in seismic imaging, for example, have helped reveal previously undiscovered oil and gas fields, particularly in deep water and below formations of salt in the subsurface. The shale revolution has been made possible largely by developments in directional and horizontal drilling and multistage hydraulic fracturing – techniques that have evolved over many years.

Seismic imaging

The emergence of three-dimensional seismic imaging during the 1990s had a dramatic impact on oil and gas exploration, in some instances raising exploration success rates from 30% to 50%. Since then, seismic acquisition technologies have advanced and can now illuminate the subsurface from different orientations. Multi- and wide-azimuth surveys, for example, enable surveys to be carried out in different directions over the same area. 4D seismic, which involves repeating the same survey at different times, plays an increasingly important role in helping to determine how reservoirs are changing as oil, gas and water move through the subsurface and are produced to the surface. These advances have been enabled by rapid increases in cost-effective computational processing capacity and deep algorithmic expertise to process and interpret vast streams of seismic data. As interest in tight oil, shale oil and shale gas grows, advances in imaging technologies that improve our understanding of subsurface factors and identification of ‘sweet spots’ will be of great value.

I would assume they were using inflation adjusted dollars. As for the jump back to 1980, I assume they did that because they wanted to look at what happened in the last 35 years to give them some perspective on what the next 35 years might look like. EIA numbers show world proved oil reserves more than doubling from 1980, going from .6 trillion to 1.6 trillion. Crude Oil Proved Reserves

However I suspect a good chunk of the proved reserve growth since 1980 was not because of any new discoveries or price changes but was instead politically motivated by OPEC's quota system. I would downgrade OPEC reserves by .3 - .4 trillion barrels. However even with this revision, world proved oil reserves still about doubled from 1980-2014.

Oil reserves 'exaggerated by one third'The scientist and researchers from Oxford University argue that official figures are inflated because member countries of the oil cartel, OPEC, over-reported reserves in the 1980s when competing for global market share. The researchers claim it is an open secret that OPEC is likely to have inflated its reserves, but that the International Energy Agency (IEA), BP, the Energy Information Administration and World Oil do not take this into account in their statistics.

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5023

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: The Earth is not running out of oil and gas, BP says

k - Yes: seismic is vastly better today then 30+ years ago. But is essential the same it was 10 years ago before the shale boom. And before the shale boom the industry was drilling horizontal laterals several times longer then the typical shale well during that boom. And 35 years ago the Rockman pumped fracs that pushed much more sand into a tite carbonate shale then the typical frac stage in the Eagle Ford Shale in the last few years.

IOW all tech to drill EFS wells as they were last year existed before the shale boom...before the price boom. Fantasizing about "future unimaginable tech advances" in the future is OK. As long as one remembers the key word in that phrase: unimaginable. LOL

IOW all tech to drill EFS wells as they were last year existed before the shale boom...before the price boom. Fantasizing about "future unimaginable tech advances" in the future is OK. As long as one remembers the key word in that phrase: unimaginable. LOL

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: The Earth is not running out of oil and gas, BP says

Thanks Rock. Another question for you: You mentioned proven reserves declined dramatically in the last 12 months as the result of the oil price collapse. But this is not showing up in the EIA data. Do you know why this is? Full 2015 data is not in yet, but even previous price crashes like 2008-2009 and 85-86 show world proved reserves kept right on ticking up. You would think prices dropping by nearly half would show a corresponding decline in proved reserves.

I grabbed a definition of proved reserves from the EIA web site if it helps:

I grabbed a definition of proved reserves from the EIA web site if it helps:

Definitions, Sources and Explanatory NotesProved reserves of crude oil as of December 31 of the report year are the estimated quantities of all liquids defined as crude oil, which geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions.

Reservoirs are considered proved if economic producibility is supported by actual production or conclusive formation test (drill stem or wire line), or if economic producibility is supported by core analyses and/or electric or other log interpretations. The area of an oil reservoir considered proved includes: (1) that portion delineated by drilling and defined by gas -- oil and/or gas -- water contacts, if any; and (2) the immediately adjoining portions not yet drilled, but which can be reasonably judged as economically productive on the basis of available geological and engineering data. In the absence of information on fluid contacts, the lowest known structural occurrence of hydrocarbons is considered to be the lower proved limit of the reservoir.

Volumes of crude oil placed in underground storage are not to be considered proved reserves.

Reserves of crude oil which can be produced economically through application of improved recovery techniques (such as fluid injection) are included in the "proved" classification when successful testing by a pilot project, or the operation of an installed program in the reservoir, provides support for the engineering analysis on which the project or program was based.

Estimates of proved crude oil reserves do not include the following: (1) oil that may become available from known reservoirs but is reported separately as "indicated additional reserves"; (2) natural gas liquids (including lease condensate); (3) oil, the recovery of which is subject to reasonable doubt because of uncertainty as to geology, reservoir characteristics, or economic factors; (4) oil that may occur in undrilled prospects; and (5) oil that may be recovered from oil shales, coal, gilsonite, and other such sources. It is necessary that production, gathering or transportation facilities be installed or operative for a reservoir to be considered proved.

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5023

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: The Earth is not running out of oil and gas, BP says

ennui2 wrote:Considering that oil is currently cheap, peakers really should be more on the defensive, not just laying back in their chairs and scoffing at predictions like this while they preach to the converted.

I agree that if PO doesn't get us first, AGW will, though, so there's really no way out of this vice. Pick your poison.

Oil is not currently cheap because production costs are still high.

-

ralfy - Light Sweet Crude

- Posts: 5606

- Joined: Sat 28 Mar 2009, 11:36:38

- Location: The Wasteland

Re: The Earth is not running out of oil and gas, BP says

kanon wrote:ennui2 wrote:Considering that oil is currently cheap, peakers really should be more on the defensive, not just laying back in their chairs and scoffing at predictions like this while they preach to the converted.

I agree that if PO doesn't get us first, AGW will, though, so there's really no way out of this vice. Pick your poison.

I'm no expert, but I don't think cheap oil disproves peak oil. There was a period where the pundits called it peak cheap oil, but they were wrong to equate peak oil with expensive oil. I understand peak oil to mean maximum rate of production, which implies that oil will be abundant at the peak. The definition of oil production has been modified to make it seem like there is more oil production than there was, but I don't think natural gas liquids or dilbit is really the same as oil. The mere existence of vast hydrocarbon stores does not disprove peak oil either, because most hydrocarbon deposits will never be produced under any circumstances. I also don't see PO as any kind of crisis on par with AGW. PO simply means we are closer to the end than the beginning of the petroleum age as new production fails to equal depletion decline. Oil prices will fall if people reduce demand, and there is lots of room for demand to fall simply due to reduced waste and available alternatives. Also, a surplus or glut of only a few percent in supply causes a disproportionate change in price. I don't see any reason to be defensive.

If we address AGW, then oil will become cheap due to falling demand, unless production is curtailed. If the lower price induces demand, this will make it more difficult to reduce emissions. It is not a matter of "picking your poison" because we have already chosen and the only issue is how bad will it get.

I said above that I wondered whether the shale and tar sand oil actually add anything to available useful oil and we see the "glut" getting larger as shale and tar sand activity drop off, so I do wonder if that is not in part a reason for the glut.

Indeed. Oil price went down because of the threat of another financial crisis. That's why prices for other commodities also dropped, and oil production costs are still high.

I think the problem is that production costs went up due to peak oil while more credit was created to encourage consumer spending and financial speculation. The latter led to financial crashes which were dealt with by more credit creation, part of which was used to produce and buy oil at higher prices. But increased credit has also led to threats of more financial crisis, which is why prices dropped while costs remained high, and the global economy weakened considerably.

In order to pay for its current debts, the oil industry will need hundreds of billions of dollars in bailouts as prices remain low. If prices go up, the global economy is weakened once more. Meanwhile, even more credit will have to be created in order to access more of oil and gas reserves, which may be provide less energy returns if they are too deep or require more processing.

Ultimately, all of these point to peak oil.

Meanwhile, we are looking at the effects of global warming plus more environmental damage. Thus, we face peak oil coupled with chronic economic problems, environmental damage, and the effects of peak oil.

And if these amplify human migration, the spread of disease, and conflict over resources, etc....

-

ralfy - Light Sweet Crude

- Posts: 5606

- Joined: Sat 28 Mar 2009, 11:36:38

- Location: The Wasteland

Re: The Earth is not running out of oil and gas, BP says

I was thinking about how the whole economy will keep on going as long as it is fed by credit. Look at the US. We are now 19 trillion in debt and counting. Will we pay it back? I think not. It's like your neighbors who can keep the whole facade going as long as they get credit. They have big cars, lots of gasoline toys and a lifestyle that looks really great, but it's all because they can borrow money. Those of us who don't borrow have to make do with what we've got, and that means our cars are smaller and older. When the repo man comes the neighbors have nothing, but my old small truck can keep going as long as I keep it maintained. So it is with the economy. We'll see everything come crashing down when they quit feeding it with easy credit. The shale gas and oil boom was fueled by easy credit. Fracking and tar sands will stop when they can't continue to borrow money. That time is coming very soon.

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: The Earth is not running out of oil and gas, BP says

kanon wrote:I understand peak oil to mean maximum rate of production

Peak oil as a movement is concern about what happens AFTER peak. Of course at the peak things are at maximum happy-go-lucky. But that was supposed to have been in the late 90s, not now. There isn't supposed to be a 2nd wave of cheap oil. Geologically that wasn't supposed to have been possible. It doesn't fit the neat shape of Hubbert's bell curve.

kanon wrote:PO simply means we are closer to the end than the beginning of the petroleum age

We've been moving closer to the end ever since we stuck the first drill into the ground. That by itself doesn't mean much.

kanon wrote:I don't see any reason to be defensive.

Considering that nobody really cares about the issue now, I'd say peakers do have reason to answer the critics. Simply trying to redefine what peak oil is to encompass everything including cheap oil is a non-starter.

kanon wrote:I wondered whether the shale and tar sand oil actually add anything to available useful oil and we see the "glut" getting larger as shale and tar sand activity drop off, so I do wonder if that is not in part a reason for the glut.

Where we go from here is an open question, but tar sands and shale has already played a large part in the glut. There's no debate to be had about that, and that in and of itself clashes with peak oil conventional wisdom that these sources were uneconomical, hence shifting the argument over to the idea that this is a credit bubble and that these companies never made a dime on unconventionals.

So yes, there's some interesting analysis to be made here and within the next few years I would expect to see the answer to some of these open questions about how much we really did effectively kick the can down the road.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: The Earth is not running out of oil and gas, BP says

ralfy wrote:Oil is not currently cheap because production costs are still high.

It's cheap to end-consumers. Therefore it's cheap. Period.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: The Earth is not running out of oil and gas, BP says

pstarr wrote:You are not the only consumer in the world. $40 (inflation adjusted) oil remains somewhat historically high, it had been less than $30 (inflation adjusted) for decades when I joined this web community.

This line of argumentation can always be used to suggest that a commodity is "too high". I'm not moved by it, sorry. I remember the first alarm bells going off here with oil passed the $60 threshold. Now it's been below $60 for some time, which is in the historical green-zone by doomer standards. The only reason people like you would say otherwise would be to try to artificially inflate people's doomer-meters long after they've packed their bags and gone home.

pstarr wrote:It seems you would rather invent bad arguments to avoid having to make good arguments. I suggest therapy.

I'm not inventing everything and you have no right to school me on gentlemanly rhetorical tactics considering that your main way of responding to me is to swear and insult me and tell me to shut the fuck up and leave, which you do with impunity despite me flagging your posts for the moderators.

What bothers you the most about my posts is that I'm piercing your doomer echo-chamber. You're not really interested in a genuine debate because your mind is closed to the idea you might actually be wrong with your analysis in some way. That's the kind of friction that could lead someone to lash out with ad homs as you so often do. So as far as getting therapy, you first.

If this board actually had more posters I would think you would have been banned already. The only reason you're not is because without you here the post-count would drop by 75%. That doesn't mean your posts have any actual value, as it's almost all content-free snark and sarcasm coming off your keyboard. I don't think anyone is entertained by that other than maybe Planty.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: The Earth is not running out of oil and gas, BP says

pstarr wrote:

Could it be.... Peak Oil?

More correlation is causation from Pstarr.

Your argument never changes. I've heard it dozens of times. I'm no more convinced by it now than I was in 2008. Recessions can and do happen without oil spikes. Do you think banging me over the head enough times with the same argument will somehow change my mind? You've got to do better than that.

Relying solely on charts and graphs and correlation is causation arguments is why The Oil Drum is dead and gone. And yet Gail keeps on plugging away. The world is more complex than that. You can't crack the code by watching charts.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: The Earth is not running out of oil and gas, BP says

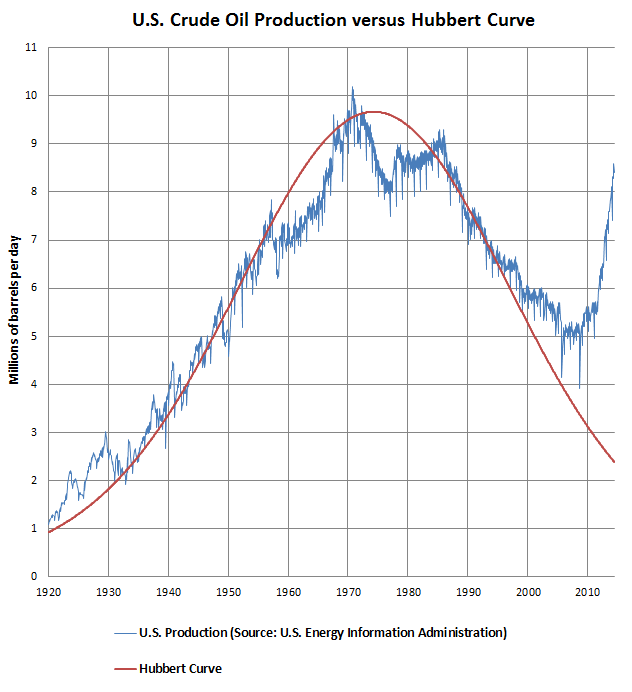

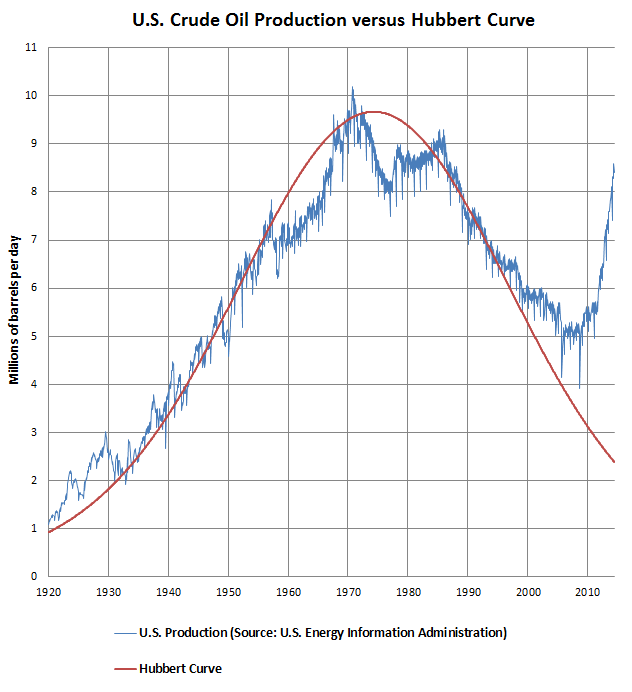

BTW here is a chart that blows Hubbert's curve right out of the water. The PO argument was initially founded on the Hubbert curve, and how he accurately predicted US peak. Well, now we're into a new paradigm and people are cherry picking which charts they think validate their argument and which to ignore, like this one.

Note that the falloff post Y2K corresponds with the "peak" of peak-oil concern of the mid 00s. Only the die-hards are still retconning their narratives to try to reconcile the fact that we're not just huddled behind our arrowslits plugging zombies by now.

Note that the falloff post Y2K corresponds with the "peak" of peak-oil concern of the mid 00s. Only the die-hards are still retconning their narratives to try to reconcile the fact that we're not just huddled behind our arrowslits plugging zombies by now.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Who is online

Users browsing this forum: No registered users and 4 guests