Ten Major Threats To the Dollar In 2009

Re: Ten Major Threats To the Dollar In 2009

OMFG!! I won't sleep for a week. Adrenaline? I don't need more stinking adrenaline. Holy crap!

There seems (from what I've been reading of analysts positions and predictions) to be a mentality that the USA is the biggest of the "too big to fail" ventures. If China does take their currency international they would likely (and soon) become the new reserve others flock too. But what would that do to the USA satellites like Australia, britian, and canada?

wouldn't they just take the whole global shooting match down with them?

From #7

If this really does transpire there will ahve to be a bottom. the US can't keep printing money forever. or will they look like Zimbabwe soon. When/if this happens I suspect the government would start seizing all assets (for teh good of all) and re-selling land (like feudal lords of old.)

There seems (from what I've been reading of analysts positions and predictions) to be a mentality that the USA is the biggest of the "too big to fail" ventures. If China does take their currency international they would likely (and soon) become the new reserve others flock too. But what would that do to the USA satellites like Australia, britian, and canada?

wouldn't they just take the whole global shooting match down with them?

From #7

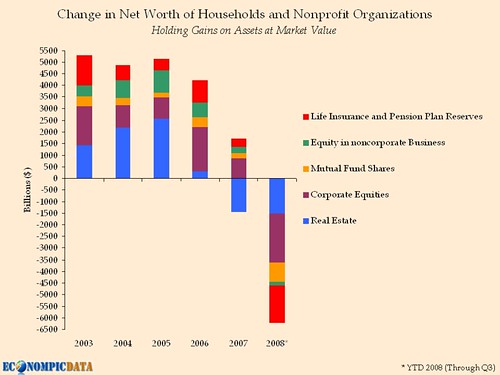

The current $2 trillion deficit projections being circulated in the media will prove woefully understated should the dynamics of hyperinflation take hold of the economy. A dollar collapse would cause our tax system to break down. Individuals whose income isn't keeping up with inflation will forgo tax payments to spend all their cash on food and basic necessities. Businessmen will find that by merely delaying tax payments, depreciation in the dollar will virtually eliminate their true value. Even the tax revenue that is paid will have lost most of its value by the time the government collects it. Meanwhile, the rising cost of everything will drive up the federal spending. The government, lacking adequate income to cover these rising expenses and unable to borrow due to the collapse of the treasury market, will be forced to resort more and more to money creation. If/when hyperinflation takes hold of America, do not be surprised to see 1% of government income come from taxes and 99% come from the creation of new money.

If this really does transpire there will ahve to be a bottom. the US can't keep printing money forever. or will they look like Zimbabwe soon. When/if this happens I suspect the government would start seizing all assets (for teh good of all) and re-selling land (like feudal lords of old.)

-

uNkNowN ElEmEnt - Expert

- Posts: 2587

- Joined: Sat 04 Dec 2004, 04:00:00

- Location: perpetual state of exhaustion

Re: Ten Major Threats To the Dollar In 2009

uNkNowN ElEmEnt wrote:When/if this happens I suspect the government would start seizing all assets (for teh good of all) and re-selling land (like feudal lords of old.)

So what they will seize?

Suburban houses?

Stocks of collapsing companies?

Private jets?

Who will buy these?

Sorry, but my view is that there is not much to seize...

-

EnergyUnlimited - Light Sweet Crude

- Posts: 7356

- Joined: Mon 15 May 2006, 03:00:00

Re: Ten Major Threats To the Dollar In 2009

No, I meant link in the last depression where they make the private ownership of gold illegal. I was however, thinking that if they seized land and sold it back to the highest bidder (liek the old feuldal kinds did) that might give them a bit of whatever the richest person has left... if there are any rich people left after this mess that is.

Especially when you consider that your government seems to think of you all as something to use and cast aside, you'd think that kind of thinking would lead them to jsut steal whatever assets (foreign accounts, lands or currency reserve accounts etc) that are in their citizens names. I mean what is to stop them now? they jsut make presidential orders/decrees or acts (liek the patriot) to suit themselves.

Especially when you consider that your government seems to think of you all as something to use and cast aside, you'd think that kind of thinking would lead them to jsut steal whatever assets (foreign accounts, lands or currency reserve accounts etc) that are in their citizens names. I mean what is to stop them now? they jsut make presidential orders/decrees or acts (liek the patriot) to suit themselves.

-

uNkNowN ElEmEnt - Expert

- Posts: 2587

- Joined: Sat 04 Dec 2004, 04:00:00

- Location: perpetual state of exhaustion

Re: Ten Major Threats To the Dollar In 2009

From teh same web site (thanks by the way this is a good resource)

New definitions for some old terms:

CEO --Chief Embezzlement Officer.

CFO-- Corporate Fraud Officer.

BULL MARKET -- A random market movement causing an investor to mistake himself for a financial genius.

BEAR MARKET -- A 6 to 18 month period when the kids get no allowance, the wife gets no jewelry

VALUE INVESTING -- The art of buying low and selling lower.

P/E RATIO -- The percentage of investors wetting their pants as the market keeps crashing.

BROKER -- What my broker has made me.

STANDARD & POOR -- Your life in a nutshell.

FINANCIAL PLANNER -- A person whose phone has been disconnected.

MARKET CORRECTION -- The day after you buy stocks.

CASH FLOW-- The movement your money makes as it disappears down the toilet.

WINDOWS -- What you jump out of when you're the sucker who bought Yahoo @ $240 per share.

INSTITUTIONAL INVESTOR -- Past week investor who's now locked up in a nuthouse.

LIQUIDITY -- When you look at your investments and wet your pants.

PROFIT -- An archaic word no longer in use.

New definitions for some old terms:

CEO --Chief Embezzlement Officer.

CFO-- Corporate Fraud Officer.

BULL MARKET -- A random market movement causing an investor to mistake himself for a financial genius.

BEAR MARKET -- A 6 to 18 month period when the kids get no allowance, the wife gets no jewelry

VALUE INVESTING -- The art of buying low and selling lower.

P/E RATIO -- The percentage of investors wetting their pants as the market keeps crashing.

BROKER -- What my broker has made me.

STANDARD & POOR -- Your life in a nutshell.

FINANCIAL PLANNER -- A person whose phone has been disconnected.

MARKET CORRECTION -- The day after you buy stocks.

CASH FLOW-- The movement your money makes as it disappears down the toilet.

WINDOWS -- What you jump out of when you're the sucker who bought Yahoo @ $240 per share.

INSTITUTIONAL INVESTOR -- Past week investor who's now locked up in a nuthouse.

LIQUIDITY -- When you look at your investments and wet your pants.

PROFIT -- An archaic word no longer in use.

-

uNkNowN ElEmEnt - Expert

- Posts: 2587

- Joined: Sat 04 Dec 2004, 04:00:00

- Location: perpetual state of exhaustion

-

Daniel_Plainview - Prognosticator

- Posts: 4220

- Joined: Tue 06 May 2008, 03:00:00

- Location: 7035 Hollis ... Near the Observatory ... Just down the way, tucked back in the small woods

Re: Ten Major Threats To the Dollar In 2009

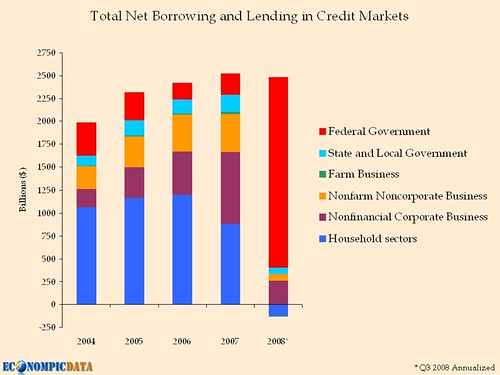

when you bail out everyone, you bail out no one as you destroy your currency.

Some wise words there.

-

Sixstrings - Fusion

- Posts: 15160

- Joined: Tue 08 Jul 2008, 03:00:00

Re: Ten Major Threats To the Dollar In 2009

Sixstrings wrote:when you bail out everyone, you bail out no one as you destroy your currency.

Some wise words there.

The currency is destroyed no matter what. In the fiat system with money as debt, it depends on growth. No growth, no interest, no ability to pay retirement, the system fails regardless.

It simply does not MATTER here whether TPTB print or don't print. If they don't print, States just collapse faster as they areunable to pay their state workers. The only thing the printing is doing is allowing some at the top fo the food chain to paper over their own losses and get nice manicures.

This monetary system is FINISHED. Its Walking Dead, Zombie Money. Buy what you can with it today. Its not even worth getting upset anymore over Bailouts. Its out of control. Live with it.

Reverse Engineer

-

ReverseEngineer - Intermediate Crude

- Posts: 3352

- Joined: Wed 16 Jul 2008, 03:00:00

-

bratticus - Permanently Banned

- Posts: 2368

- Joined: Thu 12 Jun 2008, 03:00:00

- Location: Bratislava

Re: Ten Major Threats To the Dollar In 2009

It's funny, a currency collapse is probably the most frightening thing the world of economics can dish out...yet it pales in comparrison to what nature can do (if she really wants to)...

Quote:

on 2 January 2009, seismicity of the ongoing Yellowstone earthquake swarm continues. Over 500 earthquakes, as large as M 3.9, have been recorded by an automated earthquake system since the inception of this unusual earthquake sequence that began Dec. 27, 2008. More than 300 of these events have been reviewed and evaluated by seismic analysts.

Yellowstone Quake Swarm

Quote:

on 2 January 2009, seismicity of the ongoing Yellowstone earthquake swarm continues. Over 500 earthquakes, as large as M 3.9, have been recorded by an automated earthquake system since the inception of this unusual earthquake sequence that began Dec. 27, 2008. More than 300 of these events have been reviewed and evaluated by seismic analysts.

Yellowstone Quake Swarm

Quis custodiet ipsos custodes.

-

RonMN - Intermediate Crude

- Posts: 2628

- Joined: Fri 18 Mar 2005, 04:00:00

- Location: Minnesota

Re: Ten Major Threats To the Dollar In 2009

RonMN wrote:It's funny, a currency collapse is probably the most frightening thing the world of economics can dish out...yet it pales in comparrison to what nature can do (if she really wants to)...

Quote:

on 2 January 2009, seismicity of the ongoing Yellowstone earthquake swarm continues. Over 500 earthquakes, as large as M 3.9, have been recorded by an automated earthquake system since the inception of this unusual earthquake sequence that began Dec. 27, 2008. More than 300 of these events have been reviewed and evaluated by seismic analysts.

Yellowstone Quake Swarm

Look at all the volcanoes in Central America now.

http://visz.rsoe.hu/alertmap/index.php?lang=eng

-

bratticus - Permanently Banned

- Posts: 2368

- Joined: Thu 12 Jun 2008, 03:00:00

- Location: Bratislava

Re: Ten Major Threats To the Dollar In 2009

Yeah...I know...but yellowstone is a SUPER volcano. It would not only bury most of the USA in ash & make the grain belt un-plantable. It would also change the climate of the planet.

Quis custodiet ipsos custodes.

-

RonMN - Intermediate Crude

- Posts: 2628

- Joined: Fri 18 Mar 2005, 04:00:00

- Location: Minnesota

Re: Ten Major Threats To the Dollar In 2009

uNkNowN ElEmEnt wrote: But what would that do to the USA satellites like Australia, britian, and canada?

well you're in luck. it looks like he's covered that today.

Canada

Currency: dollar—Unclear

Trade Balance: Shrinking Surplus

Story: Canadian Trade Surplus Narrows for a Second Month

Britain

Currency: pound—Doomed

Trade Balance: Growing Deficit

Story: UK trade deficit widens in October

New Zealand

Currency: dollar—Doomed

Trade Balance: Growing Deficit

Story: New Zealand’s annual current account deficit increased to 8.6 percent of GDP

Australian

Currency: yuan—Doomed

Trade Balance: Growing Deficit

Story: Australian Trade Deficit Grows for 75th Consecutive Month

see rest of world.

-

nobodypanic - Heavy Crude

- Posts: 1103

- Joined: Mon 02 Jun 2008, 03:00:00

Re: Ten Major Threats To the Dollar In 2009

uNkNowN ElEmEnt wrote:steal whatever assets...I mean what is to stop them now?

Population in 1930 ~2 billion

Population in 2009 ~7 billion

Guns in 1930

http://en.wikipedia.org/wiki/AVS-36_Simonov

http://en.wikipedia.org/wiki/Russian_M1910_Maxim

Guns in 2009

http://en.wikipedia.org/wiki/XM214_minigun

http://en.wikipedia.org/wiki/MGP-84

http://en.wikipedia.org/wiki/BXP

-

bratticus - Permanently Banned

- Posts: 2368

- Joined: Thu 12 Jun 2008, 03:00:00

- Location: Bratislava

Re: Ten Major Threats To the Dollar In 2009

What he doesn't say on that page is what to do. Since he's promoting massive inflation I'd assume rack up massive debt and see what happens would be his suggestion. That or gold...

shame on us, doomed from the start

god have mercy on our dirty little hearts

god have mercy on our dirty little hearts

- strider3700

- Intermediate Crude

- Posts: 2865

- Joined: Sun 17 Apr 2005, 03:00:00

- Location: Vancouver Island

Re: Ten Major Threats To the Dollar In 2009

Buiter: dollar collapse 2-5 years away

The long-held assumption that US assets - particularly government bonds - are a safe haven will soon be overturned as investors lose their patience with the world's biggest economy, according to Willem Buiter.

Professor Buiter, a former Monetary Policy Committee member who is now at the London School of Economics, said this increasing disenchantment would result in an exodus of foreign cash from the US.

The warning comes despite the dollar having strengthened significantly against other major currencies, including sterling and the euro, after hitting historic lows last year. It will reignite fears about the currency's prospects, as well as sparking fears about the sustainability of President-Elect Barack Obama's mooted plans for a Keynesian-style increase in public spending to pull the US out of recession.

http://www.thenewfederalistpapers.com

-

wisconsin_cur - Light Sweet Crude

- Posts: 4576

- Joined: Thu 10 May 2007, 03:00:00

- Location: 45 degrees North. 883 feet above sealevel.

Re: Ten Major Threats To the Dollar In 2009

No dollar?? Pros Say: Oil, Gold, Yen Will Rule Future

link

Ashraf Laidi of CMC Markets said the big winner in the current global environment is the yen, and gold appears to be headed back to 900. Cameron Hanover's Peter Beutel said we can expect to see a new oil squeeze, with emerging economies rebounding to compete with the U.S. for the same supplies.

...and The Second-Half Recovery Looks Elusive

The Economic Cycle Research Institute's Lakshman Achuthan said he cannot rule out a second-half recovery, but there is absolutely no sign pointing that way in the leading economic indicators.

link

"I learned long ago, never to wrestle with a pig. You get dirty, and besides, the pig likes it."

George Bernard Shaw

“You can ignore reality, but you can't ignore the consequences of ignoring reality.” Ayn Rand

George Bernard Shaw

“You can ignore reality, but you can't ignore the consequences of ignoring reality.” Ayn Rand

-

eXpat - Intermediate Crude

- Posts: 3801

- Joined: Thu 08 Jun 2006, 03:00:00

Re: Ten Major Threats To the Dollar In 2009

U.N. panel says world should ditch dollar

http://www.reuters.com/article/newsOne/idUSTRE52H2CY20090318

LUXEMBOURG (Reuters) - A U.N. panel will next week recommend that the world ditch the dollar as its reserve currency in favor of a shared basket of currencies, a member of the panel said on Wednesday, adding to pressure on the dollar.

Currency specialist Avinash Persaud, a member of the panel of experts, told a Reuters Funds Summit in Luxembourg that the proposal was to create something like the old Ecu, or European currency unit, that was a hard-traded, weighted basket.

Persaud, chairman of consultants Intelligence Capital and a former currency chief at JPMorgan, said the recommendation would be one of a number delivered to the United Nations on March 25 by the U.N. Commission of Experts on International Financial Reform.

"It is a good moment to move to a shared reserve currency," he said.

Central banks hold their reserves in a variety of currencies and gold, but the dollar has dominated as the most convincing store of value -- though its rate has wavered in recent years as the United States ran up huge twin budget and external deficits.

Some analysts said news of the U.N. panel's recommendation extended dollar losses because it fed into concerns about the future of the greenback as the main global reserve currency, raising the chances of central bank sales of dollar holdings.

"Speculation that major central banks would begin rebalancing their FX reserves has risen since the intensification of the dollar's slide between 2002 and mid-2008," CMC Markets said in a note.

Russia is also planning to propose the creation of a new reserve currency, to be issued by international financial institutions, at the April G20 meeting, according to the text of its proposals published on Monday.

http://www.reuters.com/article/newsOne/idUSTRE52H2CY20090318

"I learned long ago, never to wrestle with a pig. You get dirty, and besides, the pig likes it."

George Bernard Shaw

“You can ignore reality, but you can't ignore the consequences of ignoring reality.” Ayn Rand

George Bernard Shaw

“You can ignore reality, but you can't ignore the consequences of ignoring reality.” Ayn Rand

-

eXpat - Intermediate Crude

- Posts: 3801

- Joined: Thu 08 Jun 2006, 03:00:00

Re: Ten Major Threats To the Dollar In 2009

eXpat wrote:U.N. panel says world should ditch dollarLUXEMBOURG (Reuters) - A U.N. panel will next week recommend that the world ditch the dollar as its reserve currency in favor of a shared basket of currencies, a member of the panel said on Wednesday, adding to pressure on the dollar.

Currency specialist Avinash Persaud, a member of the panel of experts, told a Reuters Funds Summit in Luxembourg that the proposal was to create something like the old Ecu, or European currency unit, that was a hard-traded, weighted basket.

Persaud, chairman of consultants Intelligence Capital and a former currency chief at JPMorgan, said the recommendation would be one of a number delivered to the United Nations on March 25 by the U.N. Commission of Experts on International Financial Reform.

"It is a good moment to move to a shared reserve currency," he said.

Central banks hold their reserves in a variety of currencies and gold, but the dollar has dominated as the most convincing store of value -- though its rate has wavered in recent years as the United States ran up huge twin budget and external deficits.

Some analysts said news of the U.N. panel's recommendation extended dollar losses because it fed into concerns about the future of the greenback as the main global reserve currency, raising the chances of central bank sales of dollar holdings.

"Speculation that major central banks would begin rebalancing their FX reserves has risen since the intensification of the dollar's slide between 2002 and mid-2008," CMC Markets said in a note.

Russia is also planning to propose the creation of a new reserve currency, to be issued by international financial institutions, at the April G20 meeting, according to the text of its proposals published on Monday.

http://www.reuters.com/article/newsOne/idUSTRE52H2CY20090318

someone's gonna get bombed.

-

nobodypanic - Heavy Crude

- Posts: 1103

- Joined: Mon 02 Jun 2008, 03:00:00

Re: Ten Major Threats To the Dollar In 2009

uNkNowN ElEmEnt wrote:OMFG!! I won't sleep for a week. Adrenaline? I don't need more stinking adrenaline. Holy crap!

(...)

Relax, plenty of civilizations have collapsed... you just have to take care and survive

- bodigami

- Permanently Banned

- Posts: 1921

- Joined: Wed 26 Jul 2006, 03:00:00

23 posts

• Page 1 of 2 • 1, 2

Who is online

Users browsing this forum: Majestic-12 [Bot] and 12 guests