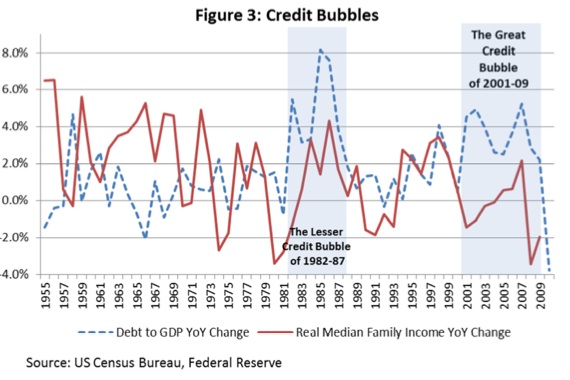

I'm having a hard time seeing where the next economic boom in the United States will come from, but I'll also admit that my macroeconomic crystal ball isn't clear on the subject. Heineken may be right, I'm not ready to dismiss the short-term resiliency of our Ponzi economy. Perhaps we will see a couple more booms, perhaps the Great Recession will see a definitive end and we'll enjoy another decade or three of “prosperity.” Who knows?

But I don't see how a natural resource boom could revive our economy.

Shale gas ain't gonna do it. Maybe there's a Saudi Arabia's worth of sweet crude just off the shore of Oregon, but somehow I doubt it.

High tech doesn't seem to be able to lift the US economy on its own, especially since the great majority of manufacturing is done overseas. Only so many Americans can be computer engineers and iPod marketers. I doubt nanotechnology or anything of the sort will do much for most Americans.

I'm having a hard time seeing housing coming back big. But in 20 years, who knows? Of course we'll be on the downslope of Hubbert's peak by then, so I don't see sprawl making a massive resurgence. Maybe the next real estate boom will be tearing down our old infrastructure and building more appropriate post-peak infrastructure. But with what money?

I think the cancerous growth machine has left the US (and likely Europe) and has arrived in the BRIC countries. That's where the booms will be, and that's where transnational capital is gambling its money. Canada and Australia also seem to be somewhat well placed given their fossil fuel resources.

My best guess is stagnation and slow decline for the next few decades here in the US, and probably Europe as well. Official US unemployment may hover around 10%, but labor force participation rates will continue to drop. Most Americans will continue to see a decline in their material standard of living. Our infrastructure will continue to slowly decay. But it may be slow enough that we'll only see the Long Decline in retrospect.

Climate change is the big wild card, long term.

A garden will make your rations go further.