by basil_hayden » Wed 23 Nov 2011, 19:52:05

by basil_hayden » Wed 23 Nov 2011, 19:52:05

As I stated in the 2011 thread, I think I'm going to throw caution to the wind and cash in most of the virtual love and respect I've banked for the past few years. And I really value that so I hope I don't blow it.

But something about 2012, whether it's the Mayans or Iran or the weather, or just people's conception of the Mayans or Iran or the weather as well as other DOOM!nosticators, leads me to believe we're in for a wacky year for oil price. As I stated at the end of the 2011 thread, I'm going with my version of roccman and Repent's DOOM! guesstimate. Regardless, I think folks will be running around prepping for the end of the world whether it comes or not - using fuel and driving up prices, even as domestic production ticks up. (Note to self: this will lead to a fall early in 2013.)

Pipelines reversing direction = WTI moving up to Brent, not the other way around, as we've seen. Strong dollar, weak Euro means more euros per barrel, hence higher Brent then higher WTI, then weaker dollar. Economy is doing all it can to pull up and not nose dive, even with bank losses have halved this year. Although Chevy will sell 12 more Volts, Libya's not coming back for awhile, it'll be Spring in Arabia again soon only a year later and a year meaner.

So there's a new floor established (first quarter), making a new high likely (third quarter), and a volatile undulation in between (second quarter) and a chill effect to the end of the year which amounts to a SWAG (scientific wild-assed guess).

So I got Ibon's soup bowl out, filled with warm water, added a dash of bunker oil from roccman and this is what it had to say, even though it feels so wrong:

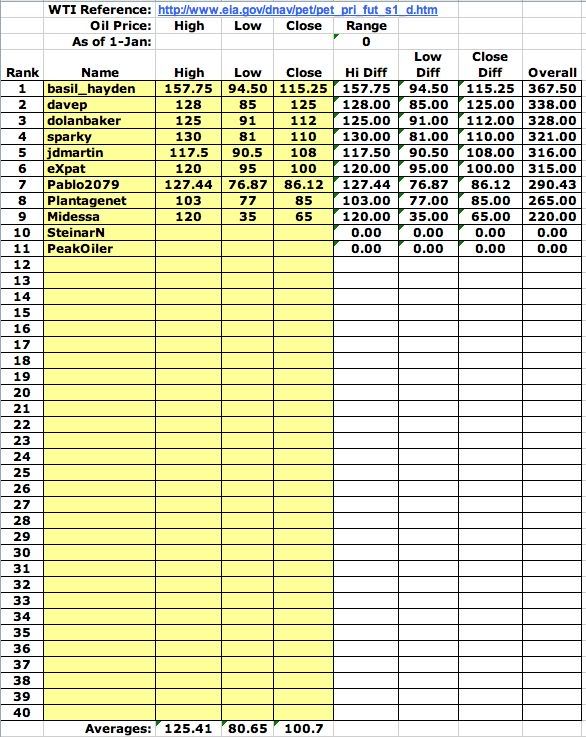

type, high, low, close

WTI 157.75, 94.50, 115.25

I have a feeling I'll be wearing it, but you only live once!