Anyone read the cover story of the latest Economist?

http://www.economist.com/node/18281774? ... N=64916986

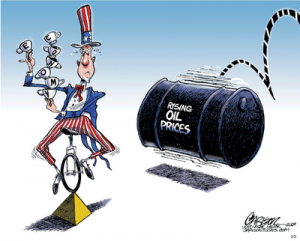

Evidently, according to both the IMF and Goldman Sachs, a 10% rise in oil prices equals a .2% reduction in GDP.

So, here goes some back-of-envelope calculations:

Expected world GDP growth/yr. = 4.6%

Current Brent crude price = $116

$128 -.2%

$140 -.4%

$154 -.6%

$169 -.8%

$186 -1%

$205 -1.2%

$225 -1.4%

$247 -1.6%

$271 -1.8%

$298 -2%

$328 -2.2%

$360 -2.4%

$396 -2.6%

$436 -2.8%

$479 -3%

$526 -3.2%

$578 -3.4%

$632 -3.6%

$695 -3.8%

$765 -4%

$841 -4.2%

$925 -4.4%

$1013 -4.6%

Therefore to stop growth completely, am I to believe the price of oil would have to rise over $1,000/barrel??! That sounds nutty. I can't imagine that the relationship is only 10%/-.2... it's gotta be higher than that!

Relation of oil prices to GDP

First unread post • 13 posts

• Page 1 of 1

Re: Relation of oil prices to GDP

I agree that growth would stop MUCH quicker than that, at least in the near to moderate term. My best guess as to the issue here is:

The folks on CNBC have been citing about a $10.00 increase per -.2% GDP impact. That sounds more like it to me -- you'd get a much more rapid and consistent effect as prices escalate, at least for the prices we can imagine in the near to moderate term. So if we get $300 oil, that would pretty much stop all economic growth in the current environment (20 * .2% is 4%). Notice that around $100 (WTI) that 10% and $10 happen to be the same thing, so as illiterate and especially mathematically illiterate as MUCH of the public and reporters are -- I could easily see this being incorrectly reported.

I also suspect it is nonlinear. There are certainly psychological bumps at round numbers -- at least in the short term. $4.00 in the U.S. seemed to be such a number in 2008.

This prediction DOES seem FAR more realistic to me however, than the doomer predictions that when prices go to "X" (like $5.00 or $8.00) in the U.S., all hell suddenly breaks loose. This seems like doomer fantasy more than a realistic economic model (or guess). After all, Europeans have been living with $10.00ish gasoline for quite a while now.

The other thing is, most of economics is just ivory tower theories. It is not easy to model real world effects, and observing them in the "messy" real world where there are literally thousands of variables and notoriously irrational human beings mucking about -- simple mathemetical models most of economic predictions are based on are a very basic and assumption-riddled "educated guess", at best.

IMO, that is why it is (justifiably) called the "dismal science". The classic econ joke that illustrates this is: "If you laid 10,000 economists end-to-end, they could not reach a conclusion."

The folks on CNBC have been citing about a $10.00 increase per -.2% GDP impact. That sounds more like it to me -- you'd get a much more rapid and consistent effect as prices escalate, at least for the prices we can imagine in the near to moderate term. So if we get $300 oil, that would pretty much stop all economic growth in the current environment (20 * .2% is 4%). Notice that around $100 (WTI) that 10% and $10 happen to be the same thing, so as illiterate and especially mathematically illiterate as MUCH of the public and reporters are -- I could easily see this being incorrectly reported.

I also suspect it is nonlinear. There are certainly psychological bumps at round numbers -- at least in the short term. $4.00 in the U.S. seemed to be such a number in 2008.

This prediction DOES seem FAR more realistic to me however, than the doomer predictions that when prices go to "X" (like $5.00 or $8.00) in the U.S., all hell suddenly breaks loose. This seems like doomer fantasy more than a realistic economic model (or guess). After all, Europeans have been living with $10.00ish gasoline for quite a while now.

The other thing is, most of economics is just ivory tower theories. It is not easy to model real world effects, and observing them in the "messy" real world where there are literally thousands of variables and notoriously irrational human beings mucking about -- simple mathemetical models most of economic predictions are based on are a very basic and assumption-riddled "educated guess", at best.

IMO, that is why it is (justifiably) called the "dismal science". The classic econ joke that illustrates this is: "If you laid 10,000 economists end-to-end, they could not reach a conclusion."

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: Relation of oil prices to GDP

Duende wrote:Anyone read the cover story of the latest Economist?

http://www.economist.com/node/18281774? ... N=64916986

Evidently, according to both the IMF and Goldman Sachs, a 10% rise in oil prices equals a .2% reduction in GDP.

So, here goes some back-of-envelope calculations:

Expected world GDP growth/yr. = 4.6%

Current Brent crude price = $116

$128 -.2%

$140 -.4%

$154 -.6%

$169 -.8%

$186 -1%

$205 -1.2%

$225 -1.4%

$247 -1.6%

$271 -1.8%

$298 -2%

$328 -2.2%

$360 -2.4%

$396 -2.6%

$436 -2.8%

$479 -3%

$526 -3.2%

$578 -3.4%

$632 -3.6%

$695 -3.8%

$765 -4%

$841 -4.2%

$925 -4.4%

$1013 -4.6%

Therefore to stop growth completely, am I to believe the price of oil would have to rise over $1,000/barrel??! That sounds nutty. I can't imagine that the relationship is only 10%/-.2... it's gotta be higher than that!

When one considers that much of global capital now draws its surplus from sweatshops in China and India, they're probably not far off. However, the fly in this ointment is that consumption still takes place in theWest where margins are squeezed and it wont take much to decouple this little arrangement. Moving consumption to the Asian giants will not work as the resulting markups will be dwarfed by the ones lost in the West.

- americandream

- Permanently Banned

- Posts: 8650

- Joined: Mon 18 Oct 2004, 03:00:00

Re: Relation of oil prices to GDP

From the article.

I think your math is a bit off. First you haven't started at the right point. The 4.5% growth estimate was from when oil was selling for $85 or less last summer.

So your chart should look like this.

85.00 ...... 4.5

93.5 ...... 4.25

102.85 ..... 4.00

113.14 ..... 3.75

124.45 ..... 3.50

136.90 ..... 3.25

150 ...... 3.00

165.65 ..... 2.50

182.21..... 2.00

200 ...... 1.75

220.47 ..... 1.5

242 ...... 1.25

266 ...... 1.00

293.44 ..... 0.75

322.79 ..... 0.5

355.07 ..... 0.25

390.57 ..... Zero

But perhaps the effect on growth is not linear or constant so that $150 oil is all it takes to stop world GDP growth.

Dearer oil still implies a transfer from oil consumers to oil producers, and since the latter tend to save more it spells a drop in global demand. A rule of thumb is that a 10% increase in the price of oil will cut a quarter of a percentage point off global growth. With the world economy currently growing at 4.5%, that suggests the oil price would need to leap, probably above its 2008 peak of almost $150 a barrel, to fell the recovery. But even a smaller increase would sap growth and raise inflation.

I think your math is a bit off. First you haven't started at the right point. The 4.5% growth estimate was from when oil was selling for $85 or less last summer.

So your chart should look like this.

85.00 ...... 4.5

93.5 ...... 4.25

102.85 ..... 4.00

113.14 ..... 3.75

124.45 ..... 3.50

136.90 ..... 3.25

150 ...... 3.00

165.65 ..... 2.50

182.21..... 2.00

200 ...... 1.75

220.47 ..... 1.5

242 ...... 1.25

266 ...... 1.00

293.44 ..... 0.75

322.79 ..... 0.5

355.07 ..... 0.25

390.57 ..... Zero

But perhaps the effect on growth is not linear or constant so that $150 oil is all it takes to stop world GDP growth.

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: Relation of oil prices to GDP

Outcast_Searcher wrote:The other thing is, most of economics is just ivory tower theories. It is not easy to model real world effects, and observing them in the "messy" real world where there are literally thousands of variables and notoriously irrational human beings mucking about -- simple mathemetical models most of economic predictions are based on are a very basic and assumption-riddled "educated guess", at best.

I think so too. I guessed oil would go to $130 this year on QE and pent up demand driving the economy but would retreat when the price slowed growth. OTOH, I argued with myself, we just recently pruned a good amount of "dead wood" from the employment rolls so the new and improved, even more service oriented and oil decoupled economy can stand an even higher price.

I'm not even educated and I have at least two guesses.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Relation of oil prices to GDP

Outcast_Searcher wrote:This prediction DOES seem FAR more realistic to me however, than the doomer predictions that when prices go to "X" (like $5.00 or $8.00) in the U.S., all hell suddenly breaks loose. This seems like doomer fantasy more than a realistic economic model (or guess). After all, Europeans have been living with $10.00ish gasoline for quite a while now.

Europeans have been living with high gasoline prices for a long time. That fact is not in dispute, but to assess any commonality with high gas prices there and here in the US is absurd. We do things drastically different here. Assuming its going to be manageable because they do it is completely wrong.

We do not share their city structure, at least in most areas. They have far more mass transit than we do. They do not have a suburban culture set up like ours. They have much better fuel economics with far more "small" vehicles than the US drivers. They utilize bikes and scooters/motorcycles FAR more than we do. Yes its a result of high prices, but when you see how they have adapted it hasnt been in a short time frame, its been over decades.

We may be thrust into over 4$/gal within the next few weeks! I believe anything over 4.50/5$ gal here in the US is a rapid decay of the economy. RAPID.

-

AirlinePilot - Moderator

- Posts: 4378

- Joined: Tue 05 Apr 2005, 03:00:00

- Location: South of Atlanta

Re: Relation of oil prices to GDP

Pops wrote:Outcast_Searcher wrote:The other thing is, most of economics is just ivory tower theories. It is not easy to model real world effects, and observing them in the "messy" real world where there are literally thousands of variables and notoriously irrational human beings mucking about -- simple mathemetical models most of economic predictions are based on are a very basic and assumption-riddled "educated guess", at best.

I think so too. I guessed oil would go to $130 this year on QE and pent up demand driving the economy but would retreat when the price slowed growth. OTOH, I argued with myself, we just recently pruned a good amount of "dead wood" from the employment rolls so the new and improved, even more service oriented and oil decoupled economy can stand an even higher price.

I'm not even educated and I have at least two guesses.

Excellent analysis!!

- americandream

- Permanently Banned

- Posts: 8650

- Joined: Mon 18 Oct 2004, 03:00:00

Re: Relation of oil prices to GDP

AirlinePilot wrote:Outcast_Searcher wrote:This prediction DOES seem FAR more realistic to me however, than the doomer predictions that when prices go to "X" (like $5.00 or $8.00) in the U.S., all hell suddenly breaks loose. This seems like doomer fantasy more than a realistic economic model (or guess). After all, Europeans have been living with $10.00ish gasoline for quite a while now.

Europeans have been living with high gasoline prices for a long time. That fact is not in dispute, but to assess any commonality with high gas prices there and here in the US is absurd. We do things drastically different here. Assuming its going to be manageable because they do it is completely wrong.

Assuming that all of America revolves around the rural areas, where folks will unfortunately be hit much harder is mostly wrong. The cities are where most of the production occurs, especially the industrial production.

Dense populated areas where lots of people live and the hub of economic activity occur (the cities) ARE similar enough to Europe to forecast that $4.00 or $5.00 gasoline, while inconvenient is certainly not catostrophic.

I live in central KY and have spent much time in (and temporarily) lived in a very rural area. It is not hard to imagine the way high gas prices will hit such people. Like I said, it will be hard on them, but that won't implode the whole economy.

Ironoically, it might be (roughly speaking) a wash on inflation in the near term. Higher prices for commodities, but lower prices based on a softer economy.

People can and WILL adapt. It will be far easier for those in cities.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

Re: Relation of oil prices to GDP

It is not just a choice between rural and city in the USA. Over half of Americans live in the suburbs and forty percent have no access to public transportation and only 4% use it to commute to work. The city has the jobs and transportation and people living in rural areas have jobs working the land or at least land enough to grow their own food and fuel. The suburbanite has none of this, just a house a driveway and a scrap of lawn. He must commute to work as exclusive zoning has insured that every job is driving distance away. The average car commuter in the US drives alone and spends 100 minutes a day round trip.

The cities can put on more trains and buses and the farmer can walk to the barn but if gas gets to $10.00 a gallon the suburbanite is in real trouble and the local government that depends on his income to pay property taxes will bounce down the cliff with him.

The cities can put on more trains and buses and the farmer can walk to the barn but if gas gets to $10.00 a gallon the suburbanite is in real trouble and the local government that depends on his income to pay property taxes will bounce down the cliff with him.

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: Relation of oil prices to GDP

I guess I am not sure what people mean by 'implode the whole economy'. There are lots of places around the world where most people can not afford to drive their own cars and public transport is poor. They are called 'developing' countries, and here people find solutions to travel demands. When I visited Chile, in the 1990s (a country that is on the verge of becoming a developed country) in the provincial city La Serena, there were a kind of mix between taxis and buses: Informal collective taxis driving set routes on the major routes. People know about them, and you placed yourself on the route and signaled, so the next taxi picked you up, if it was not already full of course. The waiting time could vary, because there were no timetables, but usually you could get a ride within 15 minutes or so. There were more official buses too, with infrequent timetables.

Today with cell phones and computers I am sure it possible to create nifty versions of collective taxis. In developing countries the most expensive part of driving your own vehicle is the purchase of the vehicle itself. In the USA, with increased gas prices, there will be no lack of vehicles. People will find ways to survive - like, if many people find it too expensive to drive to the grocery store, neighbors will pool resources to send one vehicle there and load it to the top. Or someone will set up an informal grocery store in their own home within neighborhood walking distance. More expensive per item than the big supermarkets of course, but available without driving.

Perhaps those kinds of solutions are what is meant by 'implosion of the economy'. I would call it creating a different kind of economy. Certainly it is a lot more benign situation than a physical destruction of a society in wars or like last year's Haitian earthquake -- situations that kill and traumatise people as well as destroy buildings and infrastructure.

Today with cell phones and computers I am sure it possible to create nifty versions of collective taxis. In developing countries the most expensive part of driving your own vehicle is the purchase of the vehicle itself. In the USA, with increased gas prices, there will be no lack of vehicles. People will find ways to survive - like, if many people find it too expensive to drive to the grocery store, neighbors will pool resources to send one vehicle there and load it to the top. Or someone will set up an informal grocery store in their own home within neighborhood walking distance. More expensive per item than the big supermarkets of course, but available without driving.

Perhaps those kinds of solutions are what is meant by 'implosion of the economy'. I would call it creating a different kind of economy. Certainly it is a lot more benign situation than a physical destruction of a society in wars or like last year's Haitian earthquake -- situations that kill and traumatise people as well as destroy buildings and infrastructure.

- nocar

- Tar Sands

- Posts: 810

- Joined: Fri 05 Nov 2004, 04:00:00

Re: Relation of oil prices to GDP

4 dollars away...

Oil at $110 May Trigger Pain U.S. CEOs Weathered at $100

http://www.bloomberg.com/news/2011-03-07/oil-at-110-may-trigger-pain-chief-executives-weathered-at-100.html

Oil at $110 May Trigger Pain U.S. CEOs Weathered at $100

A recovering economy helped U.S. chief executive officers weather crude’s surge past the $100 mark. At $110 a barrel, the pain would start to kick in.

As oil traded at 29-month highs last week on concern that violence in Libya would further crimp Middle Eastern supplies, CEOs said they were waiting to see how much the price rises, and for how long.

“Any time something like oil goes up dramatically overnight, it becomes very hard to adequately plan,” said Samuel Allen, 57, chairman and CEO of Deere & Co. (DE), the world’s largest maker of agricultural equipment. “It has caused us to be more careful or cautious in watching the outlook, but we have still moved forward with all our plans.”

Corporate assumptions would have to start changing when oil reaches $110 a barrel, according to economists such as Chris Low of FTN Financial in New York. Crude at that price would offset the benefit from the tax cut approved by Congress in December, and begin to slow economic growth, Low said.

“As long as consumers are willing to pay up a little more, there really isn’t going to be a significant impact,” Low said in an interview. “But we’re pretty quickly running out of time there with oil through $100 a barrel. We’re getting to levels where we have to think about taking our forecasts lower.”

http://www.bloomberg.com/news/2011-03-07/oil-at-110-may-trigger-pain-chief-executives-weathered-at-100.html

"I learned long ago, never to wrestle with a pig. You get dirty, and besides, the pig likes it."

George Bernard Shaw

“You can ignore reality, but you can't ignore the consequences of ignoring reality.” Ayn Rand

George Bernard Shaw

“You can ignore reality, but you can't ignore the consequences of ignoring reality.” Ayn Rand

-

eXpat - Intermediate Crude

- Posts: 3801

- Joined: Thu 08 Jun 2006, 03:00:00

Re: Relation of oil prices to GDP

Spiking Oil, Plunging Economy

according to an unscientific USAWatchdog.com poll of nearly 1,000 readers, more than 60% think gas prices will be $5.00 or more a gallon by this time next year.

Facebook knows you're a dog.

-

Keith_McClary - Light Sweet Crude

- Posts: 7344

- Joined: Wed 21 Jul 2004, 03:00:00

- Location: Suburban tar sands

Re: Relation of oil prices to GDP

The problem with these charts is that at about $125-140 a barrel for oil, the airlines can no longer make a profit. The prices have to start rising exponentially. People cut back dramatically on consumer spending to pad their financial position. Food prices have to begin to rise, because logistics companies have to start paying drivers more per mile. Auto-makers begin to suffer due to declining auto sales and shifts into more fuel efficient models which have a dramatically smaller profit-margin than the big gas-guzzlers.

So, maybe we lose two-tenths of a percent of GDP per ten percent increase in a barrel of oil up to a point, but somewhere around $125-$140 a barrel, a great number of things occur that will unravel a number of industries in America, and the world. Immense pressure will be put on an already fragile world economy and there is real doubt in my mind that it can take it.

So, maybe we lose two-tenths of a percent of GDP per ten percent increase in a barrel of oil up to a point, but somewhere around $125-$140 a barrel, a great number of things occur that will unravel a number of industries in America, and the world. Immense pressure will be put on an already fragile world economy and there is real doubt in my mind that it can take it.

"The world is my country, all mankind are my brethren, and to do good is my religion." -- Thomas Paine

-

JohnRM - Peat

- Posts: 152

- Joined: Fri 04 Mar 2011, 01:36:44

- Location: Eastern Pennsylvania

13 posts

• Page 1 of 1

Who is online

Users browsing this forum: No registered users and 30 guests