It is mid 2012. The Supreme Court has just upheld the health law. Natural gas is at low, low prices when fracking costs so much. Another solar company has gone under, Abound(sic) in Colorado. In short, there are all kinds of places where investment has been over-directed. Which one is in such bad shape that it will pop next?

This Poll will run for 50 days. You can change your vote if you change your mind. One vote per user.

The Next Bubble to Pop

First unread post • 10 posts

• Page 1 of 1

-

evilgenius - Intermediate Crude

- Posts: 3731

- Joined: Tue 06 Dec 2005, 04:00:00

- Location: Stopped at the Border.

Re: The Next Bubble to Pop

30 year treasury yield is 2.75%. Please add to your list.

-

mattduke - Intermediate Crude

- Posts: 3591

- Joined: Fri 28 Oct 2005, 03:00:00

Re: The Next Bubble to Pop

Has the natural gas bubble not already bust?

That said Bakken oil may feel the pressure of the lower prices and I have seen some producers pulling out. Low prices are not the friend of cornucopians.

That said Bakken oil may feel the pressure of the lower prices and I have seen some producers pulling out. Low prices are not the friend of cornucopians.

-

dorlomin - Light Sweet Crude

- Posts: 5193

- Joined: Sun 05 Aug 2007, 03:00:00

Re: The Next Bubble to Pop

muni bonds - next shoe to drop - needs added to list

then again - there is this;

http://dailybail.com/home/robert-precht ... again.html

treasuries next bubble to pop

then again - there is this;

http://dailybail.com/home/robert-precht ... again.html

treasuries next bubble to pop

"There must be a bogeyman; there always is, and it cannot be something as esoteric as "resource depletion." You can't go to war with that." Emersonbiggins

-

roccman - Light Sweet Crude

- Posts: 4065

- Joined: Fri 27 Apr 2007, 03:00:00

- Location: The Great Sonoran Desert

Re: The Next Bubble to Pop

China?

Gold?

Tuition?

Social Media?

We can only wish it's healthcare

I think there are lots of "banks" out there still playing the rackets like Jamie Diamon because nothing has changed to prevent it. He was the guy who said since 08 "Leave us alone we'll police ourselves" and the story is now the loses on that one bad bunch of bets alone could cost 10 billion. The taxpayers picked up the tab in 08 but I doubt we can or will again anytime soon.

China making a hard landing could hurt, it'a the second largest importer of goods after the US and our bank of last resort. I read that the coal is piling up at their docks, meaning industrial use is down (I guess).

Apple :

:

I think worst of all for the US is not another bubble but the fact housing won't re-inflate for years. Boomers retiring and wanting to downsize is a big deal if kids aren't going to buy the big Craker Jack Box on the Cull de Sack because kids can't find a job – there is bound to be an increase in household size and drop in formation as kids stay home instead of moving out - this is becoming a big red flag for growth.

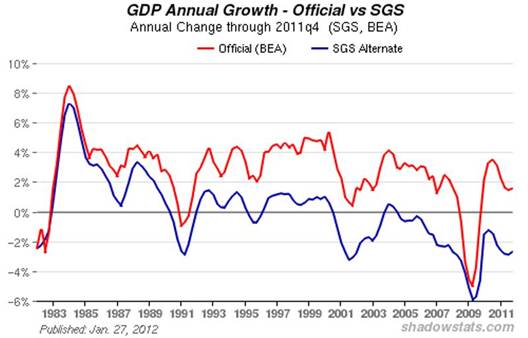

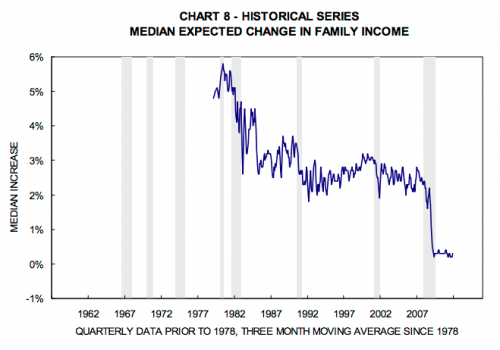

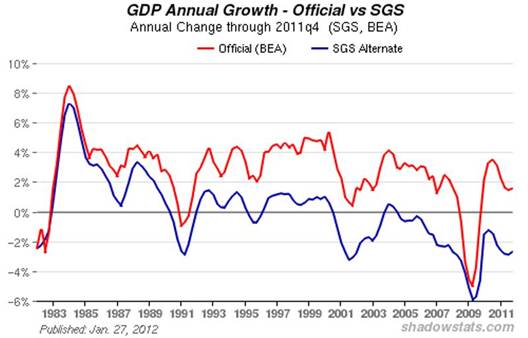

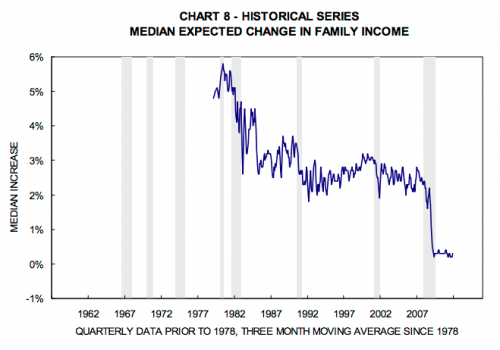

But then maybe the bubble has already burst:

Maybe we can't blow bubbles anymore because we're just trying to stay afloat:

http://marginalrevolution.com/marginalr ... ncome.html

Gold?

Tuition?

Social Media?

We can only wish it's healthcare

I think there are lots of "banks" out there still playing the rackets like Jamie Diamon because nothing has changed to prevent it. He was the guy who said since 08 "Leave us alone we'll police ourselves" and the story is now the loses on that one bad bunch of bets alone could cost 10 billion. The taxpayers picked up the tab in 08 but I doubt we can or will again anytime soon.

China making a hard landing could hurt, it'a the second largest importer of goods after the US and our bank of last resort. I read that the coal is piling up at their docks, meaning industrial use is down (I guess).

Apple

:

:

I think worst of all for the US is not another bubble but the fact housing won't re-inflate for years. Boomers retiring and wanting to downsize is a big deal if kids aren't going to buy the big Craker Jack Box on the Cull de Sack because kids can't find a job – there is bound to be an increase in household size and drop in formation as kids stay home instead of moving out - this is becoming a big red flag for growth.

But then maybe the bubble has already burst:

Maybe we can't blow bubbles anymore because we're just trying to stay afloat:

http://marginalrevolution.com/marginalr ... ncome.html

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: The Next Bubble to Pop

I posted this a year or two ago, and I still think it is true: the next bubble to pop in the US will be the insurance industry. They have their sticky fat fingers in Everything, including, IMHO, the pockets of many congress people.

"Open the gates of hell!" ~Morgan Freeman's character in the movie, Olympus Has Fallen.

- Ferretlover

- Elite

- Posts: 5852

- Joined: Wed 13 Jun 2007, 03:00:00

- Location: Hundreds of miles further inland

Re: The Next Bubble to Pop

Higher education, delivered online to the masses, pumped up by big banker investments in online delivery and government programs to either pay for or make loans easier to get. Everybody wants the degree and it's related to the "American Dream". The content can be delivered online. It's kind of a combination of housing except without the burden of having to secure physical materials and news which has been "revolutionized" by online delivery. It will burst when everyone figures out that nobody is getting smarter, therefore cannot secure jobs and the loans cannot be paid off.

-

dinopello - Light Sweet Crude

- Posts: 6088

- Joined: Fri 13 May 2005, 03:00:00

- Location: The Urban Village

Re: The Next Bubble to Pop

The "baby boomer retirement bust". We have a whole generation that is about to, or have just, retired, and there is no money to pay them.

Problem is that companies have structurally set aside too little money to pay future benefits to their employees or managed it wrongly or both.

In all the high profile cases: ENRON, Lehman, Chrysler, GM, AA, Delta, NW, UAL and many more, companies were rescued by annulling their pension obligations and transferring their pensions to the Pension Benefit Guaranty Corporation (PBGC).

PBGC Takes Step to Protect Participants in Enron's Underfunded Defined Benefit Pension Plans

PBGC Assumes Pensions at Lehman Brothers Holdings Inc

This means that the people involved will get a lot less money than they were entitled to hurting consumption.

What the AMR Bankruptcy Means to American Airlines Pension Plans

RG Steel workers should be wary of what they’ll get from PBGC

And the money has to be payed for by taxes putting a further drag on the economy.

GM's Pension: A Ticking Time Bomb for Taxpayers?

I took the US but this is of course happening in a lot of places with loose pension regulations and aging populations.

Analysis: The AIJ scandal and Japan's pension time bomb

This bubble has already burst, but I guess it will take a few years for the real effects to materialize.

Problem is that companies have structurally set aside too little money to pay future benefits to their employees or managed it wrongly or both.

In all the high profile cases: ENRON, Lehman, Chrysler, GM, AA, Delta, NW, UAL and many more, companies were rescued by annulling their pension obligations and transferring their pensions to the Pension Benefit Guaranty Corporation (PBGC).

PBGC Takes Step to Protect Participants in Enron's Underfunded Defined Benefit Pension Plans

PBGC Assumes Pensions at Lehman Brothers Holdings Inc

This means that the people involved will get a lot less money than they were entitled to hurting consumption.

What the AMR Bankruptcy Means to American Airlines Pension Plans

RG Steel workers should be wary of what they’ll get from PBGC

And the money has to be payed for by taxes putting a further drag on the economy.

GM's Pension: A Ticking Time Bomb for Taxpayers?

I took the US but this is of course happening in a lot of places with loose pension regulations and aging populations.

Analysis: The AIJ scandal and Japan's pension time bomb

This bubble has already burst, but I guess it will take a few years for the real effects to materialize.

-

smiley - Intermediate Crude

- Posts: 2274

- Joined: Fri 16 Apr 2004, 03:00:00

- Location: Europe

10 posts

• Page 1 of 1

Who is online

Users browsing this forum: No registered users and 21 guests