According to Barron's they are now at -81.34 and the P/E Ratio form of measure is now N/A.

Got gold?

frankthetank wrote:Can u elaborate a little on what this chart is saying...? I really don't have a clue!

BigTex wrote:I don't know where that figure came from, but I think it's misleading.

I placed my entire life savings on the dow jones in October of 2007.MattS wrote:roccman wrote:

Got gold?

Yes. Bought it in 1980. Can you tell me how much longer I have to wait before it gets back to the equivalent of the price I paid for it?

BigTex wrote:

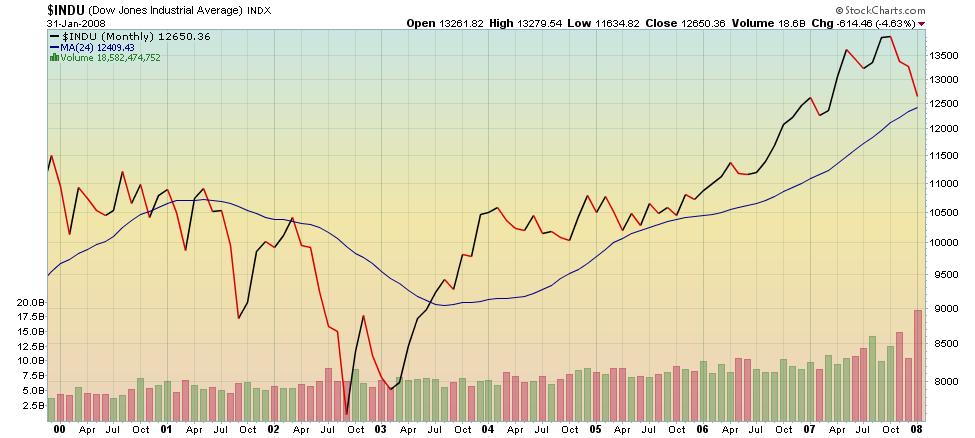

Thanks for the chart though Rocc. It's interesting that this isn't being discussed anywhere else.

MattS wrote:roccman wrote:

Got gold?

Yes. Bought it in 1980. Can you tell me how much longer I have to wait before it gets back to the equivalent of the price I paid for it?

ooh you're so smart!MattS wrote:cube wrote:I placed my entire life savings on the dow jones in October of 2007.MattS wrote:roccman wrote:

Got gold?

Yes. Bought it in 1980. Can you tell me how much longer I have to wait before it gets back to the equivalent of the price I paid for it?

How much longer do I have to wait till I get my money back?

Don't know....but way bad call for anyone with Doomeristic tendencies. I was busy pulling out of the market when it cleared like 12,700-13,200....having been burnt by silly "buy gold" bs back in 1980 I wasn't about to let something that stupid happen again.

MattS wrote:

What are you talking about? I lost my pants buying gold in 1980 listening to commodity crazies like Roccman,

*getting serious now after enjoying a good laugh with MattS....he sure knows how to play along*Twilight wrote:Buying gold at this level is stupid. You may think it is money, but it is just a liquid vehicle to people much bigger than you, with positions much bigger than yours. Once they dump to cover the implosions beginning to ripple through their investment assets, you will be screwed. And dump they will, if they can wipe out a bad bet with one that may have a 200% profit or more. I do not see this as a perpetual hedge, it will be used in the end. A real crash will result in the mother of all visits to the pawn shop. Gold is really starting to sound more like mainstream hysteria than rational thinking.

MattS wrote:roccman wrote:MattS wrote:

What are you talking about? I lost my pants buying gold in 1980 listening to commodity crazies like Roccman,

Naw bro - you were late and lost your ass.

<hanging head in shame>

Yup.....so your advice to do it all over again is less than useful.

only 15 days to drill huh?MattS wrote:cube wrote: A new oil well or gold mine cannot be brought into production in 6 months. If it only takes 6 months to open a new dot-com company or build a house that's why after only 6 years the market is over-saturated and has reached its peak. That's why the dot-com bubble and real estate only lasted for 6 years.

Even if you do not believe in PO and are convinced there's an oil reservoir the size of Texas somewhere on this planet you have to admit it is physically impossible to over-saturate the world oil market in 6 years. It doesn't matter if ALL the world's oil drilling rigs are working 24/7/365 ---> the world will not be swimming in oil in 6 years.

Maybe 12 years but not 6.

Numbers game!! 1 oil well takes 15 days to drill, another 15 to complete and start production. 1000 rigs in America drilling for natural gas stop, and start drilling the new oil discovery the size of texas.

12 wells/year/rig, 1000 rigs, 12,000 new wells in a new Ghawar in a year, making Ghawar volumes of 20,000 bbl/day/well, X 12,000 new wells = 240 Million Barrels/ Day phased in over ONE year.

Yeah...I think you need a smaller example of how fast things CAN'T be done. Those kinds of volumes can saturate this planet and a couple of others.....

Users browsing this forum: No registered users and 19 guests