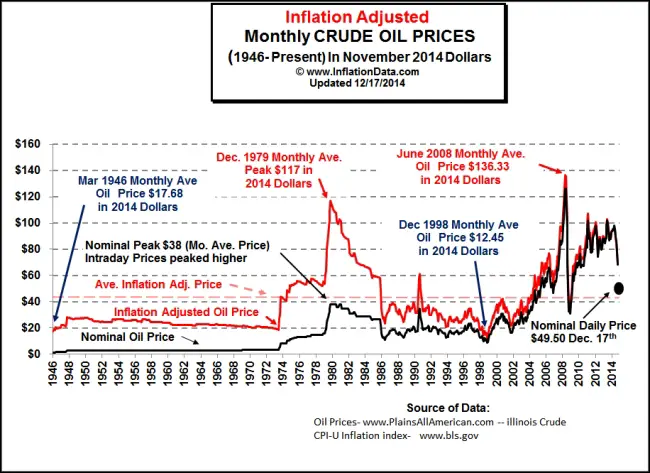

Yes, actual quantities have increased, yet prices remain higher than ever. Connect dots much? Sorry to be snide, but no discussion about energy depletion that doesn't include

net energy and price, over time, is meaningless. It is noise.

The "oil" being extracted from the Canadian tar sands, the Orinoco basin, et. al. has a much lower net energy, and a much higher cost. Even the dumbest corny should be able to figure out that it takes more energy and money to extract tar through two miles of water and rock and to refine it into something like fuel. Ditto for oil sands and their thrilling 4:1 net energy ratios. Yes, there are hydrocarbons. Lots of them. A teacup of oil in a cubic yard of granite 3 miles down will never, however, be energetically or economically profitable, even if there are trillions of such teacups.

Peak oil may have officially arrived or not in 2005 (It sure looks that way). It doesn't matter. What matters is that net energy from oil continues to decline. If you understand this statement, and can do arithmetic, you have already figured out that the net energy in the first half of the world's oil was remarkably larger than in the last half.

The lengths we are going to to extract hydrocarbons is not so much about human ingenuity as it is about desperation. Economically and politically, we don't dare stop or even slow down, without risking famine, revolutions and wars that could very well turn nuclear.

Nuclear power, ironically, might save some semblance of civilization. About 2500 new nuclear plants, running on thorium would at least replace about as much energy as we get each year from petroleum (160 exajoules or thereabouts). Even if we couldn't use if as effectively as we do oil, it would be enough to keep a few billion people from starvation.

To understand, numerically, what we're facing, start here:

http://en.wikipedia.org/wiki/Cubic_mile_of_oil

All those people who wash the dirty oil have job no more

All those people who wash the dirty oil have job no more