mos6507 wrote:

To continually get suckered into "this is the big one!" mentality on the crest of every peak of the sin wave is Boy Who Cried Wolf at its worst.

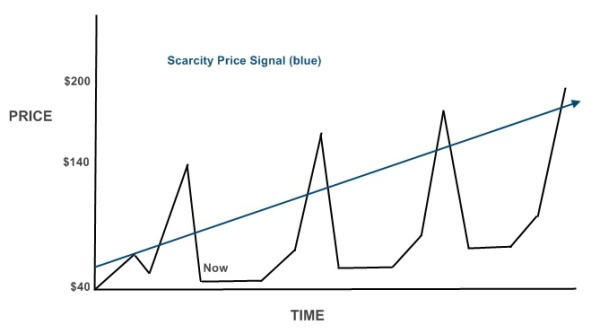

I think it is recognized that with respect to commodities, small variation in demand can greatly influence price, so the demand destruction occuring past July 2008 didn't need to be that big for the price to tank, and don't see how it is boy crying wolf, it is more a verificatin of the current oscillation principles :

1) Price and production increasing with a more or less recovering economy

2) Pricing increase getting into third gear as demand/supply tension gets higher on real geological production constraints

3) Some demand destruction release the current prod constraint vis à vis the market and the price tank

I don't deny the fact that speculation has some effect on the price especially near the spikes, but don't thing it is in any way major.

And on the other hand, the "it is because of the speculators that price is going up" meme, is an easy way out to avoid the real PO constraints.

In fact there is this guy Paul Jorion who adheres a lot to the "speculators fault theory" (and who got quite famous (in France) by accurately forecasting 2008 crash) is promoting a rule forbidding speculation (futures trading) by people not directly involved in the commercial market.

I think this would probably be a good rule (somehow the Chinese also moving this way), but a t the same time I wouldn't expect much from it regarding the resulting price.