When people read about a long-term forecast of world oil supply--say, out to 2030--they often believe that the forecasters are merely incorporating our knowledge of existing fields and figuring out how much oil can be extracted from them over the forecast period. Nothing could be further from the truth. Much of the forecast supply has not yet been discovered or has no demonstrated technology which can extract or produce it economically. In other words, such forecasts are merely guesses based on the slimmest of evidence.

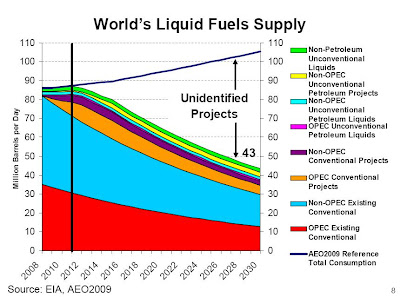

Perhaps the best ever illustration of this comes from a 2009 presentation made by Glen Sweetnam, a U.S. Energy Information Administration (EIA) official. The EIA is the statistical arm of the U.S. Department of Energy. The following chart from that presentation will upend any notion that we know exactly where all the oil we need to meet expected demand will come from.

The chart shows that by 2030 world output of oil and other liquid fuels from current fields is expected to drop to 43 million barrels per day (mbpd), some 62 million barrels below projected demand of 105 mbpd. (Though prepared in 2009, the chart takes into account known projects expected to be producing by 2012.) This drop is consistent with the observed decline in the worldwide rate of production from existing fields of about 4 percent per year. Certainly, there will be more projects identified in the 18 years ahead. And, many people will say that we already have a large new resource of tight oil (often mistakenly referred to as shale oil) which can be extracted through hydraulic fracturing or fracking. But even if the optimists are correct--and there can be no guarantee that they will be--this source of oil will only add 3 to 4 million barrels of daily production. What Sweetnam's chart tells us is that we must find and bring into production the equivalent of five new Saudi Arabias between now and 2030 in order to meet expected demand even if the volume of tight oil reaches its maximum projected output. (The Saudis currently produce about 11.7 mbpd of oil and other liquids.)

resourceinsights

Up, up, and away!!

Up, up, and away!!