But the other one works well, too...

TreebeardsUncle wrote:no big deal

This will blow over.

Homesteader wrote:So did Katrina! (Sorry TB, tried to resist. . .)TreebeardsUncle wrote:no big deal This will blow over.

what you have ALWAYS been talking about here is a rigged game,

You know, for as long as this charade goes on, I am sure analysts of all types with all sorts of spins will tell you why the system broke. Regulatory failure, ratings agency failure, SEC watchdogs checking out porn on the internet, whatever.

In essence though, what you have ALWAYS been talking about here is a rigged game, ever since the Fed confiscated all the gold in the 30s and set up a fiat monetary system. They had to go off gold of course because it simply could not work as a definition of wealth in the Oil Age. Too many people, too much energy around fro Gold to function as currency.

As financial services became more and more the generator of wealth for individuals, it has also been increasingly obvious that real wealth wasn't being generated inside the US, as debt personal, corporate and governmental increased by leaps and bounds. Can you really make money as a society depending on high stakes gamblers to rake in endless profits? Its plain silly, but so sold were and are Americans that Capitalism is the Magic Pill and the Market will always produce an accurate result that generations of Americans have bought the idea, as we burned through the wealth of the North American Continent.

Its pointless to blame the SEC or the ratings agencies, the entire system was faulty from the ground up. Capitalism is just a means for a few people to sieve up wealth from many below them in a massive Ponzi scheme. It has to crash eventually, it always does, very periodically. The results are always the same as well, War and Death. The main difference with this crash is it appears to be the end of the resources left for exploitation, and the funny money used to facilitate that exploitation is now going up in the Greatest Bonfire of Paper Wealth in all of Recorded History.

The only question which remains now is whether we will be able to clean up after the mess the Pigmen made here. To do so, fundamental concepts which are just WRONG relating to the ownership of property will have to be abandoned, and certainly many people in the US can't even CONCEIVE of such a thing. So there will be battles internal to the US as well as the battles between nations all trying to be the last one left standing at the top of the heap.

Eventually it will work itself out, one way or the other. Either we will work our way through the Zero Point to something better, or we will not and we will go the way of the Dinosaur. The next few years will determine which way it ends up going, and they won't be pleasant ones. it is not however the fault of regulators asleep at the wheel. The fault lies in the fundamental quality of greed, and how it was used by a few people at the top of the food chain to enrich themselves at the expense of the planet and most of the people who live on it. These folks will Burn in Everlasting Damnation in the Fires of Hell.

ReverseEngineer wrote:In essence though, what you have ALWAYS been talking about here is a rigged game, ever since the Fed confiscated all the gold in the 30s and set up a fiat monetary system. They had to go off gold of course because it simply could not work as a definition of wealth in the Oil Age. Too many people, too much energy around fro Gold to function as currency.

ReverseEngineer wrote:The main difference with this crash is it appears to be the end of the resources left for exploitation, and the funny money used to facilitate that exploitation is now going up in the Greatest Bonfire of Paper Wealth in all of Recorded History.

bratticus wrote:

Narz wrote:bratticus wrote:

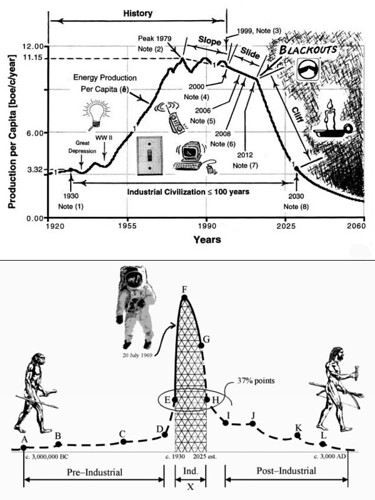

Scary stuff! Oil's gonna peak in 1979!

![new_blowingup [smilie=new_blowingup.gif]](https://www.peakoil.com/forums/images/smilies/new_blowingup.gif)

Users browsing this forum: No registered users and 24 guests