Slow Housing Opinion Poll

Slow Housing Opinion Poll

Which one of these do you think is most responsible for the continued falloff in housing?

-

evilgenius - Intermediate Crude

- Posts: 3731

- Joined: Tue 06 Dec 2005, 04:00:00

- Location: Stopped at the Border.

Re: Slow Housing Opinion Poll

People never buy when values and rates are declining.

Values are still declining because of the supply overhang now that lots of never-shoulda-qualified's are out of the market.

Then come the other things you mention I think lots of people move when they change jobs and for sure not many are doing that now. Perversely, lots of the slack in what were once fast growing markets is due to the crash in the RE market itself that's idled construction workers, everyone in the RE business and all the home improvement/furniture/interior finish related business right down the line.

Values are still declining because of the supply overhang now that lots of never-shoulda-qualified's are out of the market.

Then come the other things you mention I think lots of people move when they change jobs and for sure not many are doing that now. Perversely, lots of the slack in what were once fast growing markets is due to the crash in the RE market itself that's idled construction workers, everyone in the RE business and all the home improvement/furniture/interior finish related business right down the line.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Slow Housing Opinion Poll

It was bad enough for poisoning the poll that I voted right away upon creating it, but hey. Anyway, I voted for people not buying because their houses won't go up in value. To be sure the economy has weeded out the truly weak who never had any business buying before. They will probably not get loans now. Assuming those people were just the marginal propensity to consume, however, we can discount them.That still theoretically leaves a lot of people with the wherewithal to buy who aren't. Pop's recognition that the lack of movement created by these times has to be considered aside I voted the way I did because I feel those people have not changed their ways. I think they still look at housing as an investment, not as a place to live. When they don't see housing acting like an investment, meaning prices rising at a rate they have come to expect, they shy away.

In case you haven't guessed, I don't think housing is an 'investment'. Which is to say that unless you can sell your house and move into something smaller you can't really ever make any money in housing. The rate of price increase itself has to be rising in order for this to be wrong. There are situations where housing can be an investment, such as buy to rent or downsizing, but those come with costs of their own that can mount up in a down economy. I do hope this sparks a discussion because it speaks to the lack of recovery in the economy due to a lack of demand in housing. It also speaks to the disproportionate influence of housing in our economy and the imbalances that can create in places like the job sector.

In case you haven't guessed, I don't think housing is an 'investment'. Which is to say that unless you can sell your house and move into something smaller you can't really ever make any money in housing. The rate of price increase itself has to be rising in order for this to be wrong. There are situations where housing can be an investment, such as buy to rent or downsizing, but those come with costs of their own that can mount up in a down economy. I do hope this sparks a discussion because it speaks to the lack of recovery in the economy due to a lack of demand in housing. It also speaks to the disproportionate influence of housing in our economy and the imbalances that can create in places like the job sector.

-

evilgenius - Intermediate Crude

- Posts: 3731

- Joined: Tue 06 Dec 2005, 04:00:00

- Location: Stopped at the Border.

Re: Slow Housing Opinion Poll

Would not take my answer, let me remove my cookies AGAIN

Cliff (Start a rEVOLution, grow a garden)

-

careinke - Volunteer

- Posts: 4696

- Joined: Mon 01 Jan 2007, 04:00:00

- Location: Pacific Northwest

Re: Slow Housing Opinion Poll

That worked. I wonder if I could set up a macro to delete my PO cookies.

Cliff (Start a rEVOLution, grow a garden)

-

careinke - Volunteer

- Posts: 4696

- Joined: Mon 01 Jan 2007, 04:00:00

- Location: Pacific Northwest

Re: Slow Housing Opinion Poll

Housing was 'forced saving' for me because I'm not very disciplined and wouldn't have saved anything otherwise. I had to pay rent anyway and over time values appreciated. Also I was gonna tear out walls and make improvements just because I like to do it, so building equity was basically a 2nd job. Perhaps it wasn't as good as actually saving and investing cash but a man needs to know his limitations!

Right now 2/3 of consumers rate the economy as poor and getting worse. The sheep everyone likes to disparage are hunkered down.

Right now 2/3 of consumers rate the economy as poor and getting worse. The sheep everyone likes to disparage are hunkered down.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Slow Housing Opinion Poll

I voted for the 20% down option, though about everything you've put up there is significant. Bottom line is people aren't buying houses because they don't have any money. People would not have been buying houses through all the 2000's if not for the ARMS, liar loans and all the other dreck that substituted for real dollars.

After fueling up their cars, Twyman says they bowed their heads and asked God for cheaper gas.There was no immediate answer, but he says other motorists joined in and the service station owner didn't run them off.

-

jdmartin - Heavy Crude

- Posts: 1272

- Joined: Thu 19 May 2005, 03:00:00

- Location: Merry Ol' USA

Re: Slow Housing Opinion Poll

The PRIMARY reason is options 1 & 2. Those that have a job worry about its fragility / impermanence; and those without a job worry about the duration of their joblessness.

The majority of people under 25 are either rampantly unemployed (and living at home) or in school sucking on the student loan teat. Needless to say, they're not in the market for purchasing a home.

The majority of people under 25 are either rampantly unemployed (and living at home) or in school sucking on the student loan teat. Needless to say, they're not in the market for purchasing a home.

-

Daniel_Plainview - Prognosticator

- Posts: 4220

- Joined: Tue 06 May 2008, 03:00:00

- Location: 7035 Hollis ... Near the Observatory ... Just down the way, tucked back in the small woods

Re: Slow Housing Opinion Poll

Though all the options contribute to a slow housing market, I'll throw another factor in there: prices are still way, way too high. Here in DC prices are still high enough that it's difficult for a two income family to buy a house, unless you really want to compromise on the neighborhood.

So the net effect is a stagnant market: owners don't want to take a haircut, buyers can't afford the current prices. It makes me wonder how much longer these artificially high prices can be propped up for...

So the net effect is a stagnant market: owners don't want to take a haircut, buyers can't afford the current prices. It makes me wonder how much longer these artificially high prices can be propped up for...

"Where is the man who has so much as to be out of danger?" -Thomas Huxley

-

Duende - Coal

- Posts: 418

- Joined: Sat 27 Nov 2004, 04:00:00

- Location: The District

Re: Slow Housing Opinion Poll

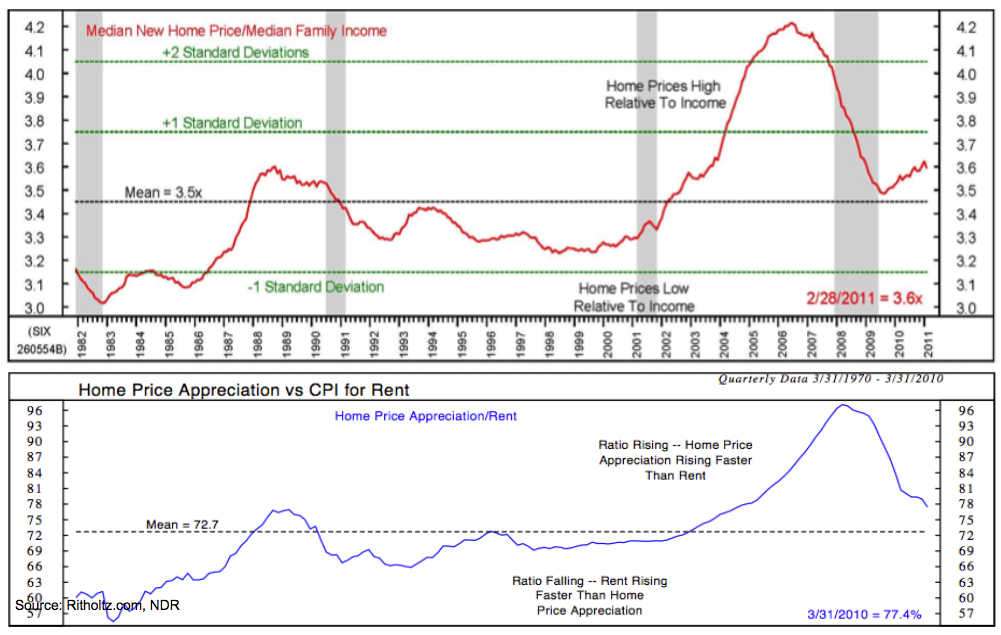

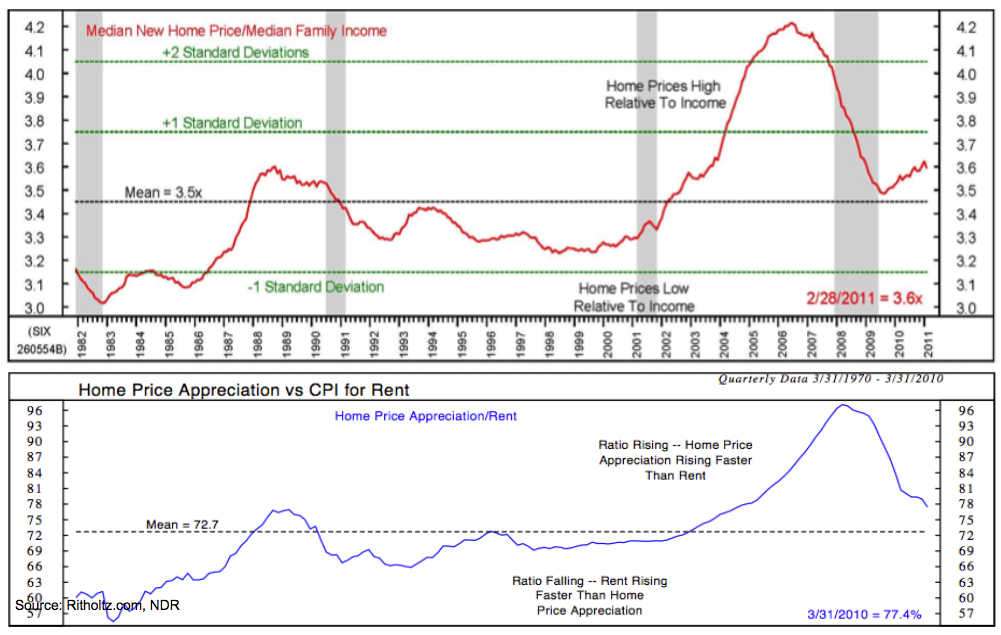

For sure people are biding their time hoping things will turn around soon. I don't think it's all about price because that's reverting back to the mean, not quite there yet... and if you believe the Realtors affordability is at an all time high:

Here's Ritholtz's take (sorry its so big, he said):

http://www.ritholtz.com/blog/2011/04/ch ... ven-close/

You can get a used 3/4 ton pickup pretty cheap nowadays too because people aren't in the mood.

I think people just aren't in the mood to buy the expansive McMansion the Boomers would like to sell. Ever since I can remember, Boomers have only talked about buying a bigger house, maybe one with a pool... and a great big "Great Room" with a two-story tall barn-height ceiling... oh, oh, and an "Owners Suite" with Jacuzzi... yeaaah ... and at least 2 and maybe a three-hole garage... and always, always, more square feet.

But Gordon Gekko is selling sub sandwiches nowadays and the average Joe, if he's buying anything, is buying a distressed property or maybe trying to downsize.

I think...

Here's Ritholtz's take (sorry its so big, he said):

http://www.ritholtz.com/blog/2011/04/ch ... ven-close/

You can get a used 3/4 ton pickup pretty cheap nowadays too because people aren't in the mood.

I think people just aren't in the mood to buy the expansive McMansion the Boomers would like to sell. Ever since I can remember, Boomers have only talked about buying a bigger house, maybe one with a pool... and a great big "Great Room" with a two-story tall barn-height ceiling... oh, oh, and an "Owners Suite" with Jacuzzi... yeaaah ... and at least 2 and maybe a three-hole garage... and always, always, more square feet.

But Gordon Gekko is selling sub sandwiches nowadays and the average Joe, if he's buying anything, is buying a distressed property or maybe trying to downsize.

I think...

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Slow Housing Opinion Poll

Isn't that really the fourth option?

-

evilgenius - Intermediate Crude

- Posts: 3731

- Joined: Tue 06 Dec 2005, 04:00:00

- Location: Stopped at the Border.

Re: Slow Housing Opinion Poll

Seems to me it's the same reason as businesses are hoarding cash and not hiring - uncertainty.

If you have a house, you're not certain you can unload it, and move to change jobs for example.

If you don't have a house, you're not sure if you can afford it, or if the value will drop like a stone after you buy it.

Or you're not sure if you can afford the gas to commute and hold the job for 15 or 30 years to pay for the gas or the mortgage.

In the long term of course, due to population pressure, real estate will continue to rise, but is now the time to buy?

Is a house a good investment if it's in the 'burbs? Rural? City?

Everyone is just stuck waiting for the other shoe to fall, IMHO.

If there is a good side to it, chasing a job and renting in the new location works out because you can rent the house you're not living in for more than the mortgage currently, assuming you're leaving a high cost area like NE USA and headed to the Midwest.

It's tricky, that's for sure. If you are employed, and have a house with a mortgage, most are probably hunkered down paying off debt and waiting for the good times to return.

If you have a house, you're not certain you can unload it, and move to change jobs for example.

If you don't have a house, you're not sure if you can afford it, or if the value will drop like a stone after you buy it.

Or you're not sure if you can afford the gas to commute and hold the job for 15 or 30 years to pay for the gas or the mortgage.

In the long term of course, due to population pressure, real estate will continue to rise, but is now the time to buy?

Is a house a good investment if it's in the 'burbs? Rural? City?

Everyone is just stuck waiting for the other shoe to fall, IMHO.

If there is a good side to it, chasing a job and renting in the new location works out because you can rent the house you're not living in for more than the mortgage currently, assuming you're leaving a high cost area like NE USA and headed to the Midwest.

It's tricky, that's for sure. If you are employed, and have a house with a mortgage, most are probably hunkered down paying off debt and waiting for the good times to return.

-

basil_hayden - Heavy Crude

- Posts: 1581

- Joined: Mon 08 Aug 2005, 03:00:00

- Location: CT, USA

Re: Slow Housing Opinion Poll

I think what's really tragic is that a lot of houses are unoccupied. All those resources that went into building those houses are now wasted. Anybody has any idea how much energy(in oil barrels equivalent) is required to build a house?

I think the reason for low sales is that people are either broke or are pretty sure they will be broke if the economy doesn't improve. Last year 1.5 million people filed for bankruptcy. This year there would be another 1.2 million. As long as it was just the middle class that was going broke, the governments did not care. They just gave the banks the power to create infinite credit. Problem solved. As long as there is a sucker out there who is willing to borrow more than than the previous sucker, there government could just look the other way.

But now even the big boys are broke. And the government seems to be digging it's own grave by running obscene deficits just to bail out the insiders. But there isn't enough money in the universe to make the big banks solvent again.

I think the reason for low sales is that people are either broke or are pretty sure they will be broke if the economy doesn't improve. Last year 1.5 million people filed for bankruptcy. This year there would be another 1.2 million. As long as it was just the middle class that was going broke, the governments did not care. They just gave the banks the power to create infinite credit. Problem solved. As long as there is a sucker out there who is willing to borrow more than than the previous sucker, there government could just look the other way.

But now even the big boys are broke. And the government seems to be digging it's own grave by running obscene deficits just to bail out the insiders. But there isn't enough money in the universe to make the big banks solvent again.

Walk Away From Your Mortgage!

John Courson, president and C.E.O. of the Mortgage Bankers Association, recently told The Wall Street Journal that homeowners who default on their mortgages should think about the “message” they will send to “their family and their kids and their friends.” Courson was implying that homeowners — record numbers of whom continue to default — have a responsibility to make good. He wasn’t referring to the people who have no choice, who can’t afford their payments. He was speaking about the rising number of folks who are voluntarily choosing not to pay.

Such voluntary defaults are a new phenomenon. Time was, Americans would do anything to pay their mortgage — forgo a new car or a vacation, even put a younger family member to work. But the housing collapse left 10.7 million families owing more than their homes are worth. So some of them are making a calculated decision to hang onto their money and let their homes go. Is this irresponsible?

Businesses — in particular Wall Street banks — make such calculations routinely. Morgan Stanley recently decided to stop making payments on five San Francisco office buildings. A Morgan Stanley fund purchased the buildings at the height of the boom, and their value has plunged. Nobody has said Morgan Stanley is immoral — perhaps because no one assumed it was moral to begin with. But the average American, as if sprung from some Franklinesque mythology, is supposed to honor his debts, or so says the mortgage industry as well as government officials. Former Treasury Secretary Henry M. Paulson Jr. declared that “any homeowner who can afford his mortgage payment but chooses to walk away from an underwater property is simply a speculator — and one who is not honoring his obligation.” (Paulson presumably was not so censorious of speculation during his 32-year career at Goldman Sachs.)

The moral suasion has continued under President Obama, who has urged that homeowners follow the “responsible” course. Indeed, HUD-approved housing counselors are supposed to counsel people against foreclosure. In many cases, this means counseling people to throw away money. Brent White, a University of Arizona law professor, notes that a family who bought a three-bedroom home in Salinas, Calif., at the market top in 2006, with no down payment (then a common-enough occurrence), could theoretically have to wait 60 years to recover their equity. On the other hand, if they walked, they could rent a similar house for a pittance of their monthly mortgage.

There are two reasons why so-called strategic defaults have been considered antisocial and perhaps amoral. One is that foreclosures depress the neighborhood and drive down prices. But in a market society, since when are people responsible for the economic effects of their actions? Every oil speculator helps to drive up gasoline prices. Every hedge fund that speculated against a bank by purchasing credit-default swaps on its bonds signaled skepticism about the bank’s creditworthiness and helped to make it more costly for the bank to borrow, and thus to issue loans. We are all economic pinballs, insensibly colliding for better or worse.

The other reason is that default (supposedly) debases the character of the borrower. Once, perhaps, when bankers held onto mortgages for 30 years, they occupied a moral high ground. These days, lenders typically unload mortgages within days (or minutes). And not just in mortgage finance, but in virtually every realm of our transaction-obsessed society, the message is that enduring relationships count for less than the value put on assets for sale.

Think of private-equity firms that close a factory — essentially deciding that the company is worth more dead than alive. Or the New York Yankees and their World Series M.V.P. Hideki Matsui, who parted company as soon as the cheering stopped. Or money-losing hedge-fund managers: rather than try to earn back their investors’ lost capital, they start new funds so they can rake in fresh incentives. Sam Zell, a billionaire, let the Tribune Company, which he had previously acquired, file for bankruptcy. Indeed, the owners of any company that defaults on bonds and chooses to let the company fail rather than invest more capital in it are practicing “strategic default.” Banks signal their complicity with this ethos when they send new credit cards to people who failed to stay current on old ones.

Mortgage holders do sign a promissory note, which is a promise to pay. But the contract explicitly details the penalty for nonpayment — surrender of the property. The borrower isn’t escaping the consequences; he is suffering them.

In some states, lenders also have recourse to the borrowers’ unmortgaged assets, like their car and savings accounts. A study by the Federal Reserve Bank of Richmond found that defaults are lower in such states, apparently because lenders threaten the borrowers with judgments against their assets. But actual lawsuits are rare.

And given that nearly a quarter of mortgages are underwater, and that 10 percent of mortgages are delinquent, White, of the University of Arizona, is surprised that more people haven’t walked. He thinks the desire to avoid shame is a factor, as are overblown fears of harm to credit ratings. Probably, homeowners also labor under a delusion that their homes will quickly return to value. White has argued that the government should stop perpetuating default “scare stories” and, indeed, should encourage borrowers to default when it’s in their economic interest. This would correct a prevailing imbalance: homeowners operate under a “powerful moral constraint” while lenders are busily trying to maximize profits. More important, it might get the system unstuck. If lenders feared an avalanche of strategic defaults, they would have an incentive to renegotiate loan terms. In theory, this could produce a wave of loan modifications — the very goal the Treasury has been pursuing to end the crisis.

No one says defaulting on a contract is pretty or that, in a perfectly functioning society, defaults would be the rule. But to put the onus for restraint on ordinary homeowners seems rather strange. If the Mortgage Bankers Association is against defaults, its members, presumably the experts in such matters, might take better care not to lend people more than their homes are worth.

- prajeshbhat

- Lignite

- Posts: 346

- Joined: Tue 17 May 2011, 02:44:33

Re: Slow Housing Opinion Poll

homeowners operate under a “powerful moral constraint” while lenders are busily trying to maximize profits

I think this is the central issue with the OWS protestors and the public more broadly - even if they haven't been able to put it into words quite yet.

Last night Leslie Stall asked Jeff Immelt (GE) if he doesn't, as an American, have some moral responsibility to the US and he said no, only to his shareholders.

It's a one way street. The human "persons" are expected to always honor their obligations even when circumstances change and force them to act against their best interest. But the corporate "persons" are expected to carry out exactly the opposite duty and always act in an amoral fashion considering only their best interest and bottom line.

What is it surprising to me is how long it's taken for people to get mad.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Slow Housing Opinion Poll

Pops wrote:What is it surprising to me is how long it's taken for people to get mad.

People believed that they too will get a piece of the pie.They did believe they are getting richer when they saw their property value rising. But now the illusion is shattered.

- prajeshbhat

- Lignite

- Posts: 346

- Joined: Tue 17 May 2011, 02:44:33

Re: Slow Housing Opinion Poll

To keep track, since this is a poll where you can change your vote, as of 10/14/11 number 2 and 7 are tied in the lead with 21%. My choice, 5, trails down at 13%. 1 and 3 each have 17%.

-

evilgenius - Intermediate Crude

- Posts: 3731

- Joined: Tue 06 Dec 2005, 04:00:00

- Location: Stopped at the Border.

Re: Slow Housing Opinion Poll

I am picking too much unemployment, but really my answer is that there are more houses than jobs and even adults willing to work.

-

GoIllini - Tar Sands

- Posts: 765

- Joined: Sat 05 Mar 2005, 04:00:00

Re: Slow Housing Opinion Poll

Pops wrote:Housing was 'forced saving' for me because I'm not very disciplined and wouldn't have saved anything otherwise. I had to pay rent anyway and over time values appreciated. Also I was gonna tear out walls and make improvements just because I like to do it, so building equity was basically a 2nd job. Perhaps it wasn't as good as actually saving and investing cash but a man needs to know his limitations!

Right now 2/3 of consumers rate the economy as poor and getting worse. The sheep everyone likes to disparage are hunkered down.

Pops, with respect, this mentality is interesting to me, since IMO, it is a central problem with our whole (first world) economic malaise.

I absolutely understand having this issue prior to 2009. What I just CAN'T understand is how many of the "consumer class" STILL can't seem to realize that if THEY don't (I exaggerate here for emphasis) want to eat dog food and live in a dumpster and rely on pliars and asparin for their medical care upon retirement -- THEY had %&^%$#(!! WELL SERIOUSLY begin a SIGNIFICANT savings plan.

(I realize that the truly poor can't do this. IMO, the middle class COULD, but won't, they'd rather (foolishly, IMO) assume Washington will "fix it".)

Wouldn't "hunkering down" equate to major savings? (The national statistics sure don't support this being a major trend).

...

So how much pain on the news DAILY does it take the frivolous spender to WAKE UP and consider their economic future is THEIR responsibility?

(I was lucky -- depression era parents beat this habit into me emotionally, or at times more literally, if I needed it. I now thank their memories for that every day).

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

23 posts

• Page 1 of 2 • 1, 2

Who is online

Users browsing this forum: No registered users and 30 guests