THE Muni Thread (merged)

THE Muni Thread (merged)

500 MPH into a brick wall - me

-

Roccland - Heavy Crude

- Posts: 1604

- Joined: Sat 16 Jun 2007, 03:00:00

THE Muni Bond Thread (merged)

The MuniBond Market is 3Trillion. http://www.ft.com/cms/s/0/72cac69e-de0d ... ck_check=1

Last edited by Ferretlover on Wed 03 Aug 2011, 16:44:53, edited 2 times in total.

Reason: Merged thread.

Reason: Merged thread.

"We Are All Travellers, From The Sweet Grass To The Packing House, From Birth To Death, We Wander Between The Two Eternities". An Old Cowboy.

-

deMolay - Intermediate Crude

- Posts: 2671

- Joined: Sun 04 Sep 2005, 03:00:00

Re: Warning On US Muni Bonds/Cuts Must Be Permanent

Warning on US muni market threat

By Nicole Bullock in New York

Published: December 1 2009 00:20 | Last updated: December 1 2009 00:20

States need to consider permanent budgetary changes to close ballooning deficits or risk “significant cracks” in the municipal bond market, the lieutenant governor of New York said on Monday.

Richard Ravitch said New York and other states had historically relied on temporary measures to balance budgets in downturns as a bridge to recovery, a strategy that was unsustainable.

EDITOR’S CHOICE

Muni bond sector thawing with a little help from BAB - Nov-15Muni bond issuers enjoy record appeal - Sep-30Bonds regain US investor appeal - Sep-25Lex: Risky US states - May-11Munis show signs of recovery - Apr-28Little foreign appetite for Japan's latest muni bonds - Feb-24“If nothing changes, you will see significant cracks in the $3,000bn [municipal bond] market,” said Mr Ravitch, a long-time fixture in New York public office who served as an adviser to the governor during New York City’s financial crisis in the 1970s. He is now devising a four-year financial plan for New York state.

The US recession has sapped state tax receipts, with revenue falling for four consecutive quarters, says the Nelson A Rockefeller Institute of Government, a research group. That has left states grappling with budget shortfalls projected to reach $350bn in the fiscal years 2010 and 2011, according to the Center on Budget and Policy Priorities.

Yields in the municipal bond market, where state and local governments raise money, have begun to rise amid concerns about the health of local economies. But thanks to federal subsidies and demand from retail investors, they remain near the historical lows reached this autumn.

In October, the Bond Buyer 11-bond GO index, which tracks 20-year bonds with an average rating of Aa1, dropped to 3.69 per cent, which is the lowest since 1967. It has risen to 4.06 per cent but remains below the 10-year average of 4.73 per cent.

Mr Ravitch, speaking at a conference on state finances held by the Rockefeller Institute, warned that in spite of the size of the fiscal problems, “the message has not gotten through”.

New York governor David Paterson late on Monday said that talks to close a deficit of more than $3bn for the fiscal year ended March 31 have ended and he would use his powers to make cuts. Mr Paterson is withholding payments on unspecified local assistance programmes to prevent the state from running out of cash before the end of the fiscal year.

The state may face significant lay-offs as well as cuts to healthcare and education spending, said Mr Ravitch.

During the past 10 years, New York had used $20bn to $24bn of “one shots”, such as borrowings, asset sales, or non-recurring revenue items, to close deficits while spending had risen consistently, said Mr Ravitch. In addition to banking on economic cyclicality rather than long-term measures to close gaps, states have looked to the federal government for help, which they received through the Obama administration’s stimulus package.

Mr Ravitch said additional stimulus was a “dubious proposition”, given what he saw as a shifting political paradigm in the US based on the sharp criticism of the administration’s healthcare reform efforts.

Unlike municipalities, US states cannot use bankruptcy to restructure budgets because they are not eligible under the US bankruptcy code.

“We need to rethink what is most important about what states do,” said Mr Ravitch, including the role that state, federal and local governments play in funding and delivering public services.

“It is going to be impossible to continue to borrow as we and other states have to fund budget gaps.”

Copyright The Financial Times Limited 2009. You may share using our article tools. Please don't cut articles from FT.com and redistribute by email or post to the web.

"We Are All Travellers, From The Sweet Grass To The Packing House, From Birth To Death, We Wander Between The Two Eternities". An Old Cowboy.

-

deMolay - Intermediate Crude

- Posts: 2671

- Joined: Sun 04 Sep 2005, 03:00:00

Municipal Bond Market Shudders

Municipal Bond Market Shudders

Has the reckoning arrived for municipal bonds?

California, led by Arnold Schwarzenegger, must sell nearly $14 billion of debt into the falling municipal bond market this month.

That is the question investors are asking after munis — those old faithfuls of investing — took their biggest hit since the financial collapse of 2008.

Concern over the increasingly strained finances of states and cities and a growing backlog of new bonds for sale overwhelmed the market last week. After performing so well for so long, munis and funds that invest in them fell hard. One big muni fund, the Pimco Municipal Income Fund II, for instance, lost 7.5 percent. The fund is still up 6.75 percent so far this year.

Muni's will be the subject of the next Fed inflationary debt-monetizing bailout.

http://www.nytimes.com/2010/11/13/busin ... f=business

Last edited by Ferretlover on Wed 03 Aug 2011, 16:43:57, edited 1 time in total.

Reason: Merged thread.

Reason: Merged thread.

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

The Muni Crash Thread

In the end, the Fed will bail them out, fo shizzle.

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: The Muni Crash Thread

California facing $20 billion budget deficits deep into 2016 – $25 billion budget deficit starring California in the face for the next fiscal year and overly optimistic economic predictions.

California, the wealthiest state in our nation is facing some Herculean financial troubles yet again. As the elections came to a dramatic close, it was announced that a $6 billion budget deficit emerged from “miscalculations” of potential revenue streams. The current Governor was overly optimistic in many respects including an expectation that the Federal government would somehow throw like a wild pitch billions of dollars onto California’s doorstep. This did not materialize. So a lame duck session of Congress is left to deal with the current fiscal year gap of $6 billion but there is little incentive for the state Congress to act when new state legislatures are sworn in early in December. The new Governor will have no honeymoon period and the 2011-12 fiscal budget is expected to have a $25 billion budget deficit. The challenges California face are magnified by its decade long reliance on the housing industry for jobs and tax revenues.

http://www.mybudget360.com/california-f ... -the-face/

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: The Muni Crash Thread

I think you're right.

It's only a matter of time before the Fed starts buying up municipal bonds for quantitative easing round 3.

It's only a matter of time before the Fed starts buying up municipal bonds for quantitative easing round 3.

"www.peakoil.com is the Myspace of the Apocalypse."

- Tyler_JC

- Expert

- Posts: 5438

- Joined: Sat 25 Sep 2004, 03:00:00

- Location: Boston, MA

Re: The Muni Crash Thread

US muni bond funds see record outflows

Investors cashed out of the $2,800bn municipal bond market in the last week, withdrawing a record $3.1bn from mutual and exchange traded funds specialising in this type of debt, Lipper, the fund tracker, said late on Thursday.

A mass exodus by retail investors has been a concern since they are the primary buyers of “munis.”

http://www.ft.com/cms/s/0/a81501ee-f34b ... z15rwBP7AQ

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: The Muni Crash Thread

Bond market turmoil hits California in the pocketbook

With some investors reluctant to buy, the state is forced to raise its rates to sell $10 billion in short-term debt.

California was forced to boost interest rates on $10 billion in short-term debt it sold Thursday, another sign of the turmoil racking the municipal bond market.

But for now, the surge in yields on many tax-free bonds "is definitely turning heads" of buyers, said Joe Lee, a muni trader at De La Rosa & Co. in Los Angeles.

The commotion over munis is part of a broader bond market upheaval triggered by investors' sudden demand for sharply higher interest rates to buy debt of all sorts.

http://www.latimes.com/business/la-fi-b ... 8079.story

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: The Muni Crash Thread

I find it fascinating that California is both financially bankrupt and claiming to be the wealthiest state all at the same time. If they had real wealth they would not be bankrupt, all they have is paper wealth that is an illusion of grand proportions.

Time for good old Kal-If-For-Nie-Ayyy to eat some humble pie and live within a budget like most middle class and poor Americans have been doing for the last two years.

Time for good old Kal-If-For-Nie-Ayyy to eat some humble pie and live within a budget like most middle class and poor Americans have been doing for the last two years.

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17059

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: The Muni Crash Thread

That's why California is in trouble.

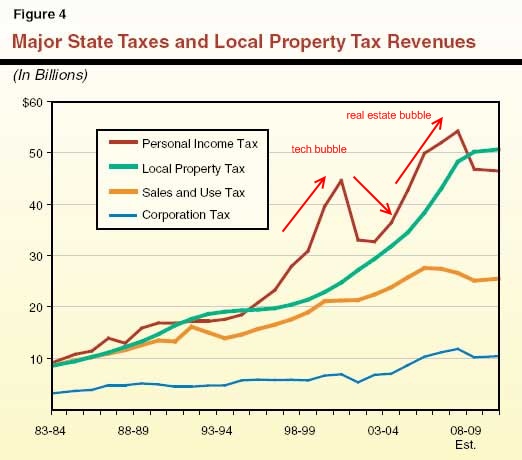

They rely heavily on volatile personal income taxes. In the good years they have a flood of tax revenue which quickly gets spent on social programs. In the bad years, the income tax revenue disappears and the state is left with massive deficits. And even during the good times they often fail to balance the budget.

A post office employee and a car salesmen should have vastly different personal savings rates. The post office employee has a steady income and a guaranteed pension. He probably does not need to save a lot of his money. The car salesmen has a higher income but also a much greater degree of variability in his income. Thus, he should save a large share of his paycheck to guard against bad times.

The same is true at the state level. If California insists on capping property taxes and focusing on income taxes as its main source of revenue, it should be far more careful about its spending habits during the boom years. Not that we'll ever get fiscal responsibility from the "Golden" state.

"www.peakoil.com is the Myspace of the Apocalypse."

- Tyler_JC

- Expert

- Posts: 5438

- Joined: Sat 25 Sep 2004, 03:00:00

- Location: Boston, MA

Re: The Muni Crash Thread

"Desperate" Budget Situation In Cook County

Cook County government is $487 million in the red, and its soon-to-be inaugurated president Toni Preckwinkle says every county department must find 21 percent in savings over the last three quarters of the county's next fiscal year to close the gap.

A somber Preckwinkle laid out the situation before reporters a day after she voted to support outgoing Chicago Mayor Richard Daley's last budget, which leans heavily on one-time reserve funds, "surplus" tax increment financing (TIF) dollars, relatively rosy budget projections, and furlough days that the city's unionized workforce have not to agreed to take.

Preckwinkle told reporters she had addressed the county's separate elected officials -- from the assessor to the state's attorney -- about finding the savings at a meeting Wednesday. "No one would be absolved from making cuts, and no one would be alone from making cuts," is how Preckwinkle described her message at the gathering. Here she is outlining the broad strokes of the budget:

It seems Cook County was spending more than it receiving. What did they expect?

http://progressillinois.com/posts/conte ... ion-county

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: The Muni Crash Thread

What Happened To Ireland This Week Could Happen To US Munis Very Soon

There is an eerie calm that has descended on the Irish story. IMF and EU folks are ‘up country’ taking a look-see and kicking some bank tires. The market for Irish debt has stabilized and the local equity index has improved at the prospect of some sort of deal that will “fix” the problem. Even the Euro has had its head lifted at the prospect.

I understand that a bailout of Ireland and Portugal is better for the markets than a crash and burn, but I am surprised at the euphoric atmosphere as we get closer to the biggest sovereign blow up in a very long time.

Speaking of sovereign blowups there is one happening in the US Muni market. There are a number of factors hitting Muni’s of late. Some are technical, some yield curve related. But there is more happening than just these things. It reminds me a bit of what happened to Ireland before they were forced to fold.

http://www.businessinsider.com/what-hap ... on-2010-11

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: The Muni Crash Thread

The way that Illinois handles its budget crises is particularly obnoxious.

Instead of immediately cutting spending, raising taxes or borrowing money, the state just stops paying its bills. They basically default on their obligations every year and no one seems to give a sh*t. Well, except for the bond market.

http://www.nytimes.com/2010/07/03/business/economy/03illinois.html

Instead of immediately cutting spending, raising taxes or borrowing money, the state just stops paying its bills. They basically default on their obligations every year and no one seems to give a sh*t. Well, except for the bond market.

http://www.nytimes.com/2010/07/03/business/economy/03illinois.html

CHICAGO — Even by the standards of this deficit-ridden state, Illinois’s comptroller, Daniel W. Hynes, faces an ugly balance sheet. Precisely how ugly becomes clear when he beckons you into his office to examine his daily briefing memo.

He picks the papers off his desk and points to a figure in red: $5.01 billion.

“This is what the state owes right now to schools, rehabilitation centers, child care, the state university — and it’s getting worse every single day,” he says in his downtown office.

Mr. Hynes shakes his head. “This is not some esoteric budget issue; we are not paying bills for absolutely essential services,” he says. “That is obscene.”

For the last few years, California stood more or less unchallenged as a symbol of the fiscal collapse of states during the recession. Now Illinois has shouldered to the fore, as its dysfunctional political class refuses to pay the state’s bills and refuses to take the painful steps — cuts and tax increases — to close a deficit of at least $12 billion, equal to nearly half the state’s budget.

Then there is the spectacularly mismanaged pension system, which is at least 50 percent underfunded and, analysts warn, could push Illinois into insolvency if the economy fails to pick up.

"www.peakoil.com is the Myspace of the Apocalypse."

- Tyler_JC

- Expert

- Posts: 5438

- Joined: Sat 25 Sep 2004, 03:00:00

- Location: Boston, MA

Re: The Muni Crash Thread

Illinois and New York issuers will offer $4.7 billion of this week’s municipal debt with scheduled sales 53 percent higher than the same week last year, as local governments seek to place deals before the end of 2010.

States and municipalities plan to borrow about $13.3 billion this week, compared with $8.7 billion sold the week after the U.S. Thanksgiving holiday in 2009, according to data compiled by Bloomberg. The alternative-minimum-tax exemption and the Build America Bond program are set to expire on Dec. 31 unless Congress extends them.

http://www.bloomberg.com/news/2010-11-2 ... redit.html

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: The Muni Crash Thread

Mounting Debts by States Stoke Fears of Crisis

The State of Illinois is still paying off billions in bills that it got from schools and social service providers last year. Arizona recently stopped paying for certain organ transplants for people in its Medicaid program. States are releasing prisoners early, more to cut expenses than to reward good behavior. And in Newark, the city laid off 13 percent of its police officers last week.

While next year could be even worse, there are bigger, longer-term risks, financial analysts say. Their fear is that even when the economy recovers, the shortfalls will not disappear, because many state and local governments have so much debt — several trillion dollars’ worth, with much of it off the books and largely hidden from view — that it could overwhelm them in the next few years.

“It seems to me that crying wolf is probably a good thing to do at this point,” said Felix Rohatyn, the financier who helped save New York City from bankruptcy in the 1970s.

Some of the same people who warned of the looming subprime crisis two years ago are ringing alarm bells again. Their message: Not just small towns or dying Rust Belt cities, but also large states like Illinois and California are increasingly at risk.

http://www.nytimes.com/2010/12/05/us/po ... 2&src=tptw

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: The Muni Crash Thread

Then there is the spectacularly mismanaged pension system, which is at least 50 percent underfunded and, analysts warn, will push Illinois into insolvency when the economy fails to pick up.

Corrected to reflect reality.

-

Cog - Fusion

- Posts: 13416

- Joined: Sat 17 May 2008, 03:00:00

- Location: Northern Kekistan

Re: The Muni Crash Thread

Muni bond market roiled by possible end of 'Build America' program

Market prices of tax-free municipal bonds took a hit on Tuesday, hurt by uncertainty over the fate of a federal subsidy program for muni issuers and by another general rise in interest rates.

The Build America Bond program, which for the last two years has allowed state and local governments to issue taxable muni bonds with interest partly paid by Uncle Sam, may not be extended beyond Dec. 31. The program wasn’t included in the compromise tax-cut agreement reached between President Obama and Republican leaders.

If the BAB program is terminated, it could mean that muni issuers that would otherwise have borrowed via the bonds in 2011 would be forced to issue conventional tax-free bonds instead -- boosting the supply of those securities.

Reacting to that possibility, some investors dumped longer-term tax-free muni issues on Tuesday, driving prices down and yields up. That showed in prices of popular muni bond mutual funds.

http://latimesblogs.latimes.com/money_c ... ields.html

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: The Muni Crash Thread

Munis Hit As Market Braces for BABs' End

Investors demanded higher interest payments on municipal bonds on Monday amid strong year-end issuance, pushing yields to the highest levels since 2009, on news that a popular bond subsidy program appeared increasingly unlikely to be extended.

The higher yields were driven in part by fears that cash-strapped state and local governments would have a harder time selling debt without the Build America Bonds program, which provides a federal subsidy on taxable bonds issued by state and local governments and opened the market to more potential buyers.

"It's finally settling in," said Patrick Early, chief municipal analyst at Wells Fargo Advisors. "We just don't see BABs coming back."

Politicians are incompetent at their own game. BaB's are out for now, but when the wave finally impacts, the Federal Reserve will bail them out. That's its job isn't it?

http://online.wsj.com/article/SB1000142 ... lenews_wsj

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: The Muni Crash Thread

`Avalanche' of Investor Sales Pushes Yields to 16-Month High: Muni Credit

Yields on top-rated tax-exempt securities due in 30 years climbed twice as fast as those on U.S. Treasuries, reaching the highest level in almost 16 months.

The prospect that tax-free municipal issuance will surge if the Build America Bonds program isn’t renewed after Dec. 31 drove 30-year tax-exempt rates up 20 basis points, or 0.2 percentage point, to 4.84 percent, the highest since Aug. 17, 2009, according to a Bloomberg Valuation index.

Bondholders sought buyers for $1.4 billion in debt yesterday, the most since June 15, 2006, according to a Bloomberg bids-wanted index.

“Nobody’s bidding,” Tony Shields, a principal in the public-finance department at Williams Capital Group LP in New York, said in an e-mail. There’s “an avalanche of bid-wanteds, and there is just not enough liquidity to accommodate this much sell-side pressure.”

http://www.bloomberg.com/news/2010-12-1 ... redit.html

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

92 posts

• Page 1 of 5 • 1, 2, 3, 4, 5

Who is online

Users browsing this forum: No registered users and 26 guests