A front-page story in The New York Times focused on a series of recent oil discoveries. But, as the story, “Oil industry sets a brisk pace of new discoveries,” published Sept. 24 acknowledges, none match the giant oil-field discoveries of the past. And despite these recent finds, world oil production has achieved a peak, or plateau, and eventually a steady decline will bring dire implications for the world economy and modern society.

Peak oil is not some fuzzy academic concern based on anecdotal information, but a geological reality. This is true for the United States (where production peaked in 1970 and has declined in most years since, despite enormous investments and technical improvements), and for most of the world's major oil-producing nations (including Indonesia, the United Kingdom, Nigeria, Norway, Mexico, Venezuela, and many dozens of smaller producers).

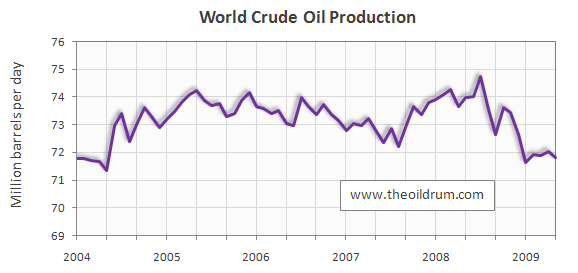

More important, the world as a whole reached a “plateau” from 2005 through July 2008, despite enormous price increases, which has been followed by a decline in production of about 5 percent in only one year. These are data from conservative American and European agencies that are in agreement.

While many would argue that sufficient financial incentives would increase production in these countries, they passed their peak production during a period of unprecedented price increases and, for most of them, stable political conditions.

Over the past year the price of oil has remained relatively low as many economies have collapsed at about the same rate as many oil fields, reducing demand. The world has not found major new resources since the 1960s, while continuing to squeeze more oil from old fields. Hundreds of major oil fields are declining severely (East Texas, Yates, Prudhoe, Brent, Forties, Ekofisk, Samotlor, Yibal and such). Many are collapsing, most notably Mexico's Cantarell Field, the world's second largest producer, which peaked in 2004 at 2.2 million barrels a day, then dropped to less than one-third of that in five years.

There is no way that the relatively few new fields recently discovered can compensate for the decline and collapse of so many older large fields, let alone allow growth of global oil production. Also, the geological realities are complicated by political events and a scarcity of investment capital to underwrite oil production.

Advances in oil production are stymied

The greatly increasing dollar and the energy needed to produce oil from ever deeper offshore ocean fields and other hostile environments trump technological oil-production advances.

In 1999, the global oil and gas industry, excluding nationalized companies, produced about one-tenth of a barrel of oil (including gas expressed as oil) per 2005 dollar spent in exploration, development and production. By 2006 that number had declined by about half. In 2005, despite all of the technological advances that allow oil companies to drill in arctic conditions or below thousands of feet of water, 60 percent of the world's oil production originated in fewer than 500 “giant” fields (about 1 percent of all oil fields worldwide); almost all of these fields were discovered 50 or more years ago.

The energy cost of getting oil and gas has significantly increased. In the 1930s, the United States recovered 100 or more barrels of oil for every barrel invested in seeking and producing it - Energy Return On Energy Invested (EROEI). This dropped to 20-30 to one in the 1970s and 10-18 to one by 2000.

Global patterns of decline are similar, and if present trends continue it will take a barrel of oil to find and produce a barrel of oil in, perhaps, as little as two to three decades. At some point, oil will not be a significant net energy source no matter the price and no matter what ill-informed economists say. We will miss it dearly as few alternatives have the favorable EROEI as petroleum did, and perhaps does still, and none except coal are conceivably of the same magnitude and quality in the foreseeable future.

It is time to prepare for a world without cheap and plentiful oil.

Robert Fromer lives in Windsor and is an environmental consultant. He wrote this article with data provided by Dr. Charles Hall, professor, SUNY College of Environmental Science and Forestry, Syracuse, New York.

http://www.theday.com/re.aspx?re=d2266a56-fc7b-429c-a175-cafd83b9ee76

A good refutation of that "oil is everywhere" article in the New York Times. The oilfinders of the world never seem to want to address the EROEI issue.