Australia has a very vulnerable economy where upcoming bad news has not been "priced in" at all. The country suffers from an epic real estate bubble that greatly exceeds those of US, Ireland, and Spain. The average Australian consumer is completely tapped out. Take out a "consumer credit" punchbowl and reduce the Chinese voracious appetite for iron ore and coal, and the Australian economy will collapse like a house of cards.

Australia today suffers from a classic case of "Dutch Disease." Its reliance on natural resource exports for its GDP growth stunts the rest of the economic development, especially manufacturing. Australian manufacturing has been declining in relative and absolute terms at a faster rate than it is in the USA and Europe. The only export growing sector is energy and mineral resources. All other sectors are either flat or falling. Until several years ago, Australia had thriving tourist and wine industries. The appreciated Australian dollar put a severe dent in their growth. Even Australians themselves ditched their domestic wine favorites for cheaper European and South American brands

Looking at the data above, one can see that the Australian GDP is very dependent on two commodities, coal and metal ore, for its economic growth, with most of it going to China. Should the Chinese economy slow down, there will be few palatable options left. Devaluing the currency may not work because Australia has little manufacturing left to pick up the slack. Lowering rates may not be enough to encourage Australian consumers to spend as the falling real estate prices will force deleveraging. Also, the falling exports would create an immediate current account deficit leading to capital flight, currency collapse, and likely inflation. The Reserve Bank of Australia will not have an option of monetary easing at all.

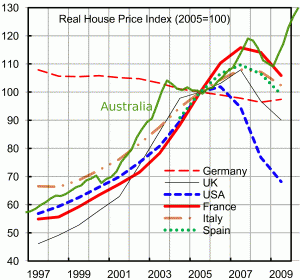

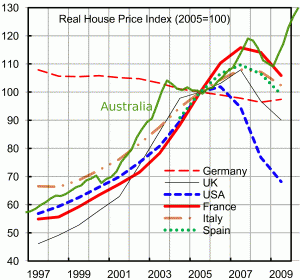

The fact that the Australian real estate bubble is probably 30 years old is missed by many observers who plot data from the year 2000. To get a proper scale of the problem, one would have to go back all the way to Japan in late 80s when the land surrounding the Emperor's palace was valued higher than the land in the state of California. Australian prices matched some of the other country's bubbles until 2008. But while the real estate process elsewhere has been deflating, the Australian prices marched higher after a brief respite:

This is just the beginning of the problem though. Australia's 4.25% short-term rate vs. the near 0% in the US and 1% in Europe drastically increases debt-servicing costs (in Australia and Europe most of the mortgages are adjustable rate).

Banks' Achilles' HeelTo its credit, Moody's sounded a warning last February when it put the "big four" on a downgrade watch because of their reliance on wholesale funding. The profitability of Australian banks is also eroding due to an inverted yield curve. The banks are forced to pay a high yield on short-term deposits but unable to lend long-term at a much higher rate. It must be disconcerting to see that the shape of the curve is somewhat similar to the US curve in 2006, just at the start of the housing bust.

This problem clearly shows up in poor Net Interest Margins (NIM) which is a difference between the cost of funding and yield on assets. Australian banks have a difficult time making money from prime mortgages, which should push them into riskier loans, just like US banks did in 2006. The Australian government is trying to extend the party by urging RBA to mimic Bernanke and introduce its own QE. However, these purchases are much riskier than American QE where the majority of bad loans have already defaulted.

Australian banks seem safe today sporting low default rates, high ratings from credit agencies, and strong capital adequacy ratios. They will remain safe as long as the Australian economy keeps expanding and real estate prices remain stable. However, once the music stops, I expect a "perfect storm": loan defaults will spike, funding will disappear, but interest rates will still stay high.

EpilogueThe Australian economy seems to be doing well today: the external debt is small, the unemployment is low, and the currency is strong. Yet, in many ways, it's very similar to the US economy in 2007 where much of the economic "wealth" was created by real estate boom and over-leveraged banks. Australia is likely to face its own "Great Recession" in the upcoming years, perhaps when commodity exports slow down. In many ways, this recession may be worse than the American one of 2008, as Australia neither enjoys the benefit of "reserve currency" that would allow it to easily "print" money nor a strong manufacturing base that would benefit from a currency devaluation.