JohnDenver wrote: So Monte, are you signing off on that as your prediction? Or not?

Kind of a weak strawman, JD.

What I responded to was.

The one thing I'm not sure of is if agriculture requires 16% of petroleum and petro decreases by 50% over 12 years after peak oil (assuming 5.7% drop per year),why wont compesating by doubling the percent to 32% that agricultures uses of the total?

So, insert my input;

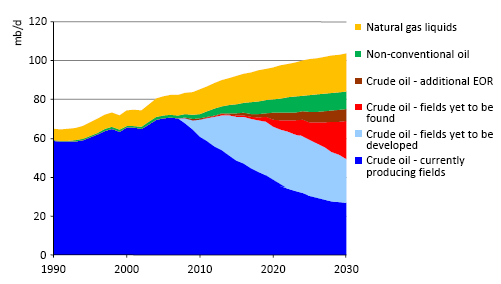

5.7%? Try 9.1% in 50% in 7.6 years IEA World Energy Outlook 2008

and it becomes:

(assuming

9.1% drop per year)

The IEA stated, "Without extra investment to raise production, the natural annual rate of output decline is 9.1 per cent."

If the 800 largest fields are currently declining at 9.1%/year, you think it is "out there" to assume a 9.1% decline post-peak, given that the investment in new production has crashed?

The IEA says even with investment, the annual rate of output decline is 6.4 per cent.

The The Financial Times wrote:

"The findings suggest the world will struggle to produce enough oil to make up for steep declines in existing fields, such as those in the North Sea, Russia and Alaska, and meet long-term demand. The effort will become even more acute as [oil] prices fall and investment decisions are delayed."

A couple of years ago, I was bashed for suggesting it would be over 5% when it was declared to be 4.5% from existing fields. And then last year it was revised upwards to 5.2%. Now, it has been revised upwards to 6.4%,

only if we invest

trillions.

I think 9.1% may be optimistic given this track record.

However, given this economic collapse we are experiencing, it may be more like Pops noted back in my Slow Decline thread.

Pops wrote:Or (this just dawned on me) maybe the period between economic peaks progressively extends out so far that there is just never another peak. IOW, there is still oil in the ground but the traditional economy is so weakened it can't revive enough to bump up against capacity. The current "bubbles" in the US economy make for a BIG problem, perhaps The Second Great Depression could make the EIA's prediction of Peak in 2030 turn out to be overly pessimistic, I'll have to meditate on that further after I go turn the thermostat up, LOL.

A Saudi saying, "My father rode a camel. I drive a car. My son flies a jet-plane. His son will ride a camel."