The commodities dip of July/August 2008

The commodities dip of July/August 2008

What is the world is going on? Corn, oil, silver and gold are nose diving. The dollar index is shooting up?

This doesn't make much sense right now since much of the US economy is teetering and our debt and inflation is literally skyrocketing.

Thoughts?

This doesn't make much sense right now since much of the US economy is teetering and our debt and inflation is literally skyrocketing.

Thoughts?

- Jotapay

- Intermediate Crude

- Posts: 3394

- Joined: Sat 21 Jun 2008, 03:00:00

Re: The commodities dip of July/August 2008

It's what happens in a deflationary credit collapse.

Civilization: the biosphere's skin disease

-

firestarter - Heavy Crude

- Posts: 1171

- Joined: Sun 19 Mar 2006, 04:00:00

Re: The commodities dip of July/August 2008

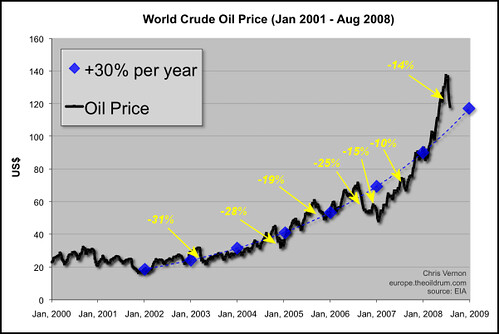

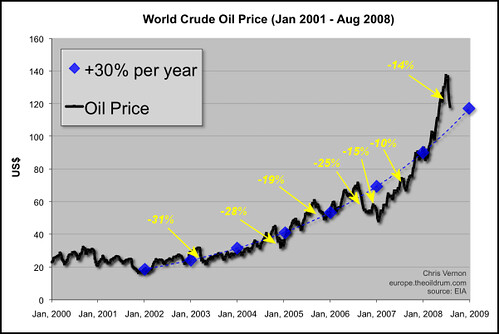

This is just how markets act.

A bunch of money had found its way into commodities as a hedge against inflation. The Fed has been letting the dollar devalue by keeping interest rates down. Recently, the dollar has bounced higher and the frenetic pace of the global economy has slackened in a response to high energy prices.

Since burgeoning demand for oil has been a salient characteristic of global markets, much of this money found its way into crude and natural gas. But this huge run-up is itself unsustainable unless the world economy keeps on keeping on.

Right now, we see fears that the world economy will slow dramatically. So some of money boosting crude and other commodities has fled those sectors as investors have taken profits or sought safer havens. Crude will probably fall to the 100 - $110 level but its anybody's guess.

[align=center] [/align]

[/align]

A bunch of money had found its way into commodities as a hedge against inflation. The Fed has been letting the dollar devalue by keeping interest rates down. Recently, the dollar has bounced higher and the frenetic pace of the global economy has slackened in a response to high energy prices.

Since burgeoning demand for oil has been a salient characteristic of global markets, much of this money found its way into crude and natural gas. But this huge run-up is itself unsustainable unless the world economy keeps on keeping on.

Right now, we see fears that the world economy will slow dramatically. So some of money boosting crude and other commodities has fled those sectors as investors have taken profits or sought safer havens. Crude will probably fall to the 100 - $110 level but its anybody's guess.

[align=center]

[/align]

[/align]- Carlhole

Re: The commodities dip of July/August 2008

firestarter wrote:It's what happens in a deflationary credit collapse.

Yes, that is exactly what is happening. You can't lose so much of the money supply in a housing and credit crisis and not have a deflationary effect. Less money bidding means lower prices. If you want to win here you will need to figure out which players are going to be able to swallow up all of the rest of their competition during the troubled times ahead. Well, anyway, that's my tip. In these times I suppose you can lose your ass whatever you do.

When it comes down to it, the people will always shout, "Free Barabbas." They love Barabbas. He's one of them. He has the same dreams. He does what they wish they could do. That other guy is more removed, more inscrutable. He makes them think. "Crucify him."

-

evilgenius - Intermediate Crude

- Posts: 3731

- Joined: Tue 06 Dec 2005, 04:00:00

- Location: Stopped at the Border.

Re: The commodities dip of July/August 2008

The commodities dip is due to renewed dollar strength, less money entering circulation and more being destroyed servicing debt and defaults.

An example of the deflationary component from the front lines: a few months ago builders' merchants were warning their customers of price hikes in common materials such as cement, concrete, rebar and steel sections for the coming months and next year, even as their customers were slamming project pipelines shut, announcing massive layoffs, cutting back what few fixed assets they had, attempting to refinance debt and focusing on completing far-advanced projects before the buyers disappear.

Here is an example:

8 May: Plans have been approved for 250 new houses, shops and a church on the outskirts of Westhill. Aberdeenshire councillors have unanimously given builder Stewart Milne's multi million pound application the go-ahead.

21 July: The Stewart Milne Group said about 289 jobs could be lost, which is approximately 20% of its UK workforce.

Think those price increases will hold? Maybe for a time, but it is a question of inertia, because next year the residential and commercial buyers will not be there. Infrastructure and government will, and you could be forgiven for failing to notice what's happening outside that comfortable cocoon, but no matter what its growth is, it will not act as a complete replacement.

I think very quickly those price increases will turn into discounts.

Now you might say aha, but even after a severe fall, energy prices will remain historically high. True, materials with high embedded energy content cost what they cost and it makes no sense to sell for less. But as volumes collapse, you are going to end up with liquidated inventories getting dumped and suppliers in competition where once they could barely keep up with orders and sold at a premium. In time, this will feed all the way back to the mills and then the mining companies themselves. Not to mention anyone with any sense has already been pricing ahead of rising energy, because just one experience is enough to teach the lesson that it hurts like hell when you do not. I can assure you it hurts.

And why is all this happening?

Because banks are lending people and companies less money on more onerous terms. That source of spending on industrial commodities is drying up. The state is not going to keep building half million square foot warehouses on city boundaries while others stand empty, nor will it start completing tower blocks once their concrete skeletons have stood undefended from the weather for a year.

Whatever printing the central banks are doing so far to cover the implosion of financial assets is currently not significant enough to do much to compensate for the loss of the real source of inflation.

How bullish do you have to be to believe the ME Gulf, China and India will substantially replace the demand destruction that is about to take place in the West? Also, what is the prospect of banks lending yet more money for infrastructure there, when falling energy and commodity prices are reducing their income, hence safe debt load? Do you not think this might become a negative feedback loop as they wait and see what happens?

An example of the deflationary component from the front lines: a few months ago builders' merchants were warning their customers of price hikes in common materials such as cement, concrete, rebar and steel sections for the coming months and next year, even as their customers were slamming project pipelines shut, announcing massive layoffs, cutting back what few fixed assets they had, attempting to refinance debt and focusing on completing far-advanced projects before the buyers disappear.

Here is an example:

8 May: Plans have been approved for 250 new houses, shops and a church on the outskirts of Westhill. Aberdeenshire councillors have unanimously given builder Stewart Milne's multi million pound application the go-ahead.

21 July: The Stewart Milne Group said about 289 jobs could be lost, which is approximately 20% of its UK workforce.

Think those price increases will hold? Maybe for a time, but it is a question of inertia, because next year the residential and commercial buyers will not be there. Infrastructure and government will, and you could be forgiven for failing to notice what's happening outside that comfortable cocoon, but no matter what its growth is, it will not act as a complete replacement.

I think very quickly those price increases will turn into discounts.

Now you might say aha, but even after a severe fall, energy prices will remain historically high. True, materials with high embedded energy content cost what they cost and it makes no sense to sell for less. But as volumes collapse, you are going to end up with liquidated inventories getting dumped and suppliers in competition where once they could barely keep up with orders and sold at a premium. In time, this will feed all the way back to the mills and then the mining companies themselves. Not to mention anyone with any sense has already been pricing ahead of rising energy, because just one experience is enough to teach the lesson that it hurts like hell when you do not. I can assure you it hurts.

And why is all this happening?

Because banks are lending people and companies less money on more onerous terms. That source of spending on industrial commodities is drying up. The state is not going to keep building half million square foot warehouses on city boundaries while others stand empty, nor will it start completing tower blocks once their concrete skeletons have stood undefended from the weather for a year.

Whatever printing the central banks are doing so far to cover the implosion of financial assets is currently not significant enough to do much to compensate for the loss of the real source of inflation.

How bullish do you have to be to believe the ME Gulf, China and India will substantially replace the demand destruction that is about to take place in the West? Also, what is the prospect of banks lending yet more money for infrastructure there, when falling energy and commodity prices are reducing their income, hence safe debt load? Do you not think this might become a negative feedback loop as they wait and see what happens?

Last edited by Twilight on Fri 08 Aug 2008, 14:09:36, edited 2 times in total.

- Twilight

- Expert

- Posts: 3027

- Joined: Fri 02 Mar 2007, 04:00:00

Re: The commodities dip of July/August 2008

The dollar's climb in the last couple of days may also be due to the conflict in South Ossetia.

Conflicts in certain areas of the world often seem to spark a "flight to safety" in currencies.

That has usually meant strength for the U.S. Dollar.

The dollar's rise in turn is driving down commodities.

Conflicts in certain areas of the world often seem to spark a "flight to safety" in currencies.

That has usually meant strength for the U.S. Dollar.

The dollar's rise in turn is driving down commodities.

- erl

- Tar Sands

- Posts: 580

- Joined: Mon 21 Mar 2005, 04:00:00

Re: The commodities dip of July/August 2008

Jotapay wrote:Thoughts?

you are asking for some causal backstory to explain market fluctuation. there is none. there never is one. someone made a decision to trade. that's it.

-

aflurry - Tar Sands

- Posts: 824

- Joined: Mon 28 Mar 2005, 04:00:00

Re: The commodities dip of July/August 2008

Not always. Sometimes there is a change of paradigm. I think one is gathering enough strength to move the market, though it may do so next year. Right now is more likely a change of sentiment preceding the real fun.

- Twilight

- Expert

- Posts: 3027

- Joined: Fri 02 Mar 2007, 04:00:00

Re: The commodities dip of July/August 2008

Twilight wrote:Right now is more likely a change of sentiment preceding the real fun.

Whew! I was worried for a second there I would run out of train wrecks to watch!

- Jotapay

- Intermediate Crude

- Posts: 3394

- Joined: Sat 21 Jun 2008, 03:00:00

Re: The commodities dip of July/August 2008

Read Mises, an early 20th century economist, for what / why about deflationary forces (which is what the OP just described).

Credit is how monetary expansion occurs. When credit dries up, money becomes scarce. Scarce money is valuable money.

The more distant future (ie, 2+ years out) may still hold hyperinflation in store, most likely the result of federal policy makers caving to populist demand for relief from a deflationary spiral and simply printing money (they are not doing that yet, they are still pushing on the credit string).

That isn't where we are right now. We're in the initial phase of a deflationary spiral.

Credit is how monetary expansion occurs. When credit dries up, money becomes scarce. Scarce money is valuable money.

The more distant future (ie, 2+ years out) may still hold hyperinflation in store, most likely the result of federal policy makers caving to populist demand for relief from a deflationary spiral and simply printing money (they are not doing that yet, they are still pushing on the credit string).

That isn't where we are right now. We're in the initial phase of a deflationary spiral.

Welcome to the Kondratieff Winter

-

shady28 - Coal

- Posts: 412

- Joined: Wed 06 Jul 2005, 03:00:00

Re: The commodities dip of July/August 2008

I don't want to say I disagree with some of the well made points about deflation above, but I have some alternative explanations.

First, buying of US dollars by foreign central banks and funds has been very heavy these last few weeks. It's has not been unusual for this to occur when the US Treasury issues a large amount of bonds/bills. This is exactly what has happened lately. The amount of foreign buying is almost exactly the amount of new Treasury debt. This is no coincidence.

Second, the buying of dollars by foreign central banks is in the long run inflationary - not deflationary. Admittedly in the short run, people talk about an artifically made "rally". However foreign central banks create even more money to buy Treasuries - thereby adding to the world money supply.

Whether all this new money offsets the effects of economic deflation is open to debate, but so far, monetary inflation is way ahead of economic deflation.

Do any of you deflationists want make a figurative bet that commodity indexes will be lower at year end? I bet higher.

First, buying of US dollars by foreign central banks and funds has been very heavy these last few weeks. It's has not been unusual for this to occur when the US Treasury issues a large amount of bonds/bills. This is exactly what has happened lately. The amount of foreign buying is almost exactly the amount of new Treasury debt. This is no coincidence.

Second, the buying of dollars by foreign central banks is in the long run inflationary - not deflationary. Admittedly in the short run, people talk about an artifically made "rally". However foreign central banks create even more money to buy Treasuries - thereby adding to the world money supply.

Whether all this new money offsets the effects of economic deflation is open to debate, but so far, monetary inflation is way ahead of economic deflation.

Do any of you deflationists want make a figurative bet that commodity indexes will be lower at year end? I bet higher.

It's already over, now it's just a matter of adjusting.

-

DantesPeak - Expert

- Posts: 6277

- Joined: Sat 23 Oct 2004, 03:00:00

- Location: New Jersey

Re: The commodities dip of July/August 2008

DantesPeak wrote:Do any of you deflationists want make a figurative bet that commodity indexes will be lower at year end? I bet higher.

At year end, no bet. Too short a timescale for the stuff I am seeing appear as Q3 progresses, and some real eureka moments I am having these last couple of weeks. But a respectable time into next year, I expect construction-related commodities at least to have tanked. The US will be seeing its builders filing for bankruptcy protection one after another, and the layoffs in Europe will be well under way. In the UK there is a rush to complete advanced builds, but ground breaking is gone, the builders are laying off their design teams and managers, and the agencies supplying labour and consultants will have their phones cease ringing shortly. Completely. Well, except for government and infrastructure work, but given how far ahead that is budgeted (5 years not uncommon), there will be no new game in town. Judging by what some have said in the press, their backlogs are already down to whatever they are doing now, with the next job being whatever they get.

A fine example of demand that will not materialise. Appreciate the size.

And another. Notice the disparity in scale. 3,000 houses cancelled, a small local railway station will still be built for an existing community, with roadworks at a couple of junctions. £10m total expenditure set against perhaps £300m of business cancelled. Luckily I am not doing houses.

The striking thing is, the production and distribution capacity to supply the required materials still exists. These were next year's sales. So with all that production capacity about to be freed up as abruptly as the pulling of credit last month, competition for sales increasing and ahead-of-the-energy-curve price increases looking unnecessary, either someone absolutely huge steps in and starts buying, or rocks and metals dive.

EDIT: I suppose in these uncertain times there is no telling what might happen to the dollar or another key currency, what fresh market intervention we might see, whether energy prices might spike again, and so on. I accept that point. So I say this based on the cursed fundamentals that have let us down so often. I just do not see who will be buying the physical goods over here at any price next year, except the comparatively small sectors I have mentioned.

- Twilight

- Expert

- Posts: 3027

- Joined: Fri 02 Mar 2007, 04:00:00

Re: The commodities dip of July/August 2008

I have to disagree with the assertion that debt creation is outrunning debt collapse.

Consider that, just from housing, somewhere in the neighborhood of $2 trillion is suspected to be bad - above and beyond what has already been declared. Throw in the potential for 10+ trillion in debt to collapse if the current crises isn't stopped.

Indeed the federal government running a deficit continues to inject liquidity into markets via debt creation (aka, treasury bonds). There is nothing new here - what is new is that the credit markets are contracting faster than the federal government creates new debt. The $400 billion or so that the feds create in debt in a normal year has been eclipsed by the credit collapse now running into the trillions. Now they are talking about 800 billion in deficit spending for 2009. If we are talking about $2 trillion in credit gone bad for 2007-2008 (most of it in 2008), my guess is 2009 will wind up being much worse. It's like trying to put out a forest fire with a fire truck.

The only way the federal deficit spending would overcome the current bubble collapse would be to begin running multi trillion dollar deficts per year. If / when that happens, you might see a hyper-inflationary scenario. It's a lot more likely we will see government at all levels (state, local, fedeeral) begin to cut back spending. This will only feed the deflationary bubble and make dollars even more scarce.

The alternative is to ramp up debt expansion via government borrowing, which will only provide short term (perhaps a year or two) of relief, and then quickly hasten the demise of the dollar as the debt service load becomes unbearable. But by 'hasten' we would likely still be talking 5 or more years down the road.

What's happening is the classic economic cycle. Wikipedia has good info on monetary expansion :

http://en.wikipedia.org/wiki/United_Sta ... omparables

"When the expenses of the U.S. Government exceed the revenue collected, it issues new debt to cover the deficit. This debt typically takes the form of new issues of government bonds which are sold on the open market. However, the debt can also be monetized by which the Federal Reserve creates an entry on its books to credit the US Government for an amount equal to the dollar amount of the bonds the Federal Reserve is acquiring. The money created in this process not only includes the new dollars that came into existence just to purchase the bonds, but much more because this new money is now sitting in the form of checkbook money at the Federal Reserve. Under the scheme of Fractional Reserve Banking this new checkbook money is treated as an asset to lend against. Economists estimate the expansion of the money supply as being many times the amount of the initial money created with the exact amount being a function of what percentage of deposits banks must set aside as "reserves".[15][16]

The ultimate consequence of monetizing U.S. debt is that it expands the money supply which will tend to dilute the value of dollars already in circulation. Thus, expanding the pool of money puts downward pressure on the dollar, downward pressure on short-term interest rates (the banks have more to lend) and upward pressure on inflation. Typically this causes an inflationary boom that ends in a deflationary bust to complete the business cycle. Note that money supply expansion is not the only force at work in inflation or interest rates. United States Dollars are essentially a commodity on the world market and the value of the dollar at any given time is subject to the law of supply and demand. In recent years, the debt has soared and inflation has stayed relatively low in part because China has been willing to accumulate reserves denominated in U.S. Dollars. Currently, China holds over $1 trillion in dollar denominated assets (of which $330 billion are U.S. Treasury notes). In comparison, $1.4 trillion represents M1 or the "tight money supply" of U.S. Dollars which suggests that the value of the U.S. Dollar could change dramatically should China ever choose to divest itself of a large portion of those reserves."

Consider that, just from housing, somewhere in the neighborhood of $2 trillion is suspected to be bad - above and beyond what has already been declared. Throw in the potential for 10+ trillion in debt to collapse if the current crises isn't stopped.

Indeed the federal government running a deficit continues to inject liquidity into markets via debt creation (aka, treasury bonds). There is nothing new here - what is new is that the credit markets are contracting faster than the federal government creates new debt. The $400 billion or so that the feds create in debt in a normal year has been eclipsed by the credit collapse now running into the trillions. Now they are talking about 800 billion in deficit spending for 2009. If we are talking about $2 trillion in credit gone bad for 2007-2008 (most of it in 2008), my guess is 2009 will wind up being much worse. It's like trying to put out a forest fire with a fire truck.

The only way the federal deficit spending would overcome the current bubble collapse would be to begin running multi trillion dollar deficts per year. If / when that happens, you might see a hyper-inflationary scenario. It's a lot more likely we will see government at all levels (state, local, fedeeral) begin to cut back spending. This will only feed the deflationary bubble and make dollars even more scarce.

The alternative is to ramp up debt expansion via government borrowing, which will only provide short term (perhaps a year or two) of relief, and then quickly hasten the demise of the dollar as the debt service load becomes unbearable. But by 'hasten' we would likely still be talking 5 or more years down the road.

What's happening is the classic economic cycle. Wikipedia has good info on monetary expansion :

http://en.wikipedia.org/wiki/United_Sta ... omparables

"When the expenses of the U.S. Government exceed the revenue collected, it issues new debt to cover the deficit. This debt typically takes the form of new issues of government bonds which are sold on the open market. However, the debt can also be monetized by which the Federal Reserve creates an entry on its books to credit the US Government for an amount equal to the dollar amount of the bonds the Federal Reserve is acquiring. The money created in this process not only includes the new dollars that came into existence just to purchase the bonds, but much more because this new money is now sitting in the form of checkbook money at the Federal Reserve. Under the scheme of Fractional Reserve Banking this new checkbook money is treated as an asset to lend against. Economists estimate the expansion of the money supply as being many times the amount of the initial money created with the exact amount being a function of what percentage of deposits banks must set aside as "reserves".[15][16]

The ultimate consequence of monetizing U.S. debt is that it expands the money supply which will tend to dilute the value of dollars already in circulation. Thus, expanding the pool of money puts downward pressure on the dollar, downward pressure on short-term interest rates (the banks have more to lend) and upward pressure on inflation. Typically this causes an inflationary boom that ends in a deflationary bust to complete the business cycle. Note that money supply expansion is not the only force at work in inflation or interest rates. United States Dollars are essentially a commodity on the world market and the value of the dollar at any given time is subject to the law of supply and demand. In recent years, the debt has soared and inflation has stayed relatively low in part because China has been willing to accumulate reserves denominated in U.S. Dollars. Currently, China holds over $1 trillion in dollar denominated assets (of which $330 billion are U.S. Treasury notes). In comparison, $1.4 trillion represents M1 or the "tight money supply" of U.S. Dollars which suggests that the value of the U.S. Dollar could change dramatically should China ever choose to divest itself of a large portion of those reserves."

Welcome to the Kondratieff Winter

-

shady28 - Coal

- Posts: 412

- Joined: Wed 06 Jul 2005, 03:00:00

Re: The commodities dip of July/August 2008

World money supply is growing by about $3 trillion or so per year, and accelerating. I'll be happy to discuss the possibility of deflation when I see money supply growth slow down. Granted there is a significant chance of a sudden and severe deflation panic, similar to those the US occasionally experienced before the Federal Reserve. But it is even more likely that world central banks will act to increase inflation to offset deflationary events. I am not saying they will succeed in the long run, but in the short run (2 to 10 years).

Financial Sense

"DRIVERS OF INFLATION #9

Excessive Money Supply Growth

by Monty Guild & Tony Danaher

Guild Investment Management, Inc.

July 3, 2008

... worldwide money supply is growing fast, and excess money chasing goods and services creates inflation. China, Russia, Persian Gulf countries, India, and Brazil are growing their money supply way above the rates the governments desire. In fact, world money supply growth is estimated at 13-14% over the last

12 months.

Countries that run current account deficits, such as the U.S., Britain, and others have substantial trade imbalances with countries running current account surpluses, such as China, Russia, Singapore, Norway, and the Persian Gulf oil producers. As money flows into the surplus countries as a result of their exports, the receiving country must sterilize the inflows of foreign currency. To do this, the surplus countries' central banks must print money in their own currency in an amount equal to the inflows of dollars, or pounds, or other currency. This results in an expansion of their money supply. Eventually, having increases in money supply that exceed increases in productivity leads to inflation as we discussed earlier.

When a country has a surplus and their currency is partially or completely pegged to the dollar (e.g. China, Saudi Arabia, and other Persian Gulf states), they are in a difficult position. They must raise the value of their currency and their interest rates if they want to solve their inflation problem. However, current account countries are slow to act in this manner because even though inflation is rising, their standard of living is rising faster due to their current account surplus and the wealth the country is accumulating. This inflation ends up in the feedback loop discussed in driver number nine, and is how currency sterilization activities by current account surplus countries lead to an increase in global inflation."

Financial Sense

It's already over, now it's just a matter of adjusting.

-

DantesPeak - Expert

- Posts: 6277

- Joined: Sat 23 Oct 2004, 03:00:00

- Location: New Jersey

Re: The commodities dip of July/August 2008

If not at year end then how about 1 year from now?Twilight wrote:At year end, no bet. Too short a timescale for the stuff I am seeing appear as Q3 progresses, and some real eureka moments I am having these last couple of weeks.DantesPeak wrote:Do any of you deflationists want make a figurative bet that commodity indexes will be lower at year end? I bet higher.

My crystal ball (powered by a non-renewable energy source) sees higher commodity prices.

what is a construction commodity? You mean building materials like lumber and iron?Twilight wrote:But a respectable time into next year, I expect construction-related commodities at least to have tanked.

The price of Wood has already "softened" due to the housing crunch.

- cube

- Intermediate Crude

- Posts: 3909

- Joined: Sat 12 Mar 2005, 04:00:00

Re: The commodities dip of July/August 2008

Alright. Q3 next year, I expect lower prices on commodities used heavily in building materials. Iron, steel, cement, no recovery in zinc, but I am specifically excluding copper. While not in this category, I also reckon lead will end up significantly lower. Consumption in the ME Gulf and China may hold up a little longer, but the North American and European markets are in decline and it will take a lot of pumping to compensate for a plain lack of buyers.

- Twilight

- Expert

- Posts: 3027

- Joined: Fri 02 Mar 2007, 04:00:00

Re: The commodities dip of July/August 2008

James Turks explanation for dollar movement is similar to what you've proposed, Dantes Peak:

gold money

Also, about three weeks ago, Mr Bill linked a Reuters article about FCB intervention in the currency markets. This was literally one or two days before the dollar bottomed.

At Ticker Forum, there's a poster who speculated that hedge funds were in part behind the dollar rise:

ticker forum

"...When central banks intervene in the currency markets, they exchange their currency for dollars. Central banks then use the dollars they acquire to buy US government debt instruments so that they can earn interest on their money. The debt instruments central banks acquire are held in custody for them at the Federal Reserve, which reports this amount weekly.

On July 16, 2008 (the closest date of the weekly reports to the July 15th low in the Dollar Index), the Federal Reserve reported holding $2,349 billion of US government paper in custody for central banks. In its report released today, this amount had grown over the past three weeks to $2,401 billion, a 38.4% annual rate of growth. To put this phenomenally high growth rate into perspective, for the twelve months ending this past July 16th, assets in the Federal Reserve's custody account grew by 17.3%, which is less than one-half the growth rate experienced over the past three weeks.

So central banks were accumulating dollars over the past three weeks at a rate far above what one would expect as a result of the US trade deficit. The logical conclusion is that they were intervening in currency markets. They were buying dollars for the purpose of propping it up, to keep the dollar from falling off the edge of the cliff and doing so ignited a short covering rally, which is not too difficult to do given the leverage employed in the markets these days by hedge funds and others. So central banks pushed in one direction and funds and traders then stepped on board. In other words, central banks ignited the fuse of a bear market rally...."

gold money

Also, about three weeks ago, Mr Bill linked a Reuters article about FCB intervention in the currency markets. This was literally one or two days before the dollar bottomed.

At Ticker Forum, there's a poster who speculated that hedge funds were in part behind the dollar rise:

These series of trades are what hedgefunds were doing because their logical appeals:

1. short financials

2. long cmdtys

3. short $ vs. euro

4. short high P/E nasdaq stocks

The problem with long-short trade is just that you can be right fundamentally about 3 out of the 4 trades.

But just one of them could be wrong and as you cover, you also cover the existing position and this clearly triggers a feedback loop.

The one that is wrong was the idea that USA will print like Zimb, and thus long commodities indiscriminately. These would prove disastrous as they force unwind the otherwise "correct" trades.

So far from my trades I anticipated #1 - 3 correctly (deffering financials short while continuing to sell cmdtys).

I underestimated the extent to which the hedgefunds do #4 though, and as a result took a bit of a hit although not much as I just scaled in 2 days ago.

From Amaranth's experience, once the margin call is over prices quickly adjust to where they were and in this case I am just salivating over the potentials in financials.

By the way, the CRE lack of participation in this rally is perfectly explained by the LACK of shorting in that sector as opposed to financials. There's no immediate comparison of ABK/MBI/FRE in CRE space, ... well maybe GGP who seems to have a refinance schedule every other weeks.

As a final reminder, in a margin call, the lender's goal is not to maximize profit but to minimize losses and thus prices could be unpredictable as the need to cover quickly outweighs EVERY other consideration. Thus the strong incentive for everyone to stay away from this runaway trainwreck just purely from technical reason. One week is about as good as historically true in the unwindings of such event, but the larger the trade typically it takes longer periods to clear. Think back on how crazy people were in the past 3 months on commodities and decoupling theories to help quantify that last statement.

ticker forum

Civilization: the biosphere's skin disease

-

firestarter - Heavy Crude

- Posts: 1171

- Joined: Sun 19 Mar 2006, 04:00:00

Re: The commodities dip of July/August 2008

I'm hesitant to speculate on building materials but I'm confident commodities like energy, precious metals, and grains will be higher next year.Twilight wrote:Alright. Q3 next year, I expect lower prices on commodities used heavily in building materials. Iron, steel, cement, no recovery in zinc, but I am specifically excluding copper. While not in this category, I also reckon lead will end up significantly lower.

As for lead I wouldn't be so sure about it going down.

The most common application for lead is for car batteries.

however...

There has been a massive surge in demand for "e-bikes" in China.

(battery power bikes using lead acid batteries)

A single e-bike requires just as much lead metal as a car.

An e-bike is actually fairly competitive to a gasoline powered scooter in cost + performance and rising oil prices can only make this more so.

I think lead will go up.

- cube

- Intermediate Crude

- Posts: 3909

- Joined: Sat 12 Mar 2005, 04:00:00

Re: The commodities dip of July/August 2008

cube wrote:I'm hesitant to speculate on building materials but I'm confident commodities like energy, precious metals, and grains will be higher next year.Twilight wrote:Alright. Q3 next year, I expect lower prices on commodities used heavily in building materials. Iron, steel, cement, no recovery in zinc, but I am specifically excluding copper. While not in this category, I also reckon lead will end up significantly lower.

...

Inflation in prices of commodities - including precious metals, oil, lead, grain - makes no sense in the face of an economic catastrophe. Who will be buying these things in a year?

I continue to find it amazing that, in the face of facts, people continue to hold to yesterdays 'common knowledge'.

Here's a little snippet - a SMALL example of just how fast demand can drop. Suffice it to say that this has only just begun, we don't see mass unemployment and real economic hardship yet. What do you figure the drop in demand will look like when we DO?

http://www.purchasing.com/article/CA6582945.html

"U.S. stainless steel consumption dropped by 12.5% in the first quarter from the year-ago period and may have dropped even more when April-June data is tabulated. That’s the word from analysts who say it’s hard to see any demand positives this year.

In fact, global demand growth for stainless steel mill products slowed so much in the second quarter that there now is world oversupply, according to a market review by Finnish stainless steel producer Outokumpu, which produces stainless steel at plants in Finland, the United Kingdom and the U.S."

Welcome to the Kondratieff Winter

-

shady28 - Coal

- Posts: 412

- Joined: Wed 06 Jul 2005, 03:00:00

49 posts

• Page 1 of 3 • 1, 2, 3

Who is online

Users browsing this forum: Majestic-12 [Bot] and 10 guests