Shadowstats' John Williams: Prepare For The Hyperinflationary Great Depression

http://www.zerohedge.com/article/shadowstats-john-williams-prepare-hyperinflationary-great-depression

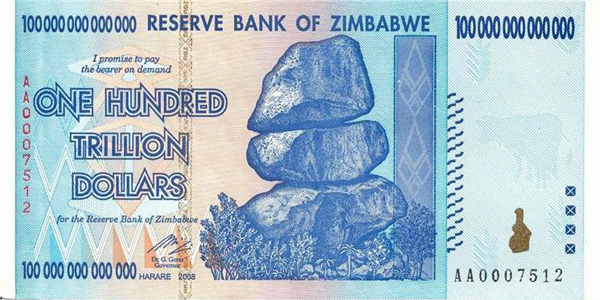

John Williams, who runs the popular counter government data manipulation site Shadowstats, has thrown down the gauntlet to deflationists, and in an extensive report concludes that the probability of a hyperinflationary episode in America over the next year has reached critical levels. While the debate between deflationists and (hyper)inflationists has been a long and painful one, numerous events set off in motion by the Bernanke Fed (as a direct legacy of the Greenspan multi-decade period of cheap and boundless credit) may have well cast America as the unwilling protagonist in the sequel of the failed monetary policy economic experiment better known as Zimbabwe.