How does the current oil crash change the PO story?

How does the current oil crash change the PO story?

Even though I was the only one who predicted a crash from $145 to $70, I'm still a PO believer. Somewhere in the near future, oil production will peak.

The current crash (oil below $50 and onto $40) might even worsen the effects of PO.

The date of the actual peak may be pushed back by a few years, but so are investments in renewables.

In short, PO may take us by even bigger surprise and leave us even more unprepared.

Had oil prices remained in the $70-90 bracket, then investments in post-oil renewables would have continued steadily, making it more easy to transit beyond the peak. But a price below $50 really kills this industry.

So the reality is now entirely different: we will be more vulnerable to PO than ever before.

Anyone agree with this very simple analysis?

The current crash (oil below $50 and onto $40) might even worsen the effects of PO.

The date of the actual peak may be pushed back by a few years, but so are investments in renewables.

In short, PO may take us by even bigger surprise and leave us even more unprepared.

Had oil prices remained in the $70-90 bracket, then investments in post-oil renewables would have continued steadily, making it more easy to transit beyond the peak. But a price below $50 really kills this industry.

So the reality is now entirely different: we will be more vulnerable to PO than ever before.

Anyone agree with this very simple analysis?

The Beginning is Near!

-

lorenzo - Intermediate Crude

- Posts: 2184

- Joined: Sat 01 Jan 2005, 04:00:00

Re: How does the current oil crash change the PO story?

I see it as a last unexptected chance to make a killing on NYMEX options, for those who missed the boat last time.

Hell, take out a loan and put your money in crude at 150 a barrel for 2013 (December). It'll only cost you 3350 dollars for 1000 barrels. I see this as the best retirement plan currently on offer.

As for the impact, somebody else said that in fact any new upturn in the economy will be knocked down by sky-rocketing commodity prices - I agree. So make wise investment choices and keep improving your doomstead.

Oh, and keep your job.

Hell, take out a loan and put your money in crude at 150 a barrel for 2013 (December). It'll only cost you 3350 dollars for 1000 barrels. I see this as the best retirement plan currently on offer.

As for the impact, somebody else said that in fact any new upturn in the economy will be knocked down by sky-rocketing commodity prices - I agree. So make wise investment choices and keep improving your doomstead.

Oh, and keep your job.

Last edited by davep on Thu 20 Nov 2008, 15:34:45, edited 1 time in total.

What we think, we become.

-

davep - Senior Moderator

- Posts: 4578

- Joined: Wed 21 Jun 2006, 03:00:00

- Location: Europe

Re: How does the current oil crash change the PO story?

It doesn't change the Peak Oil story. World production peaked circa 2006 and is still declining. The new Alberta oil sands projects are now being postponed, which will stretch production further out into the future as a plateau and not restore the peak. Tupi won't produce a barrel of oil for at least five years, probably longer. Meanwhile, all the existing fields continue their steady decline.

Demand, of course, is falling faster than production, leading to the peculiar circumstance that we may have shortages simultaneously with low prices. Another peculiar situation is that the price of gold is steadily declining despite increasing difficulties in most cities in buying physical gold such as coins or ingots.

I tell people who talk of an oil bubble that the good news is that oil prices are in the toilet, but the bad news is that so is the economy.

Demand, of course, is falling faster than production, leading to the peculiar circumstance that we may have shortages simultaneously with low prices. Another peculiar situation is that the price of gold is steadily declining despite increasing difficulties in most cities in buying physical gold such as coins or ingots.

I tell people who talk of an oil bubble that the good news is that oil prices are in the toilet, but the bad news is that so is the economy.

-

DaleFromCalgary - Peat

- Posts: 66

- Joined: Thu 31 Jul 2008, 03:00:00

Re: How does the current oil crash change the PO story?

Peak oil is an underground phenomenon. I think peak oil --"the midpoint of global hydrocarbon production"-- is here or perhaps even 2-3 years behind us. Time will tell, but in a way it's irrelevant of when it happens. What's relevant is that modern society will have difficulties coping with the scarcity of the main ingredient that made our society modern.

Crude oil prices, which are all over the board, it's above ground and --the geologists among us will correct me-- I don't think oil wells lose sleep over what happens above ground. When it's dry, it's dry.

I doubt the current recession and 2-3bbl/day of demand destruction will push back the last day of hydrocarbon production by decades, much less centuries. We're still on schedule to find ourselves staring at the last oil well with virtually no preparation to speak of.

My 2 cents. Try to make a buck.

Crude oil prices, which are all over the board, it's above ground and --the geologists among us will correct me-- I don't think oil wells lose sleep over what happens above ground. When it's dry, it's dry.

I doubt the current recession and 2-3bbl/day of demand destruction will push back the last day of hydrocarbon production by decades, much less centuries. We're still on schedule to find ourselves staring at the last oil well with virtually no preparation to speak of.

My 2 cents. Try to make a buck.

Last edited by VMarcHart on Thu 20 Nov 2008, 16:02:33, edited 1 time in total.

On 9/29/08, cube wrote: "The Dow will drop to 4,000 within 2 years". The current tally is 239 bold predictions, 9 right, 96 wrong, 134 open. If you've heard here, it's probably wrong.

-

VMarcHart - Heavy Crude

- Posts: 1644

- Joined: Mon 26 May 2008, 03:00:00

- Location: Now overpopulating California

Re: How does the current oil crash change the PO story?

lorenzo wrote:Even though I was the only one who predicted a crash from $145 to $70, I'm still a PO believer. Somewhere in the near future, oil production will peak.

The current crash (oil below $50 and onto $40) might even worsen the effects of PO.

The date of the actual peak may be pushed back by a few years, but so are investments in renewables.

In short, PO may take us by even bigger surprise and leave us even more unprepared.

Had oil prices remained in the $70-90 bracket, then investments in post-oil renewables would have continued steadily, making it more easy to transit beyond the peak. But a price below $50 really kills this industry.

So the reality is now entirely different: we will be more vulnerable to PO than ever before.

Anyone agree with this very simple analysis?

I'll only address this one point: You can't push back what's already passed us by.

But assuming for a moment the peak is yet to come, if worldwide oil consumption is down a million or so bbls/day (for example) under the stress of the current economic problems, that'll only reflect about five days worth of lost consumption over the course of a year. If the slowdown lasts five years that still only adds up to a few weeks rather than a few years of production. In fact, lower oil prices will lead to even more consumption so it's doubtful if it'll add up to more than a few weeks worth over the course of the crisis unless it lasts decades, in which case we'll have far more pressing concerns to address than the ever fluctuating price and availability of oil.

Edit for silly typo.

Got Dharma?

Everything is Impermanent. Shakyamuni Buddha

Everything is Impermanent. Shakyamuni Buddha

-

eastbay - Expert

- Posts: 7186

- Joined: Sat 18 Dec 2004, 04:00:00

- Location: One Mile From the Columbia River

Re: How does the current oil crash change the PO story?

To put it very simply, I think the current price drop will make our situation worse because there will be less investment in alternatives, and those that adjusted their travel behavior will slip back into their cars...

-

BicycleCommuter - Wood

- Posts: 33

- Joined: Thu 17 Feb 2005, 04:00:00

- Location: Boulder, Colorado

Re: How does the current oil crash change the PO story?

davep wrote:

So, if I'm to understand the process correctly, I invest $3,350 now to buy 1000 barrels of oil that I agree ahead of time to sell for $150 each in December, 2013?

Hell, take out a loan and put your money in crude at 150 a barrel for 2013 (December). It'll only cost you 3350 dollars for 1000 barrels. I see this as the best retirement plan currently on offer.

So, if I'm to understand the process correctly, I invest $3,350 now to buy 1000 barrels of oil that I agree ahead of time to sell for $150 each in December, 2013?

"Where is the man who has so much as to be out of danger?" -Thomas Huxley

-

Duende - Coal

- Posts: 418

- Joined: Sat 27 Nov 2004, 04:00:00

- Location: The District

Re: How does the current oil crash change the PO story?

Duende wrote:davep wrote:Hell, take out a loan and put your money in crude at 150 a barrel for 2013 (December). It'll only cost you 3350 dollars for 1000 barrels. I see this as the best retirement plan currently on offer.

So, if I'm to understand the process correctly, I invest $3,350 now to buy 1000 barrels of oil that I agree ahead of time to sell for $150 each in December, 2013?

No, you generally sell it the month before (or earlier). Plus, it's an option to buy, with no obligation, should the price fall to 10 dollars and stay there.

If, for example, oil reaches 300 dollars beforehand, you could make 150k (plus whatever time element, interest element and volatility element are left on the option).

Now is historically a very good time to buy. The hedge funds now just want to survive. Anyone with cash can make a great investment.

What we think, we become.

-

davep - Senior Moderator

- Posts: 4578

- Joined: Wed 21 Jun 2006, 03:00:00

- Location: Europe

Re: How does the current oil crash change the PO story?

The most important thing with regard to oil and the U.S. is this:

When the dollar crashes, and when we can no longer continue to borrow money from the rest of the world, then we probably won't be able to continue to import oil.

That's when gasoline goes to $10 or $20 per gallon.

The oil price and oil production statistics aren't nearly as important as that point.

When the dollar crashes, and when we can no longer continue to borrow money from the rest of the world, then we probably won't be able to continue to import oil.

That's when gasoline goes to $10 or $20 per gallon.

The oil price and oil production statistics aren't nearly as important as that point.

-

Polemic - Lignite

- Posts: 353

- Joined: Sun 24 Sep 2006, 03:00:00

- Location: Austin, TX

Re: How does the current oil crash change the PO story?

It is as has been predicted here for years.

A Bumpy Plateau.

Use this time to make yourself ready for when the Supply side of the equation limits the availability of Oil Slaves regardless of your Ability to Pay.

You are wasting time tapping...

A Bumpy Plateau.

Use this time to make yourself ready for when the Supply side of the equation limits the availability of Oil Slaves regardless of your Ability to Pay.

You are wasting time tapping...

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: How does the current oil crash change the PO story?

Just an aside but I notice both Twilight in the Desert and Deffeyes's Hubbert's Peak are both in the Entertainment section of the Rigzone bookstore.  Perhaps an indication of the esteem they receive.

Perhaps an indication of the esteem they receive.

Perhaps an indication of the esteem they receive.

Perhaps an indication of the esteem they receive.Cogito, ergo non satis bibivi

And let me tell you something: I dig your work.

And let me tell you something: I dig your work.

-

TheDude - Expert

- Posts: 4896

- Joined: Thu 06 Apr 2006, 03:00:00

- Location: 3 miles NW of Champoeg, Republic of Cascadia

Re: How does the current oil crash change the PO story?

As far as i can see, then the oil crash in historical terms was an inevitability as soon as the global economy started heading south. The typical reaction when the crap hits the fan. The problem lies in when "historically" the World tries to exit an economic slump. As historically, the World has had the fuel in which to power its way out of trouble.

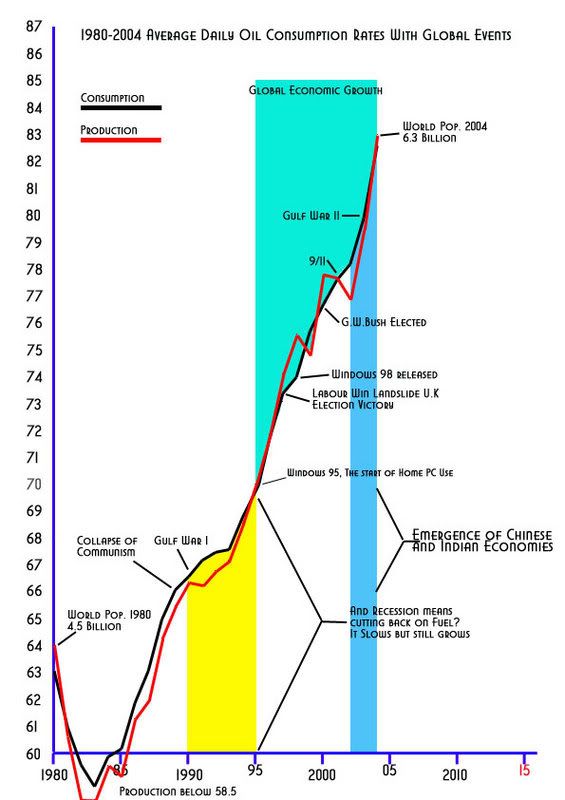

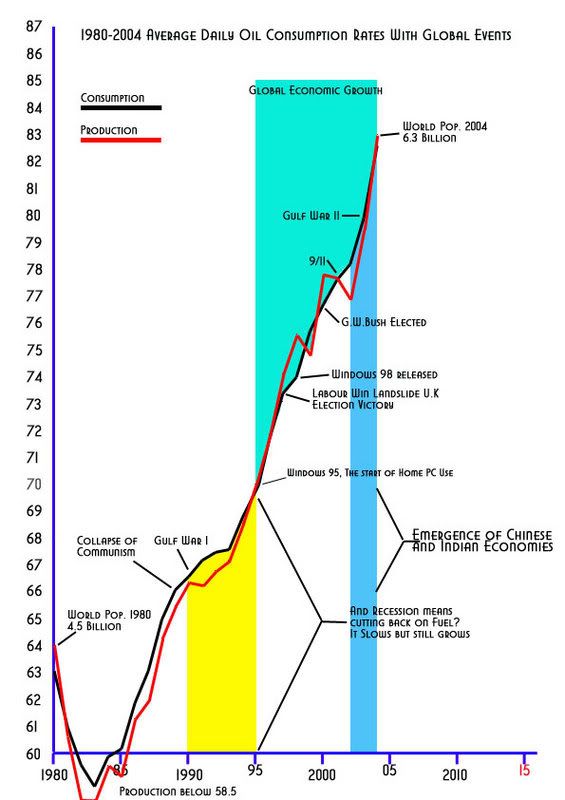

I knocked this graph up a few years ago

What struck me was the the constant that forced production and consumption ever upward, regardless of the Global ecomnomic climate, that being the growth in population.

I once believed in the threat of Peak Oil but am more concerned with EROEI. A collapsing oil market is possibly the worst scenario to find ourselves in as those ignorant of the principles of P.O will greet the cheap oil with open arms. EROEI, regardless of price has the abnility to be far more devastating than just issues caused as a result of expensive oil alone.

I knocked this graph up a few years ago

What struck me was the the constant that forced production and consumption ever upward, regardless of the Global ecomnomic climate, that being the growth in population.

I once believed in the threat of Peak Oil but am more concerned with EROEI. A collapsing oil market is possibly the worst scenario to find ourselves in as those ignorant of the principles of P.O will greet the cheap oil with open arms. EROEI, regardless of price has the abnility to be far more devastating than just issues caused as a result of expensive oil alone.

THE FUTURE IS HISTORY!

-

Gazzatrone - Tar Sands

- Posts: 581

- Joined: Mon 07 Nov 2005, 04:00:00

- Location: London, UK

Re: How does the current oil crash change the PO story?

lorenzo wrote:The current crash (oil below $50 and onto $40) might even worsen the effects of PO. *** In short, PO may take us by even bigger surprise and leave us even more unprepared. *** So the reality is now entirely different: we will be more vulnerable to PO than ever before.

Quite true.

lorenzo wrote:Anyone agree with this very simple analysis?

I agree.

-

Daniel_Plainview - Prognosticator

- Posts: 4220

- Joined: Tue 06 May 2008, 03:00:00

- Location: 7035 Hollis ... Near the Observatory ... Just down the way, tucked back in the small woods

Re: How does the current oil crash change the PO story?

The current crash (oil below $50 and onto $40) might even worsen the effects of PO.

I'd say that the current economic collapse is PRECISELY what has been predicted as a result of peak oil on this site and others. This is peak oil.

-

DefiledEngine - Lignite

- Posts: 344

- Joined: Thu 19 Aug 2004, 03:00:00

Re: How does the current oil crash change the PO story?

At first I thought that the crash in the price of oil would mask Peak Oil. Maybe for a short while. But If you really understand PO and the underlying issue of EROEI, then it may just be the worst case scenario.

The more I think it through, the more it looks like we just may see production slow at a greater rate than demand. The scarier thought I am having right now is this may be artificially enabled. If the price gets below some ugly point, the folks who export oil are going to become desperate. They will use the necessary and available tools to stabilize price, whether we like it or not.

One thing that a lot of folks are not grasping, or are refusing to see, is that this particular price collapse is not commensurate with the demand picture.

It just isn't, not in any way shape or form. Yes the US (and some of the OECD nations) have reduced demand due to high prices. I do not dispute that. The issue at hand is why have prices collapsed over 60% in just months?

The answer lies in what is going on globally. A large and probably long term collapse of our economic system. While things are deflating everyone everywhere is de-leveraging. They are selling EVERYTHING THEY HAVE. It is contributing more to the price collapse of crude than normal fundamentals can manage. If you believe that price is collapsing due to the future demand picture, than you better start thinking about Mad Max, because that's where we are headed. This price collapse has overshot just like the spike did. There is no doubt in my mind.

This will not continue forever and the dollar will likely not remain in prominence once everyone sees we cannot pay them back for the money we borrowed through T-bill auctions. Its going to happen, its only a matter of time. My guess is sometime next year this goes down, but with things as volatile as they are it could happen tomorrow!

Once the dollar begins its fall, oil will get very pricey again for the US. I see this as a second plausible scenario along with large scale production decline due to loss of capital investment. But the IEA has just handed us a nasty reminder that in order to basically remain on a plateau we are going to require trillions in investment to keep our heads above water.

Guess what? That money isn't going to be there. Anyone who believes it will be over the next 5-8 years is smoking some really good sh1t and I want some of it. The IEA magically assumes also that reserve growth will be larger than it ever has been, and astronomical production from CTL and Tar Sands will step in to fill the gap of decline! And Oh, by the way, we also need to find a crap load of new oil really soon!!!

When you take all this into account, I don't see how folks can possibly believe oil will continue its price decline barring a large meteorite strike or a global nuclear exchange.

My thoughts are that one of these events is going to take place, and any one of them can drive price back up.

-Collapsing Dollar.

- Lack of large scale capital investment in oil production over a

long time period

- Panic in export nations due to prices being far too low.

If any one of them comes to pass it's bad. Here's hoping we don't get a few of them all rolled up together!

I will be going long oil in a gigantic way any moment now and will discipline myself to hold it. I see little probability that over the longer term price remains depressed.

In answer to the OP, no it doesn't change the story at all, just how we are going to get screwed by it.

The more I think it through, the more it looks like we just may see production slow at a greater rate than demand. The scarier thought I am having right now is this may be artificially enabled. If the price gets below some ugly point, the folks who export oil are going to become desperate. They will use the necessary and available tools to stabilize price, whether we like it or not.

One thing that a lot of folks are not grasping, or are refusing to see, is that this particular price collapse is not commensurate with the demand picture.

It just isn't, not in any way shape or form. Yes the US (and some of the OECD nations) have reduced demand due to high prices. I do not dispute that. The issue at hand is why have prices collapsed over 60% in just months?

The answer lies in what is going on globally. A large and probably long term collapse of our economic system. While things are deflating everyone everywhere is de-leveraging. They are selling EVERYTHING THEY HAVE. It is contributing more to the price collapse of crude than normal fundamentals can manage. If you believe that price is collapsing due to the future demand picture, than you better start thinking about Mad Max, because that's where we are headed. This price collapse has overshot just like the spike did. There is no doubt in my mind.

This will not continue forever and the dollar will likely not remain in prominence once everyone sees we cannot pay them back for the money we borrowed through T-bill auctions. Its going to happen, its only a matter of time. My guess is sometime next year this goes down, but with things as volatile as they are it could happen tomorrow!

Once the dollar begins its fall, oil will get very pricey again for the US. I see this as a second plausible scenario along with large scale production decline due to loss of capital investment. But the IEA has just handed us a nasty reminder that in order to basically remain on a plateau we are going to require trillions in investment to keep our heads above water.

Guess what? That money isn't going to be there. Anyone who believes it will be over the next 5-8 years is smoking some really good sh1t and I want some of it. The IEA magically assumes also that reserve growth will be larger than it ever has been, and astronomical production from CTL and Tar Sands will step in to fill the gap of decline! And Oh, by the way, we also need to find a crap load of new oil really soon!!!

When you take all this into account, I don't see how folks can possibly believe oil will continue its price decline barring a large meteorite strike or a global nuclear exchange.

My thoughts are that one of these events is going to take place, and any one of them can drive price back up.

-Collapsing Dollar.

- Lack of large scale capital investment in oil production over a

long time period

- Panic in export nations due to prices being far too low.

If any one of them comes to pass it's bad. Here's hoping we don't get a few of them all rolled up together!

I will be going long oil in a gigantic way any moment now and will discipline myself to hold it. I see little probability that over the longer term price remains depressed.

In answer to the OP, no it doesn't change the story at all, just how we are going to get screwed by it.

-

AirlinePilot - Moderator

- Posts: 4378

- Joined: Tue 05 Apr 2005, 03:00:00

- Location: South of Atlanta

Re: How does the current oil crash change the PO story?

AirlinePiliot said:

My greatest fear is that the market may be entering a state of Chaos. (Strange Attractors and all of that kind of stuff.) If that situation comes to pass, logic will no longer be able to determine short term outcome. We will have to wait for a re-stabilization point to occur before we will be able to have a reasonable chance of accurately predicting the future.

I will be going long oil in a gigantic way any moment now and will discipline myself to hold it. I see little probability that over the longer term price remains depressed.

My greatest fear is that the market may be entering a state of Chaos. (Strange Attractors and all of that kind of stuff.) If that situation comes to pass, logic will no longer be able to determine short term outcome. We will have to wait for a re-stabilization point to occur before we will be able to have a reasonable chance of accurately predicting the future.

-

shortonoil - False ETP Prophet

- Posts: 7132

- Joined: Thu 02 Dec 2004, 04:00:00

- Location: VA USA

Re: How does the current oil crash change the PO story?

But you just predicted a collapse the entire monetary system.shortonoil wrote:We will have to wait for a re-stabilization point to occur before we will be able to have a reasonable chance of accurately predicting the future.

On 9/29/08, cube wrote: "The Dow will drop to 4,000 within 2 years". The current tally is 239 bold predictions, 9 right, 96 wrong, 134 open. If you've heard here, it's probably wrong.

-

VMarcHart - Heavy Crude

- Posts: 1644

- Joined: Mon 26 May 2008, 03:00:00

- Location: Now overpopulating California

Re: How does the current oil crash change the PO story?

shortonoil wrote:My greatest fear is that the market may be entering a state of Chaos. (Strange Attractors and all of that kind of stuff.) If that situation comes to pass, logic will no longer be able to determine short term outcome. We will have to wait for a re-stabilization point to occur before we will be able to have a reasonable chance of accurately predicting the future.

I agree, but at the moment I see the risk is worth taking. If all hell breaks loose as we all think it might it just wont matter anyway.

Vmarc,

I think a collapse is possible but we wont just descend into another stone age either. Things will go on and something else, something different will emerge from the collapse, it always does. This time it may take longer and with the decline in EROEI it may not involve rampant growth, but we will survive. We just have to get through the pain and suffering first.

-

AirlinePilot - Moderator

- Posts: 4378

- Joined: Tue 05 Apr 2005, 03:00:00

- Location: South of Atlanta

Re: How does the current oil crash change the PO story?

At the last ASPO meeting in Sacramento one of the speakers asked the question, " What happens to your oil future contract if the government starts fixing prices and rationing oil?"

If I didn't have all my assets tied in land investments and had some liquidity I may be inclined to go long on oil at the moment but I have a deep distrust in the current financial markets being free of manipulations and interventions. This really makes the little guy exposed to forces beyond ones ability to predict.

Be very careful.

If I didn't have all my assets tied in land investments and had some liquidity I may be inclined to go long on oil at the moment but I have a deep distrust in the current financial markets being free of manipulations and interventions. This really makes the little guy exposed to forces beyond ones ability to predict.

Be very careful.

Patiently awaiting the pathogens. Our resiliency resembles an invasive weed. We are the Kudzu Ape

blog: http://blog.mounttotumas.com/

website: http://www.mounttotumas.com

blog: http://blog.mounttotumas.com/

website: http://www.mounttotumas.com

-

Ibon - Expert

- Posts: 9568

- Joined: Fri 03 Dec 2004, 04:00:00

- Location: Volcan, Panama

25 posts

• Page 1 of 2 • 1, 2

Who is online

Users browsing this forum: No registered users and 36 guests