Say goodbye to alternatives and any chance at a slow decline.

Thom Whipple Falls Church News

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

AirlinePilot wrote:Never fear peakster's! Things may be temporarily in a slight holding pattern but not to worry, very shortly we are going to trudge blindly right off the plateau!

Say goodbye to alternatives and any chance at a slow decline.

Thom Whipple Falls Church News

Tanada wrote:Weren't they supposed to fill the SPR up to capacity when oil falls below $80.00? When are they gaoing to start doing so? As I understand it they have capacity for another 300 Mbbl, so even if they start buying at 1 Mbbl/day it would take most of a year to do the filling.

killJOY wrote:I never thought peak oil left us. In fact, I'm with Michael Klare, who called it long ago: the housing crash and ensuing clusterfrig is partly the result of oil prices spiking due to supply constrictions:

TheDude wrote:Agree with Whipple all the way, except that like many he doesn't believe there's been much demand destruction. At least in the States the VMT stats and EIA figures suggest there has been a reduction in demand;

Plantagenet wrote:Here's another prescient discussion of the "head-fake".....i.e. recession bringing on lower oil prices just as global oil production starts to drop.

head fake

The head fake will result in 2-3 years of lower oil prices, wasting still more time that should've been used to bring on alternative "green" energy and nukes.

OPEC is cutting production so I doubt that'll happen. Whatever they cut production by in order to stabilize prices will be available later, not to mention that a short-fall in supply at some later date will simply lead to the higher prices that made some projects attractive in the first place. In short, a reduction in demand can only stretch the plateau/decline out farther, not induce greater declines. That said, over the next decade or so I'm pretty sure that demand, not supply, will drive prices in either direction, since that's where the greatest changes can be made.MD wrote:The plateau was supposed to be extended by the production of more expensive oil. Now that won't happen to the same extent. Therefore we'll fall off the peak more rapidly. It won't get much attention though. The wreckage that was America will take the attention and bubbles will take the bulk of the blame.

Professor Membrane wrote: Not now son, I'm making ... TOAST!

Lets see...Gebari wrote:Every oil price spike in history has triggered a global recession:

1973: Arab oil embargo oil price spike: few years later - GLOBAL RECESSION

1979: Iranian revolution oil price spike: few years later - GLOBAL RECESSION

1990: Gulf War oil price spike: few years later - GLOBAL RECESSION

2006: Peak oil price spike: few years later - GLOBAL RECESSION

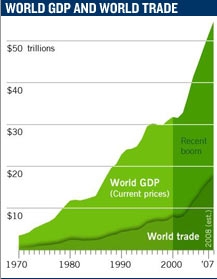

So we had peak oil burst a bubble in 1980, and then oil production continued to increase, past peak?Gebari wrote:It's no coincidence. Peak oil is the hidden cause of our crisis - it burst the bubble of the pyramid scheme that developed since around 1980, a bubble that we had to develop because peak oil per capita meant that proper economic growth became more difficult, so we resorted to not so real ways to keep the illusion of our economy growing.

Ah yes, w/ the average driver going ~12,000 miles/year, getting ~17mpg, and having to pay ~$700-1400 more per year due to higher oil prices, oil must be the reason why we've seen all this toxic equity. Having subprime and ARM borrowers pay anywhere from a few thousand to ten thousand plus per year more than what they did at the start of their loans couldn't be what caused this downturn in the markets. And it's not like we would see people running to commodities in the hope that they can avoid losses, because then we would be seeing a significant drop in oil prices... Oh, wait, nvm.Gebari wrote:The bubble was only possible with cheap and reasonably plentiful oil, so when this ended inflation rose, triggering interest rate hikes, combined with cost of living increasing (gasoline, food etc - peak oil triggered) made it more difficult for sub-prime mortage owners to pay - setting off a cascade of other events leading to the current financial crisis. Something like that.

Professor Membrane wrote: Not now son, I'm making ... TOAST!

Users browsing this forum: No registered users and 35 guests