Have you been watching oil prices?

Have you been watching oil prices?

The news over the last few days has been distinctly bearish for oil.

U.S. stockpiles are at 16 year highs. GDP just came in at -6% - worst in 27 years.

And what is oil doing on the front part of the new contract? We're up to 54. Wow.

Hang on to your seats. Dr. Schmuto's gut is telling him that we just got on a ride, and we're not going to be getting off any time soon. And me gut has been damn accurate over the last 10 years.

U.S. stockpiles are at 16 year highs. GDP just came in at -6% - worst in 27 years.

And what is oil doing on the front part of the new contract? We're up to 54. Wow.

Hang on to your seats. Dr. Schmuto's gut is telling him that we just got on a ride, and we're not going to be getting off any time soon. And me gut has been damn accurate over the last 10 years.

- Schmuto

- Tar Sands

- Posts: 659

- Joined: Wed 17 Dec 2008, 04:00:00

Re: Have you been watching oil prices?

I can not imagine what will happen to oil prices when the global economy picks up just a little bit.

Buckle up, we are on a rough ride, fellas.

Buckle up, we are on a rough ride, fellas.

-

misterno - Tar Sands

- Posts: 843

- Joined: Wed 07 Mar 2007, 04:00:00

- Location: Somewhere super boring

Re: Have you been watching oil prices?

misterno wrote:I can not imagine what will happen to oil prices when the global economy picks up just a little bit.

Buckle up, we are on a rough ride, fellas.

IMO, it will never "pick up a little bit." Not in the next 50 years anyway.

We are in the slow grind that many of us predicted. It's a convergence of several historical events . . .

1. Unwinding of 30-100 years of excessive debt expansion.

2. The restrictions on economic activity caused by a government of monstrous proportions that consumes, without production, a huge percentage of economic activity, and that, remarkably, continues to grow at an unprecedented pace. It seems that we are hell bent on proving the point, by negative inference, that aggressively reducing government size would be among the best things to do at this juncture.

3. Peak oil.

4. Population.

The Montequest principal lives - no problems are soluble absent a substantial reduction in population. As one PO poster once said - we will achieve population reduction - but only through starvation.

I have maintained for 2 years that the KSA is engaged in a great deception. I don't believe they can expand production significantly, I don't believe they have the future capacity they claim, and I believe that their main fields are in relentless and serious decline.

It's a very simple relationship.

OIL = GDP.

If you put each country's GDP next to oil consumption, you will see that they are strongly correlated. That is causative.

As oil gets more expensive, GDP must decline.

If we are past peak, which is seems we must be, then the only way for a country to increase GDP will be to control oil outside of the trading markets.

As long as oil is traded freely, no country will escape the decades long recession (depression) that we now face - it is not possible.

If oil price climbs inexorably back over 100, as I expect it to, the economy will continue to contract.

It will be brutal and remorseless.

It will be worsened substantially by government intervention, which I have always expected to happen at around 200 a barrel. Cube thought 300. Those numbers may be lowered because now, different from before, we are in a massive recession, and the government will be under more pressure to "do something" when gasoline hits 5 bucks a gallon.

- Schmuto

- Tar Sands

- Posts: 659

- Joined: Wed 17 Dec 2008, 04:00:00

Re: Have you been watching oil prices?

KSA's big problem at present isn't peak oil, it's an oil glut causing oil prices below the minimum they need to maintain their economy. Any slow creep upwards in oil prices is largely due to voluntary production cuts by OPEC and elsewhere in order to reach that minimum support level and should not be construed as the opening stages of another superspike. Although some people are driving more or going back to SUVs, in aggregate, oil demand remains down and all you need to do is hit up google news to verify that. We will get to peak oil doom, just not right now. Right now if you still have a job I suggest you all eat, drink and be merry.

- mos6507

Re: Have you been watching oil prices?

mos6507 wrote:KSA's big problem at present isn't peak oil, it's an oil glut causing oil prices below the minimum they need to maintain their economy. Any slow creep upwards in oil prices is largely due to voluntary production cuts by OPEC and elsewhere in order to reach that minimum support level and should not be construed as the opening stages of another superspike. Although some people are driving more or going back to SUVs, in aggregate, oil demand remains down and all you need to do is hit up google news to verify that. We will get to peak oil doom, just not right now. Right now if you still have a job I suggest you all eat, drink and be merry.

mos6507,

You are quickly becoming my favorite poster.

AAA

How can Ludi spend 8-10 hrs/day on the internet and claim to be homesteading???

-

AAA - Tar Sands

- Posts: 702

- Joined: Wed 12 Nov 2008, 04:00:00

Re: Have you been watching oil prices?

Schmuto wrote:It's a very simple relationship.

OIL = GDP.

Simple and wrong.

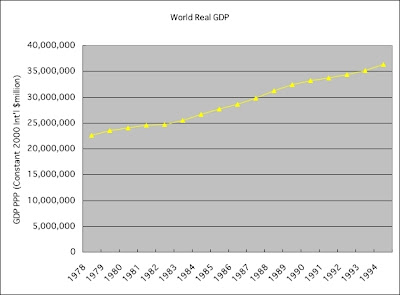

From 1979 to 1989, there was ZERO net growth in world oil consumption. (BP Stat. Rev.)

1979 64381kbd

1980 61841

1981 59911

1982 58193

1983 57920

1984 59145

1985 59391

1986 61147

1987 62439

1988 64238

1989 65588

During that same period, world real GDP grew steadily

(figures from World Bank's World Development Indicators Database):

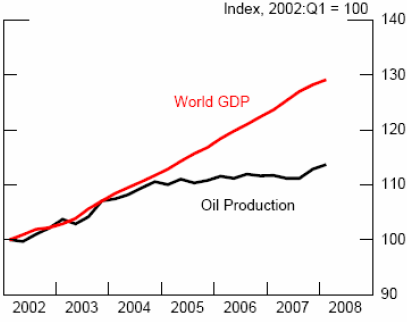

Another graphic from the CFTC, courtesy of the Oil Drum:

One of the main reasons for the above phenomenon is that a major chunk of world growth comes from China and India, who are mainly powered by coal, not oil. Energy is energy. Oil is nice but not essential.

In any case, the evidence clearly shows that OIL ≠ GDP.

- JohnDenver

- Intermediate Crude

- Posts: 2145

- Joined: Sun 29 Aug 2004, 03:00:00

Re: Have you been watching oil prices?

The other thing we did in the 80's was become more efficient. That means that we were able to do more with the same amount of oil coming in. This starved OPEC, and they had to cut prices to stay in business. There was always lots of oil around, but this time it's different. There's a little glut right now, but no capacity to draw on to get prices down. There are no "swing" producers any more. We get what we can pump out, and that will have to be enough.

We are in the downward slope of peak oil now.

I think growth is over.

We are in the downward slope of peak oil now.

I think growth is over.

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: Have you been watching oil prices?

Schmuto wrote:The news over the last few days has been distinctly bearish for oil.

U.S. stockpiles are at 16 year highs. GDP just came in at -6% - worst in 27 years.

And what is oil doing on the front part of the new contract? We're up to 54. Wow.

Hang on to your seats. Dr. Schmuto's gut is telling him that we just got on a ride, and we're not going to be getting off any time soon. And me gut has been damn accurate over the last 10 years.

We'll see if this lasts.

http://www.cnbc.com/id/29895119

But hey, who knows? Maybe the world economy will come roaring back quicker than anyone expected, letting these making-a-quick-buck traders off the hook.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: Have you been watching oil prices?

Schmuto wrote:It's a very simple relationship.

OIL = GDP.

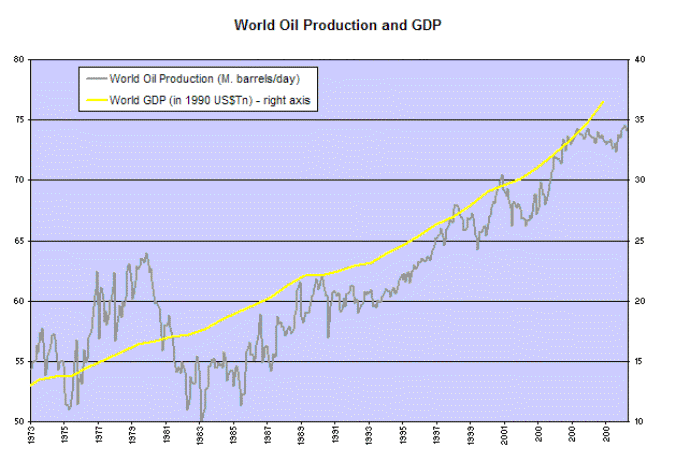

Sorta, kinda.

Making my own chart with data from the EIA and the Bureau of Economic Analysis, the above looks like curve fitting.

Cogito, ergo non satis bibivi

And let me tell you something: I dig your work.

And let me tell you something: I dig your work.

-

TheDude - Expert

- Posts: 4896

- Joined: Thu 06 Apr 2006, 03:00:00

- Location: 3 miles NW of Champoeg, Republic of Cascadia

Re: Have you been watching oil prices?

I think that there is a lot of pure speculation going on here. The bottom line is this. We all know that we were on a plateau, there can be no denying that. Even at ridiculous prices we were struggling to stay concurrent with demand. By some plausible and measurable data we were not keeping up with it.

We all agree that those prices could not hold. So we see that demand came down a bit, but be careful here. Demand has not "cratered", it hasn't fallen off the "cliff". We've seen a small decrease in demand coupled with massive and global deleveraging which is likely in it's last throes. Price is simply moderating back to somewhere near where it should be to maintain a balance with perceived costs/demand/future required investments. I believe that the pressure for price will be upward a bit more in the short term, than it will be driven by what the global economy does. If we figure out this present credit/banking/monetary crisis the price will go higher on perceived demand growth. If that does not take place and we depress globally (economically), than it's a race between demand destruction and decline.

Remember that there is good evidence right now that global supply is being curtailed both voluntarily and involuntarily by losses in the greater economic malaise. Both due to loss in revenue from oil sales and loss of investment from a broken credit/banking system. Some of this may actually be permanent, and has the result of shoving us off the plateau and into early decline. I believe that this "race" is what we should be focusing on. It's dynamic and its a change from where we were a year ago.

I also think that looking back on other demand/supply events is a futile excercise as the timeframe we are in right now has no corollary. We are likely at Peak right now or very soon. It gets unmasked by any economic positives globally and this will happen quickly IMHO.

Interesting times indeed and the only thing I think we can all agree on is that things can go either way. As we move down the road I believe the only constant is going to be volatility.

We all agree that those prices could not hold. So we see that demand came down a bit, but be careful here. Demand has not "cratered", it hasn't fallen off the "cliff". We've seen a small decrease in demand coupled with massive and global deleveraging which is likely in it's last throes. Price is simply moderating back to somewhere near where it should be to maintain a balance with perceived costs/demand/future required investments. I believe that the pressure for price will be upward a bit more in the short term, than it will be driven by what the global economy does. If we figure out this present credit/banking/monetary crisis the price will go higher on perceived demand growth. If that does not take place and we depress globally (economically), than it's a race between demand destruction and decline.

Remember that there is good evidence right now that global supply is being curtailed both voluntarily and involuntarily by losses in the greater economic malaise. Both due to loss in revenue from oil sales and loss of investment from a broken credit/banking system. Some of this may actually be permanent, and has the result of shoving us off the plateau and into early decline. I believe that this "race" is what we should be focusing on. It's dynamic and its a change from where we were a year ago.

I also think that looking back on other demand/supply events is a futile excercise as the timeframe we are in right now has no corollary. We are likely at Peak right now or very soon. It gets unmasked by any economic positives globally and this will happen quickly IMHO.

Interesting times indeed and the only thing I think we can all agree on is that things can go either way. As we move down the road I believe the only constant is going to be volatility.

-

AirlinePilot - Moderator

- Posts: 4378

- Joined: Tue 05 Apr 2005, 03:00:00

- Location: South of Atlanta

Re: Have you been watching oil prices?

Revi wrote:There's a little glut right now, but no capacity to draw on to get prices down.

There would be no capacity to get prices down if demand returned to 2008 peak levels. I don't think there is any desire on the part of oil producers to get oil prices lower than they are now. They actually want to raise them back up to at least $60. The anxiety we used to have about $60+ oil turned out to be largely irrational. The economy is fully capable of functioning unhindered with oil in the $60-$80 range.

If there is one thing I think Matt Simmons is good for is putting the oil price into perspective by talking about its relative price comapred to other commodities. Per cup, oil even at $100 is dirt cheap compared to what it gives back in energy. Gasoline at anything less than $3.50 is a complete bargain when you look at what it enables Joe Average to accomplish. The trip I took to Maine and Vermont at $1.80 a gallon felt almost effortless. At $4.00 and above a gallon, disgressionary road trips like that would been hard to justify. There is a sweet spot and a breaking point here as far as transportation goes and how it fits into a middle class person's budget.

- mos6507

Re: Have you been watching oil prices?

Schmuto wrote:

It's a very simple relationship.

OIL = GDP.

Yes I think you have the right basic idea.

I prefer a more generalized form of this relationship

(energy use) = (economic activity)

or

(energy use) = (x)(economic activity)

where x is the multiplicative factor or proportionality constant that determines how much economic activity is supported by the utilization of a particular energy source.

Last edited by bencole on Fri 27 Mar 2009, 12:09:41, edited 1 time in total.

- bencole

- Lignite

- Posts: 359

- Joined: Thu 26 Feb 2009, 03:29:52

Re: Have you been watching oil prices?

Oil's going back down again.

Really, now is not the time to panic on every slight movement in oil prices. Wait until we go over $75/bbl or something to call a new spike, and even then, be wary of speculation (since a significant chunk of oil at $147/bbl WAS due to speculation rather than geology).

"The still-poor demand picture may once again become a dominant theme if an equities setback dampens the hopes of oil bulls," said Brenda Sullivan, an analyst at Sucden Financial Research.

Really, now is not the time to panic on every slight movement in oil prices. Wait until we go over $75/bbl or something to call a new spike, and even then, be wary of speculation (since a significant chunk of oil at $147/bbl WAS due to speculation rather than geology).

- mos6507

Re: Have you been watching oil prices?

mos6507 wrote:KSA's big problem at present isn't peak oil, it's an oil glut causing oil prices below the minimum they need to maintain their economy.

Oil glut? What oil glut? Do you have data to support that? How about a graph of oil-in-storage over time? My understanding is that such storage is at multi decade lows.

mos6507 wrote:Any slow creep upwards in oil prices is largely due to voluntary production cuts by OPEC and elsewhere in order to reach that minimum support level and should not be construed as the opening stages of another superspike.

This is groping in the dark. As a first matter, I don't agree that all cuts are necessarily voluntary, and you sure don't know and can't prove that they are. We'll only know for sure when oil gets back to 150 and the don't produce more.

Secondly, the movement upwards in the last week or two has not been a "slow creep up" as you sanguinely phrase it.

In three months we've gone from upper 30s to 54 dollars a barrel. That's an increase of about 40% - not a slow creep by any means, but rather a very quick and sustained upturn, and one that at most points in the 50 years before the last 10 would be considered a stunning move.

mos6507 wrote:Although some people are driving more or going back to SUVs, in aggregate, oil demand remains down and all you need to do is hit up google news to verify that. We will get to peak oil doom, just not right now. Right now if you still have a job I suggest you all eat, drink and be merry.

You have neglected to refute my main point on this, which is that the news has been extremely bearish, but prices are increasing. Thoughts on that?

Finally, your focus on "driving more" and "going back to SUVs" is losing the forest for the trees. Those things are virtually irrelevant to what is going on. If I'm correct and we're seeing price movement because supplies are getting tight, then even a contraction of 5 or 10% in U.S. driving is not going to make much of a difference.

As for your party-on suggestion, I have to ask Mos - was it not you who posted recently that your finances were in disarray and you wanted input on what to do?

Perhaps you shouldn't give advice on matters of finances and partying on if your own house is in disarray.

- Schmuto

- Tar Sands

- Posts: 659

- Joined: Wed 17 Dec 2008, 04:00:00

Re: Have you been watching oil prices?

JohnDenver wrote:

Simple and wrong.

. . .

In any case, the evidence clearly shows that OIL ≠ GDP.

Nonsense.

You are correct that oil is a component of total energy.

But so what?

My point was simply that oil IS GDP.

You countered with - "GDP has other components other than oil."

I agree with that, but it does not serve as a counter to my point.

It's like me saying, "if we grow fewer grains, caloric availability must go down, because grains=calories," and you reply with, "we get a lot of calories from fruits."

So what?

End of the day, this is what is . . .

OIL=GDP.

As oil production declines, so to will "the GDP derived from oil". Do you prefer that phrasing?

If your counter is that "we can substitute other energy supplies for oil, thereby raising GDP" then I'd say you are incorrect, but that is another argument, and time will show that you incorrect.

EDIT

Oh yes, and another thing - - -

The recent increases in GDP (last 4 years), which seem to diverge from a flattened oil production curve, are misleading because that "GDP" expansion was simply the end of a long game of pumping the economy with ever more debt.

The two lines will converge again, as soon as the excesses of the last few years are gone, and at 6% decline in GDP the last quarter, it won't be long.

Don't be fooled by banker tricks - oil=gdp.

- Schmuto

- Tar Sands

- Posts: 659

- Joined: Wed 17 Dec 2008, 04:00:00

Re: Have you been watching oil prices?

TheDude wrote:Schmuto wrote:It's a very simple relationship.

OIL = GDP.

Sorta, kinda.

Sorta kinda?

Your chart supports the point completely. Well done.

- Schmuto

- Tar Sands

- Posts: 659

- Joined: Wed 17 Dec 2008, 04:00:00

Re: Have you been watching oil prices?

mos6507 wrote:Revi wrote:There's a little glut right now, but no capacity to draw on to get prices down.

There would be no capacity to get prices down if demand returned to 2008 peak levels. I don't think there is any desire on the part of oil producers to get oil prices lower than they are now. They actually want to raise them back up to at least $60. The anxiety we used to have about $60+ oil turned out to be largely irrational. The economy is fully capable of functioning unhindered with oil in the $60-$80 range.

This is just more baseless pontification.

You act as if the economy reacts in a matter of weeks to oil prices. You are wrong.

There is zero evidence that the economy would do fine with 60 dollar oil. The fact is, we haven't had 60 dollar oil long enough to know either way.

Oil breached 60 when? In 05/06?

The economy has done pretty lousy since then.

- Schmuto

- Tar Sands

- Posts: 659

- Joined: Wed 17 Dec 2008, 04:00:00

Re: Have you been watching oil prices?

mos6507 wrote:"The still-poor demand picture may once again become a dominant theme if an equities setback dampens the hopes of oil bulls," said Brenda Sullivan, an analyst at Sucden Financial Research.

Really, now is not the time to panic on every slight movement in oil prices. Wait until we go over $75/bbl or something to call a new spike, and even then, be wary of speculation (since a significant chunk of oil at $147/bbl WAS due to speculation rather than geology).

1. I don't subscribe to citations to unknowns. Every 30 something peon with a degree higher than a GED was offering opinions on the way up and the way down to 147. Almost to person they were wrong most of the time.

2. There's no panic here Mos. I panicked in 05 when I first figured out PO. I gathered myself and went long oil futes in 06 at about 65 - sold at 140 (SWEET!!). The regular posters on this board are well past panic mode. In this thread we are simply discussing, or trying to, THIS --

3. Why is the oil market not tracking the economic news.

That's it Mos.

You're like a Toad Mos - you run around all day drinking lots of fluids and avoiding the boys room so that you can come hopping in and start pissing any time you think you have a point.

The question here is . . .

Evidence . . .

Worst economic news in 3 decades.

High current U.S. stockpile report.

Oil up substantially.

If that isn't something that deserves vetting on PO.com, then what the hell are we doing here? Reading all the articles on Arctic ice melting?

Finally Mos, your advice seems to be, "wait until there's a spike before you call a spike."

That's brilliant. Have you contacted Jim Kramer to tell him you're ripping off his technique?

I'm not "calling" anything here.

I'm pointing out that there is a huge disconnect between what the news is telling us SHOULD be happening to oil price and what IS happening to oil price.

If oil goes back down to 40 and stays there, then order is reestablished.

But if it doesn't, and it keeps creeping up as we approach summer, then something is amiss.

And, if it's not too much to ask, i'd like to speculate on that here on PO.com.

- Schmuto

- Tar Sands

- Posts: 659

- Joined: Wed 17 Dec 2008, 04:00:00

Who is online

Users browsing this forum: No registered users and 17 guests