Low energy prices -> Production declines (hearsay)

Re: Low energy prices -> Production declines (hearsay)

yep and that's what all the optimists are forgettin

-

sameu - Tar Sands

- Posts: 579

- Joined: Thu 18 Aug 2005, 03:00:00

- Location: Belgium, Europe

Re: Low energy prices -> Production declines (hearsay)

This is what i have been learning also. i have a "relative" in the field and they tell me it will take 18-24 months and possibly a good bit longer to ramp things back up once demand signals increase. I somehow even doubt that possibility as the turn in price which is needed for new production once it is shutdown is what causes any recovery to stall.

At some point the decline catches up with us no matter what we do.

At some point the decline catches up with us no matter what we do.

-

AirlinePilot - Moderator

- Posts: 4378

- Joined: Tue 05 Apr 2005, 03:00:00

- Location: South of Atlanta

Re: Low energy prices -> Production declines (hearsay)

Shannymara said:

This is not surprising. The AvailableEnergy model predicts that economic activity (thus demand for oil) will decline before we see declines in the production of oil. That was posted here more than a year ago. It also gives a quantitative estimate of that decline. It can be expected that world demand will fall by 4.3% in ‘09.

Because oil production will decline after economic activity declines, there will be a tendency for there to be some ongoing excess supply. I expect even higher inventory levels in 2011 when the energy savings from the oil industry’s E&D reductions have finally been used by the general economy and the world’s GDP decline tips to -7.1%.

Oil’s peak production is resulting from a decline in demand. Falling demand is occurring because oil’s declining ERoEI is contributing less energy for the production of non-energy goods and services. This is contrary to the general assumption that PO will result from a shortage of the product. We have no shortage of the product, there is still 4.3 gb of it buried in the earth. We have a shortage of oil that can be used as a high density energy source. That shortage has now grown critical, and the world’s economies are contracting as a result.

As a cravat, some may argue that if there is plenty of oil, and we have an energy shortage, just pump more oil. That argument ignores the Second Law. It tells us that pumping more low energy density oil is not going to give us any more energy. It says that we just put the extra energy gained back into pumping more oil.

My industry friend (I can't say who or give any other details, sorry) told me the other day how so many of their projects are not profitable at current prices that a steep production decline is inevitable, and that even if we get a huge price spike there will be 1-2 year lag time to ramp it back up again.

This is not surprising. The AvailableEnergy model predicts that economic activity (thus demand for oil) will decline before we see declines in the production of oil. That was posted here more than a year ago. It also gives a quantitative estimate of that decline. It can be expected that world demand will fall by 4.3% in ‘09.

Because oil production will decline after economic activity declines, there will be a tendency for there to be some ongoing excess supply. I expect even higher inventory levels in 2011 when the energy savings from the oil industry’s E&D reductions have finally been used by the general economy and the world’s GDP decline tips to -7.1%.

Oil’s peak production is resulting from a decline in demand. Falling demand is occurring because oil’s declining ERoEI is contributing less energy for the production of non-energy goods and services. This is contrary to the general assumption that PO will result from a shortage of the product. We have no shortage of the product, there is still 4.3 gb of it buried in the earth. We have a shortage of oil that can be used as a high density energy source. That shortage has now grown critical, and the world’s economies are contracting as a result.

As a cravat, some may argue that if there is plenty of oil, and we have an energy shortage, just pump more oil. That argument ignores the Second Law. It tells us that pumping more low energy density oil is not going to give us any more energy. It says that we just put the extra energy gained back into pumping more oil.

-

shortonoil - False ETP Prophet

- Posts: 7132

- Joined: Thu 02 Dec 2004, 04:00:00

- Location: VA USA

Re: Low energy prices -> Production declines (hearsay)

Weird. I was just thinking about that this morning.

There used to be rigs running all over our area trying to suck out some NG and oil here and there.

And I kept thinking, "would that be profitable at 1/2 the price?"

Now I hear stories of some neighbors with gas/oil wells not getting paid by the energy companies. Perhaps overextended.

Oil is staying rock steady at 50.

The second most interesting stat for the oil industry that we will never know is - "how much per barrel does each well cost to operate, including all required inputs?"

Of course, the most interesting stat, which we also will never know, is, "what is the maximum rate of output of each well over the next 36 months."

Oil rock solid at 50.

It's going to be a very interesting year.

There used to be rigs running all over our area trying to suck out some NG and oil here and there.

And I kept thinking, "would that be profitable at 1/2 the price?"

Now I hear stories of some neighbors with gas/oil wells not getting paid by the energy companies. Perhaps overextended.

Oil is staying rock steady at 50.

The second most interesting stat for the oil industry that we will never know is - "how much per barrel does each well cost to operate, including all required inputs?"

Of course, the most interesting stat, which we also will never know, is, "what is the maximum rate of output of each well over the next 36 months."

Oil rock solid at 50.

It's going to be a very interesting year.

- Schmuto

- Tar Sands

- Posts: 659

- Joined: Wed 17 Dec 2008, 04:00:00

Re: Low energy prices -> Production declines (hearsay)

The last time we had a significant decline in world oil consumption in the early 80's, it took at least 5 years for consumption to get back to its pre-decline levels. If it takes 1-2 years for companies to ramp up their operations again, so what? We might not need the extra oil for another 5 years.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: Low energy prices -> Production declines (hearsay)

The last time we had a significant decline in world oil consumption in the early 80's, it took at least 5 years for consumption to get back to its pre-decline levels. If it takes 1-2 years for companies to ramp up their operations again, so what? We might not need the extra oil for another 5 years.

Back then we did not have the emerging dragon which is Asian consumption. Even though China and India have been thrown into a recession perhaps worse than other areas a lot of the economists seem to think they will be the first to come up. I spoke with a guy whose business it is to understand world markets just yesterday and his comment was there are some strong signs that production is increasing in China as a consequence of the incentives and a slight resurgance in local SE Asia demand for products such as steel.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Low energy prices -> Production declines (hearsay)

Shannymara wrote: They are scrapping projects, shutting down wells (gas and oil), and selling things off.

I heard it's the radical environmentalists and left-wing-ism that are shutting down projects!

- Ludi

Re: Low energy prices -> Production declines (hearsay)

Shannymara wrote: shutting down wells (gas and oil),

I want to clarify one thing. I am assuming you mean shutting-in wells rather than plugging wells.

Many wells are being shut-in due to low prices locally but once prices creep up then they will open the wells back up and add supply to the market.

Also flow rates are being choked back to reduce production for the same reasons.

I don't have any idea how many or what percentage it is but know it is happening in more and more places.

How can Ludi spend 8-10 hrs/day on the internet and claim to be homesteading???

-

AAA - Tar Sands

- Posts: 702

- Joined: Wed 12 Nov 2008, 04:00:00

Re: Low energy prices -> Production declines (hearsay)

rockdoc123 wrote:The last time we had a significant decline in world oil consumption in the early 80's, it took at least 5 years for consumption to get back to its pre-decline levels. If it takes 1-2 years for companies to ramp up their operations again, so what? We might not need the extra oil for another 5 years.

Back then we did not have the emerging dragon which is Asian consumption. Even though China and India have been thrown into a recession perhaps worse than other areas a lot of the economists seem to think they will be the first to come up. I spoke with a guy whose business it is to understand world markets just yesterday and his comment was there are some strong signs that production is increasing in China as a consequence of the incentives and a slight resurgance in local SE Asia demand for products such as steel.

It's not necessarily true that a rebound in the economies of China and India will mean they'll be consuming more oil - at least not India. As I've been reporting in several articles here, there have been some large NG discoveries in India having come online recently which should reduce India's need for oil. It's expected to reduce India's need for imports by 10%, regardless of what happens to their economy.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: Low energy prices -> Production declines (hearsay)

Shannymara said:

The Peak Oil movement has historically done itself a great disservice by separating itself into two camps. Those that viewed PO from an economic perspective and those who viewed it primarily as a geological phenomena. That allowed skeptics and those who wished to disclaim it, more than amble ammunition to exploit the weaknesses in the single model theories.

PO can not be adequately defined by any single discipline. Founded in basic resource extraction, to be fully comprehended, it has to be expanded into the real technological, economic world. The economists looked at the 4.3 gb figure and assumed that somehow, someone would devised a way to use it. Their models demanded that it must be so. The geologists looked at OOP, production figures, and historical trends and came to their own conclusions. PO would arrive in 2020, 2030, 2050 or sometime. Their supply side approach, which never fully defined what was usable supply, included everything but a reasonable projection of demand.

This schism left the unanointed in a vacuum, and one of the most important decisions of modern history was left to languish in limbo for fifty years. Hubbert, no doubt, understood the predicament; for it, he was ridiculed by his piers. At that famous API conference in 1956, he wrapped his determinations in the eloquence of a logistic curve, and passed it on to the next generation.

Now we sit at the sundown of the fossil fuel age, watching our culture disintegrate. The G20 holds meetings to evaluate how best to shuffle trillions, hoping that somehow a Royal Flush will appear. Except for a few, and most of them are more dedicated by intuition than analysis, rarely can one be found who appreciates our situation. The PO movement has much to answer for, while our premise was so right, our interpretation of it was so disastrously wrong.

AvailableEnergy

This aspect of the situations reminds me a lot of some things MonteQuest used to talk about, too, as far as peak oil being primarily an economic problem (I might be misquoting him but I'm sure y'all can look it up if you are curious). So far it seems to me he was correct. The interplay between economics and geology, as well as geopolitics, is certainly interesting and complex.

The Peak Oil movement has historically done itself a great disservice by separating itself into two camps. Those that viewed PO from an economic perspective and those who viewed it primarily as a geological phenomena. That allowed skeptics and those who wished to disclaim it, more than amble ammunition to exploit the weaknesses in the single model theories.

PO can not be adequately defined by any single discipline. Founded in basic resource extraction, to be fully comprehended, it has to be expanded into the real technological, economic world. The economists looked at the 4.3 gb figure and assumed that somehow, someone would devised a way to use it. Their models demanded that it must be so. The geologists looked at OOP, production figures, and historical trends and came to their own conclusions. PO would arrive in 2020, 2030, 2050 or sometime. Their supply side approach, which never fully defined what was usable supply, included everything but a reasonable projection of demand.

This schism left the unanointed in a vacuum, and one of the most important decisions of modern history was left to languish in limbo for fifty years. Hubbert, no doubt, understood the predicament; for it, he was ridiculed by his piers. At that famous API conference in 1956, he wrapped his determinations in the eloquence of a logistic curve, and passed it on to the next generation.

Now we sit at the sundown of the fossil fuel age, watching our culture disintegrate. The G20 holds meetings to evaluate how best to shuffle trillions, hoping that somehow a Royal Flush will appear. Except for a few, and most of them are more dedicated by intuition than analysis, rarely can one be found who appreciates our situation. The PO movement has much to answer for, while our premise was so right, our interpretation of it was so disastrously wrong.

AvailableEnergy

-

shortonoil - False ETP Prophet

- Posts: 7132

- Joined: Thu 02 Dec 2004, 04:00:00

- Location: VA USA

Re: Low energy prices -> Production declines (hearsay)

AAA wrote:Shannymara wrote: shutting down wells (gas and oil),

I want to clarify one thing. I am assuming you mean shutting-in wells rather than plugging wells.

Many wells are being shut-in due to low prices locally but once prices creep up then they will open the wells back up and add supply to the market.

You cant just turn an entire industry off on the scale we are currently doing, and it appears to me to be significant at this point, then expect when demand signals rebound to turn it right back on. No sir! Economies dont work like that, companies dont, and industries bludgeoned by low revenues and lack of credit dont either. Going forward my guess is the banking/lending crisis strikes this industry particularly hard due to the longer lead times, larger capital requirements, and risky nature of volatile crude and NG prices.

It's directly why i believe that if and when demand rebounds, even slightly, we see another spike in the price of crude. The longer we remain at or below current crude and NG prices the uglier it gets as companies have no choice but to lay down rigs, employees, and cancel longer term capital outlays in order to remain viable.

It's a fools errand to believe that we just crank it right back up when we need it again.

-

AirlinePilot - Moderator

- Posts: 4378

- Joined: Tue 05 Apr 2005, 03:00:00

- Location: South of Atlanta

Re: Low energy prices -> Production declines (hearsay)

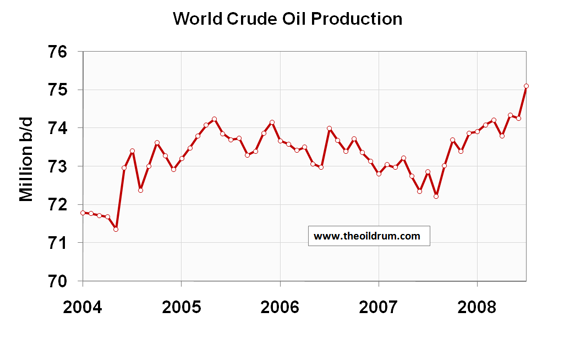

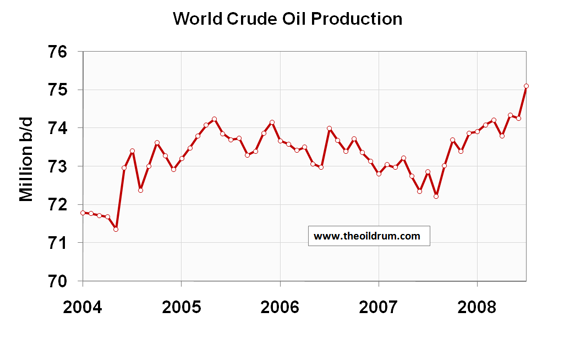

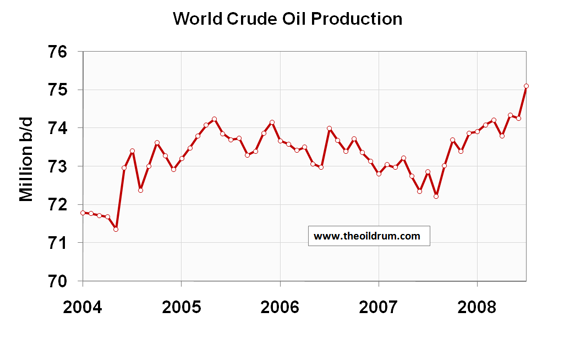

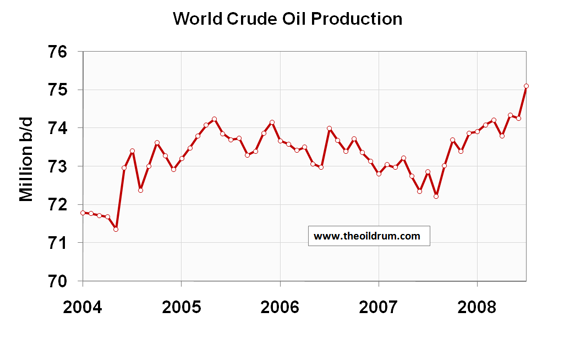

Some people here seem to be forgetting that as recently as the first half of last year and the last half of 2007 the world's oil producers "cranked it right back up when we needed it again" to the tune of 2+ million bpd in just about a year's time.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: Low energy prices -> Production declines (hearsay)

AirlinePilot wrote:AAA wrote:Shannymara wrote: shutting down wells (gas and oil),

I want to clarify one thing. I am assuming you mean shutting-in wells rather than plugging wells.

Many wells are being shut-in due to low prices locally but once prices creep up then they will open the wells back up and add supply to the market.

You cant just turn an entire industry off on the scale we are currently doing, and it appears to me to be significant at this point, then expect when demand signals rebound to turn it right back on. No sir! Economies dont work like that, companies dont, and industries bludgeoned by low revenues and lack of credit dont either. Going forward my guess is the banking/lending crisis strikes this industry particularly hard due to the longer lead times, larger capital requirements, and risky nature of volatile crude and NG prices.

It's directly why i believe that if and when demand rebounds, even slightly, we see another spike in the price of crude. The longer we remain at or below current crude and NG prices the uglier it gets as companies have no choice but to lay down rigs, employees, and cancel longer term capital outlays in order to remain viable.

It's a fools errand to believe that we just crank it right back up when we need it again.

Do you work in the oil industry or are you reading this stuff online and consider yourself knowledgeable?

I do work in the oil industry. My family has been in the oil industry for over 50 years. I don't know everything but I personally know of many companies shutting-in production both oil and natural gas. My family owns WI and ORRI in wells and many are being voluntarily shut-in.

You cannot shut-in wells in every field because in some places shutting-in a well will actually damage formations, water-cut, etc... but many places you can shut-in wells if prices don't favor the operators and then when prices do favor the operator they can start producing the wells.

How can Ludi spend 8-10 hrs/day on the internet and claim to be homesteading???

-

AAA - Tar Sands

- Posts: 702

- Joined: Wed 12 Nov 2008, 04:00:00

Re: Low energy prices -> Production declines (hearsay)

OF,

It's tiring pointing out the "obvious" to you time and time again.

Yes your chart shows production growth, but lets take a peek at what is happening NOW. In light of the largest credit/banking/lending crisis in modern times.

That is what is going to cause the delays my friend. You also had rapidly increasing oil prices prior to 2008 which bouyed the production end of things significantly. You have exactly the opposite going on right now with prices plunging farther than they ever did in the history of the industry!

Your obfuscation of data to fit your premise is blatant, it's childish, and it lacks credibility.

It's tiring pointing out the "obvious" to you time and time again.

Yes your chart shows production growth, but lets take a peek at what is happening NOW. In light of the largest credit/banking/lending crisis in modern times.

That is what is going to cause the delays my friend. You also had rapidly increasing oil prices prior to 2008 which bouyed the production end of things significantly. You have exactly the opposite going on right now with prices plunging farther than they ever did in the history of the industry!

Your obfuscation of data to fit your premise is blatant, it's childish, and it lacks credibility.

-

AirlinePilot - Moderator

- Posts: 4378

- Joined: Tue 05 Apr 2005, 03:00:00

- Location: South of Atlanta

Re: Low energy prices -> Production declines (hearsay)

AirlinePilot wrote:OF,

It's tiring pointing out the "obvious" to you time and time again.

Yes your chart shows production growth, but lets take a peek at what is happening NOW. In light of the largest credit/banking/lending crisis in modern times.

That is what is going to cause the delays my friend. You also had rapidly increasing oil prices prior to 2008 which bouyed the production end of things significantly. You have exactly the opposite going on right now with prices plunging farther than they ever did in the history of the industry!

Your obfuscation of data to fit your premise is blatant, it's childish, and it lacks credibility.

AirlinePilot,

Do you work in the oil industry or are you reading this stuff online and consider yourself knowledgeable?

Do you realize that most major projects that were brainstorm ideas in early 2005 won't see any production for another 1-5 years?

Most major projects take 5-7 years to produce 1 barrel of oil and many take 10+ years. You can't build something like Thunderhorse in a couple of weeks.

How can Ludi spend 8-10 hrs/day on the internet and claim to be homesteading???

-

AAA - Tar Sands

- Posts: 702

- Joined: Wed 12 Nov 2008, 04:00:00

Re: Low energy prices -> Production declines (hearsay)

AAA wrote:Do you work in the oil industry or are you reading this stuff online and consider yourself knowledgeable?

I do work in the oil industry. My family has been in the oil industry for over 50 years. I don't know everything but I personally know of many companies shutting-in production both oil and natural gas. My family owns WI and ORRI in wells and many are being voluntarily shut-in.

You cannot shut-in wells in every field because in some places shutting-in a well will actually damage formations, water-cut, etc... but many places you can shut-in wells if prices don't favor the operators and then when prices do favor the operator they can start producing the wells.

I'm not saying this isnt happening. What I'm saying is that on the larger scale, larger than in almost the entire history of the oil industry, we are shutting in AND shutting down existing production as project funding dries up or it becomes extremely difficult to finance new concerns. In light of this PRESENT SCENARIO shutting in production isnt happening on the same scale as in the past. It's much larger an Issue now and this directly affects how fast and how much we can respond to demand signals. Thats fundamental economics really. Future credit and lending practices ARE (and will contihue to) making it harder to complete and plan major projects due to the low price and recent volatility in the price of crude.

I do not work in the Industry. I'm an Airline pilot. This particular problem, PO, and the current trends directly affect my lively hood so I have studied both the industry and the financial world to understand how my future will be affected. After 6 years of intensive study, I consider myself an expert on oil production and the markets involved in its delivery as a product.

I do have a close relative who IS involved in the industry from a discovery perspective.

-

AirlinePilot - Moderator

- Posts: 4378

- Joined: Tue 05 Apr 2005, 03:00:00

- Location: South of Atlanta

Re: Low energy prices -> Production declines (hearsay)

AP, the only childish things here are your accusations.

1. Right now, OECD stocks are through the roof. It is going to take a while to work these down, during which time "low" prices (which, at $50 aren't even that low) are no big deal.

2. If and when those stocks get drawn down and demand goes up again, the price will go up again. Once the price goes up again, output can go up again, just as it has in the very recent past. Notice on this chart we have not just one but *two* periods when output increased by 2+ million bpd in a year or less.

1. Right now, OECD stocks are through the roof. It is going to take a while to work these down, during which time "low" prices (which, at $50 aren't even that low) are no big deal.

2. If and when those stocks get drawn down and demand goes up again, the price will go up again. Once the price goes up again, output can go up again, just as it has in the very recent past. Notice on this chart we have not just one but *two* periods when output increased by 2+ million bpd in a year or less.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: Low energy prices -> Production declines (hearsay)

AirlinePilot wrote:After 6 years of intensive study, I consider myself an expert on oil production and the markets involved in its delivery as a product.

6 years and you are an expert. haha

My father is a CFO of a large independent oil company and has spent 27 years working in the oil industry and does not consider himself an expert.

How many oil and gas leases have you read?

How many JOAs have you read?

Do you even know what WI or ORRI is without googling it?

How many petroleum geology classes have you taken?

How many petroleum engineering classes have you taken?

How many oil industry conferences have you been too?

How can Ludi spend 8-10 hrs/day on the internet and claim to be homesteading???

-

AAA - Tar Sands

- Posts: 702

- Joined: Wed 12 Nov 2008, 04:00:00

Re: Low energy prices -> Production declines (hearsay)

AAA wrote:Do you realize that most major projects that were brainstorm ideas in early 2005 won't see any production for another 1-5 years?

Most major projects take 5-7 years to produce 1 barrel of oil and many take 10+ years. You can't build something like Thunderhorse in a couple of weeks.

Thats actually quite insulting to my intelligence. Your missing the larger picture AAA. I tend to focus on the longer term. On that horizon I see large problems.

The fact that many refuse to see on the tip of their nose is that we are in the process of completely reshaping how the world does business. it is going to be harder to get money to do things with in the future, especially when it comes to the huge dollars required to drill and refine the harder oil we need to produce. On top of that risky projects involving volatile commodities wont fare as well as they have in the past in light of the soon to be acknowledged long term decline of oil production. That volatility is what will kill a lot of investment that wasn't even thought about in the past. The backside of the decline curve is going to look like that.

You need to realize this whole thing is not just about Geology. Go find Shortonoil's model of Available Energy and try to understand it. Its not a pretty picture and we dont have a lot of time left until the dollars thrown at this problem result in diminishing returns.

-

AirlinePilot - Moderator

- Posts: 4378

- Joined: Tue 05 Apr 2005, 03:00:00

- Location: South of Atlanta

Re: Low energy prices -> Production declines (hearsay)

I consider myself an expert compared to majority of the population. I've probably read enough books to fill several college level course with material on those subjects you so acrimonioulsy list! Reading leases, understanding mud samples, figuring out which type of pipe to order, or attending conferences doesn't give you any lock on the ability to think. Give me a break.

OF,

We are not talking about Stocks, we are talking about what is happening right now with production and how that changes moving forward in light of present and likely future economic and financial markets.

OF,

We are not talking about Stocks, we are talking about what is happening right now with production and how that changes moving forward in light of present and likely future economic and financial markets.

-

AirlinePilot - Moderator

- Posts: 4378

- Joined: Tue 05 Apr 2005, 03:00:00

- Location: South of Atlanta

49 posts

• Page 1 of 3 • 1, 2, 3

Who is online

Users browsing this forum: No registered users and 18 guests