PHILADELPIA - THE NEW CUSHING, OK?

PHILADELPIA - THE NEW CUSHING, OK?

From: http://www.rigzone.com/news/oil_gas/a/1 ... t/?all=HG2

Crude oil to U.S. East Coast refineries has typically been delivered by water-borne methods since the early 1900s. Some people who are currently retired and had spent a career in refining thought that rail-borne crude deliveries was an antiquated idea and not viable.

The fortunes of the region's oil processing facilities had taken a downward turn. Sunoco had announced that it would close or sell its Marcus Hook and Philadelphia refineries. Subsequently, Phillips 66 announced plans to immediately idle its Trainer refinery and sell the asset as a terminal or refinery. Together, these refineries accounted for nearly 700,000 barrels per day of processing capacity – roughly one-half of the refining capacity in the Northeast.

Canopy's president and a refining industry veteran saw an opportunity that could provide an economic lifeline to struggling Philadelphia-area refineries: shipping light sweet crude oil produced in the Bakken Shale via unit trains to an independent Delaware River terminal facility tied into the region's well-developed rail network. The Northeast also lacks crude oil pipeline capacity that could deliver domestic production priced to the WTI benchmark, which would enable East Coast refiners to avoid the premium Brent price.

Shipping domestically produced crude oil in rail tank cars is more expensive than transporting the commodity by pipeline, but Galloway contends that bringing in 70,000 to 80,000 barrels a day on a unit train would still make the Philadelphia refining market dramatically more competitive. Recent trends suggest that processing Bakken crude rather than imported slates could save a refiner roughly $25 per barrel in feedstock costs.

Approximately 550,000 barrels per day of crude is currently being shipped by rail out of the Bakken and more than 70 percent of that volume goes to the Gulf Coast, Hatfield noted. With North Dakota's oil production rising toward an estimated peak ranging from 1.2 to 2.1 million barrels per day, pipelines cannot be built fast enough to accommodate the state's surging production growth. Directing production to the East Coast by rail represents one near-term solution to easing export capacity constraints.

"That's one of the beauties of rail...It's quick to market."

Crude oil to U.S. East Coast refineries has typically been delivered by water-borne methods since the early 1900s. Some people who are currently retired and had spent a career in refining thought that rail-borne crude deliveries was an antiquated idea and not viable.

The fortunes of the region's oil processing facilities had taken a downward turn. Sunoco had announced that it would close or sell its Marcus Hook and Philadelphia refineries. Subsequently, Phillips 66 announced plans to immediately idle its Trainer refinery and sell the asset as a terminal or refinery. Together, these refineries accounted for nearly 700,000 barrels per day of processing capacity – roughly one-half of the refining capacity in the Northeast.

Canopy's president and a refining industry veteran saw an opportunity that could provide an economic lifeline to struggling Philadelphia-area refineries: shipping light sweet crude oil produced in the Bakken Shale via unit trains to an independent Delaware River terminal facility tied into the region's well-developed rail network. The Northeast also lacks crude oil pipeline capacity that could deliver domestic production priced to the WTI benchmark, which would enable East Coast refiners to avoid the premium Brent price.

Shipping domestically produced crude oil in rail tank cars is more expensive than transporting the commodity by pipeline, but Galloway contends that bringing in 70,000 to 80,000 barrels a day on a unit train would still make the Philadelphia refining market dramatically more competitive. Recent trends suggest that processing Bakken crude rather than imported slates could save a refiner roughly $25 per barrel in feedstock costs.

Approximately 550,000 barrels per day of crude is currently being shipped by rail out of the Bakken and more than 70 percent of that volume goes to the Gulf Coast, Hatfield noted. With North Dakota's oil production rising toward an estimated peak ranging from 1.2 to 2.1 million barrels per day, pipelines cannot be built fast enough to accommodate the state's surging production growth. Directing production to the East Coast by rail represents one near-term solution to easing export capacity constraints.

"That's one of the beauties of rail...It's quick to market."

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: PHILADELPIA - THE NEW CUSHING, OK?

I've heard from the analysts that transportation for Bakken oil via rail to seaborne is $15-$20/bbl. Sound reasonable to you Rock?

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: PHILADELPIA - THE NEW CUSHING, OK?

ROCKMAN wrote:From: http://www.rigzone.com/news/oil_gas/a/1 ... t/?all=HG2

Crude oil to U.S. East Coast refineries has typically been delivered by water-borne methods since the early 1900s. Some people who are currently retired and had spent a career in refining thought that rail-borne crude deliveries was an antiquated idea and not viable.

The fortunes of the region's oil processing facilities had taken a downward turn. Sunoco had announced that it would close or sell its Marcus Hook and Philadelphia refineries. Subsequently, Phillips 66 announced plans to immediately idle its Trainer refinery and sell the asset as a terminal or refinery. Together, these refineries accounted for nearly 700,000 barrels per day of processing capacity – roughly one-half of the refining capacity in the Northeast.

Canopy's president and a refining industry veteran saw an opportunity that could provide an economic lifeline to struggling Philadelphia-area refineries: shipping light sweet crude oil produced in the Bakken Shale via unit trains to an independent Delaware River terminal facility tied into the region's well-developed rail network. The Northeast also lacks crude oil pipeline capacity that could deliver domestic production priced to the WTI benchmark, which would enable East Coast refiners to avoid the premium Brent price.

Shipping domestically produced crude oil in rail tank cars is more expensive than transporting the commodity by pipeline, but Galloway contends that bringing in 70,000 to 80,000 barrels a day on a unit train would still make the Philadelphia refining market dramatically more competitive. Recent trends suggest that processing Bakken crude rather than imported slates could save a refiner roughly $25 per barrel in feedstock costs.

Approximately 550,000 barrels per day of crude is currently being shipped by rail out of the Bakken and more than 70 percent of that volume goes to the Gulf Coast, Hatfield noted. With North Dakota's oil production rising toward an estimated peak ranging from 1.2 to 2.1 million barrels per day, pipelines cannot be built fast enough to accommodate the state's surging production growth. Directing production to the East Coast by rail represents one near-term solution to easing export capacity constraints.

"That's one of the beauties of rail...It's quick to market."

Certainly it is more expensive to rail ship than to use a pipeline, but on the other hand a rail line can be used to move almost any commodity while a pipeline has to be dedicated to one type of product (Oil, Ammonia, Natural Gas, Water). Unit trains aren't pretty to look at, but I grew up a quarter mile from the tracks and saw endless unit trains hauling coked coal, raw coal, limestone and hundreds of car carriers united together. They can be a PITA if you are waiting to cross, but even so the efficiency compared to trucking is off the charts.

Besides it would be a shame to build a brand new oil pipeline from ND to PA just to have the tight shale run out in 5 or 10 years and then it sits empty.

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17059

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: PHILADELPIA - THE NEW CUSHING, OK?

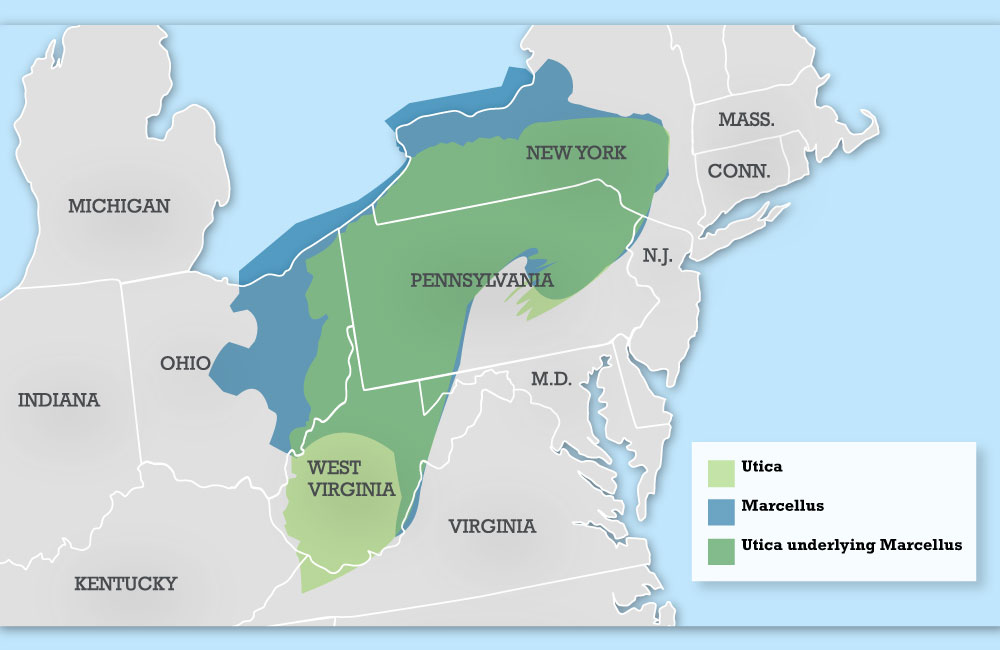

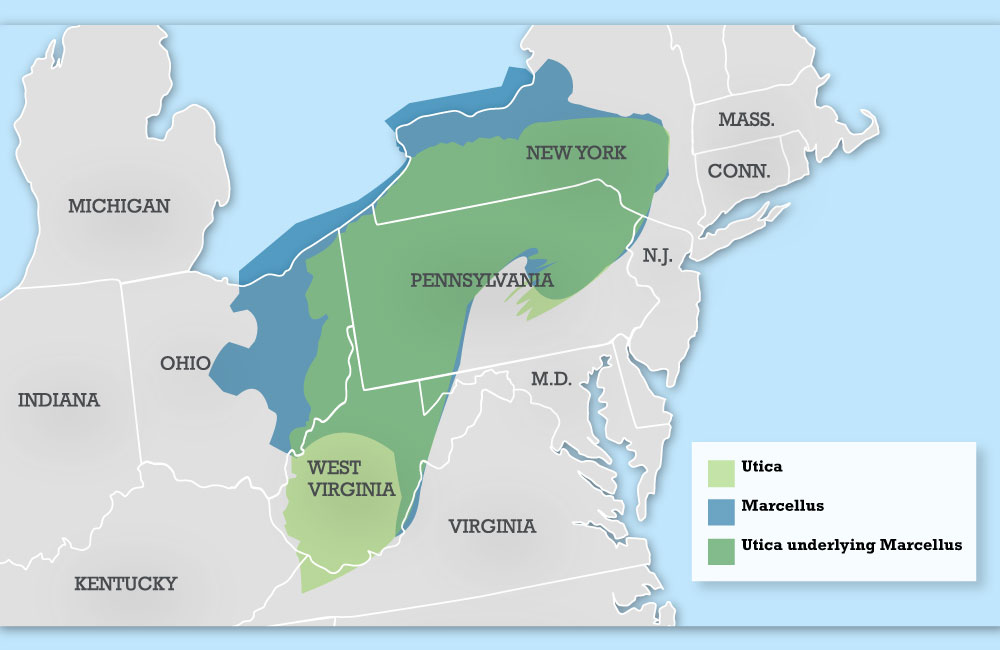

Pennsylvania allows fracking and the Devonian Marcellus Shale is found there.

Why do they have to ship oil by rail all the way from North Dakota to Pennsylvania? Isn't there any oil at all in the Marcellus?

Why do they have to ship oil by rail all the way from North Dakota to Pennsylvania? Isn't there any oil at all in the Marcellus?

-

Plantagenet - Expert

- Posts: 26628

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: PHILADELPIA - THE NEW CUSHING, OK?

John – No idea. Too far removed from my piece of the oil patch. Once it leaves the tanks on my lease I’m out of the picture.

tanada – I think you may have hit it right on the nose. It varies a good bit by the p/l guys I know figure it takes a good 4 to 6 years to recover the initial capex of a new p/l. And then you need to add a couple of years at a minimum for construction. And only then are you building your profit margin. And it’s rare for any p/l to be built unless there is a guaranteed long term volume commitment. I doubt many oil producers would put up multi-$billion surety bonds to cover their volume pledges. Pipeliners aren’t explorationists: their margins tend to be low, are very risk averse and don’t take anyone’s promises serious. Especially oil companies. LOL.

But as you say rail delivery has a lot more flexibility and can more readily adjust to changing dynamics. There were hundreds of $millions lost by companies that built p/l’s to gather up all that shale gas back in ’08. Some were new to the game and got their heads handed to them when those dynamic changed so quickly.

tanada – I think you may have hit it right on the nose. It varies a good bit by the p/l guys I know figure it takes a good 4 to 6 years to recover the initial capex of a new p/l. And then you need to add a couple of years at a minimum for construction. And only then are you building your profit margin. And it’s rare for any p/l to be built unless there is a guaranteed long term volume commitment. I doubt many oil producers would put up multi-$billion surety bonds to cover their volume pledges. Pipeliners aren’t explorationists: their margins tend to be low, are very risk averse and don’t take anyone’s promises serious. Especially oil companies. LOL.

But as you say rail delivery has a lot more flexibility and can more readily adjust to changing dynamics. There were hundreds of $millions lost by companies that built p/l’s to gather up all that shale gas back in ’08. Some were new to the game and got their heads handed to them when those dynamic changed so quickly.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: PHILADELPIA - THE NEW CUSHING, OK?

Tanada wrote:Besides it would be a shame to build a brand new oil pipeline from ND to PA just to have the tight shale run out in 5 or 10 years and then it sits empty.

It would appear that running out in 5 or 10 years isn't what those doing the independent projections have in mind.

tight oil to 2035 (tight being the newest euphemism for shale stuff, for better or worse)

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: PHILADELPIA - THE NEW CUSHING, OK?

That graph shows about 1.7 Million bbl/d of tight oil from 2020 to 2035 without serious declines, meanwhile over here in the real world we keep being told that A) the number of places left to drill shrinks every month and B) the decline rate on tight oil wells is very very steep in the first two years.

Once you run out of locations for infill drilling the decline rate will cause production to decline steeply. The estimates I was looking at the other day stated that Bakken will run out of drilling locations by 2016 or 2017 if they keep up the current pace and EFS will do the same in 2018 or 2019. Unless someone finds a play as good as one or both of those two and ramps up drilling there between now and 2016 then remorseless decline rates will start cutting the tight oil supply in 2017, not 2020, and the decline will steepen in 2019 when both shale's are done with infill drilling.

The only thing I can think of to make that graph correct is it must have been built upon a slower drilling rate so that infill drilling would last until 2020 in both places. Even then it assumes a very gentle decline slope, nothing like that demonstrated so far in the real world.

Once you run out of locations for infill drilling the decline rate will cause production to decline steeply. The estimates I was looking at the other day stated that Bakken will run out of drilling locations by 2016 or 2017 if they keep up the current pace and EFS will do the same in 2018 or 2019. Unless someone finds a play as good as one or both of those two and ramps up drilling there between now and 2016 then remorseless decline rates will start cutting the tight oil supply in 2017, not 2020, and the decline will steepen in 2019 when both shale's are done with infill drilling.

The only thing I can think of to make that graph correct is it must have been built upon a slower drilling rate so that infill drilling would last until 2020 in both places. Even then it assumes a very gentle decline slope, nothing like that demonstrated so far in the real world.

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17059

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: PHILADELPIA - THE NEW CUSHING, OK?

I find this interesting and confusing. We keep our boat in Delaware City, 30 miles South of Philly,and the refinery there has reopened and is undergoing continued restoration. A new rail yard has been built nearby. And a substation is going in.

Wharf always has one or two tankers or lighters there.

From Wiki...

The Delaware City Refinery, currently owned by Delaware City Refining Corporation, a subsidiary of PBF Energy, is an oil refinery in Delaware City, Delaware. When operational it has a total throughput capacity of 210,000 barrels per day (33,000 m3/d),[1][2] and employs around 570 individuals.[1]

The refinery was commissioned in 1956 and Getty Oil operated it up until 1984, when Texaco bought Getty. In 1988, Star Enterprises, a company started when Saudi Aramco bought half interest, took over the refinery until 1998, when Motiva Enterprises, a joint venture between Star(Saudi Aramco) and Shell, operated it. Motiva's operation was the most controversial, with many lawsuits resulting from an explosion and many federal emission regulations violations.[3][4] Premcor Refining Group bought the refinery from Motiva in 2004,[5] but Valero acquired Premcor a year later.

On 20 November 2009, the refinery was shut down permanently as part of cost-cutting measures by Valero Energy Corporation.[6][7] Anticipated economic impacts of the closure include major reductions in tax revenue and retails sales for Delaware City, increased materials acquisition cost for petroleum products re-sellers and an increase to consumer gasoline prices in the longer term.[8][9]

On 25 January 2010, Petroplus, the largest independent refining company in Europe, announced its interest in buying the refinery.

In June 2010, it was announced that the Delaware City Refinery was purchased by PBF Energy Partners for $220 million. The refinery was expected to reopen in Spring 2011.[10]

PBF Energy announced that the restart of the refinery was completed successfully on 7 October 2011.[11] The refinery processes heavy sour crude.

Wharf always has one or two tankers or lighters there.

From Wiki...

The Delaware City Refinery, currently owned by Delaware City Refining Corporation, a subsidiary of PBF Energy, is an oil refinery in Delaware City, Delaware. When operational it has a total throughput capacity of 210,000 barrels per day (33,000 m3/d),[1][2] and employs around 570 individuals.[1]

The refinery was commissioned in 1956 and Getty Oil operated it up until 1984, when Texaco bought Getty. In 1988, Star Enterprises, a company started when Saudi Aramco bought half interest, took over the refinery until 1998, when Motiva Enterprises, a joint venture between Star(Saudi Aramco) and Shell, operated it. Motiva's operation was the most controversial, with many lawsuits resulting from an explosion and many federal emission regulations violations.[3][4] Premcor Refining Group bought the refinery from Motiva in 2004,[5] but Valero acquired Premcor a year later.

On 20 November 2009, the refinery was shut down permanently as part of cost-cutting measures by Valero Energy Corporation.[6][7] Anticipated economic impacts of the closure include major reductions in tax revenue and retails sales for Delaware City, increased materials acquisition cost for petroleum products re-sellers and an increase to consumer gasoline prices in the longer term.[8][9]

On 25 January 2010, Petroplus, the largest independent refining company in Europe, announced its interest in buying the refinery.

In June 2010, it was announced that the Delaware City Refinery was purchased by PBF Energy Partners for $220 million. The refinery was expected to reopen in Spring 2011.[10]

PBF Energy announced that the restart of the refinery was completed successfully on 7 October 2011.[11] The refinery processes heavy sour crude.

-

Newfie - Forum Moderator

- Posts: 18510

- Joined: Thu 15 Nov 2007, 04:00:00

- Location: Between Canada and Carribean

Re: PHILADELPIA - THE NEW CUSHING, OK?

.

Didn't Buffet stuffed around buying rail assets ?

Didn't Buffet stuffed around buying rail assets ?

-

sparky - Intermediate Crude

- Posts: 3587

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Sydney , OZ

Re: PHILADELPIA - THE NEW CUSHING, OK?

Tanada wrote:

The only thing I can think of to make that graph correct is it must have been built upon a slower drilling rate so that infill drilling would last until 2020 in both places. Even then it assumes a very gentle decline slope, nothing like that demonstrated so far in the real world.

The math behind how the sum of a large number of non-linear declines works can be extremely tricky, and does depend on the activity assumed to be going on. I haven't seen the estimate you mention about running out of drilling locations, but there are about 5000+ Bakken and Three Forks wells already, and the USGS provides some interesting numbers to play with on their factsheets nowadays:

http://pubs.usgs.gov/fs/2013/3013/

and while I certainly could be wrong, the number of wells to get that amount out of the ground has to be in the 10,000's of wells yet to go. Take the resource amount, divide by the average EUR, and you can approximate the number of wells to get that resource. So if they've drilled 5000+ over the past decade, and have 10,000's to go, that works out to more than just 3 or 4 years worth of work. Not sure if that is anywhere near enough to get to 2035, but a slower drilling rate has at least the potential to get there.

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: PHILADELPIA - THE NEW CUSHING, OK?

John – Yep…very tricky. Within certain limits the assumptions made can produce a wide range of outcomes. Initially any projections have to make an accurate y-by-y forecast of oil prices for the next 20 years. Have you seen such forecast that you believe will be accurate? I haven’t and I don’t fault anyone for not coming up with those magical numbers. But one has to base the future development of any resource on pricing. And then there’s a question of credit: companies are drilling with a lot of very cheap borrowed $’s right now. What happens if interest rates increase significantly? And if they do so during a period of lower oil prices credit lines will be reduced in addition to having to pay more for those loans. Reduced capex = less drilling = less production = smaller credit lines.

And then there’s the geologic unknown. Is the performance of the next 10,000+ wells going to match those of the last few years? Or be better…or worse? Lots of vertical holes drilled in the Bakken the last 50 years so there is some knowledge as to where the better undrilled locations are. But there are usually some undiscovered sweet spots in all trends. OTOH there are some horrible sour spots yet to be discovered: about 6 months ago there was a well drilled in an area where little Bakken penetrations have occurred. Presumably this is one of the areas folks are projecting some new oil to be developed. Not only did this well not find commercial oil production in the Bakken but the formation itself wasn’t even present in this area. Opps. LOL.

Now try to integrate the non-linear decline you mention with an equally non-linear drill rate looped with variations in local production character, oil prices and financial capabilities. This makes it very difficult IMHO to accept anyone’s estimate (optimistic or pessimistic) as very credible. Of course, given we live in a free society, there’s nothing to stop anyone from trying. Especially when they are “experts”…despite never having ever recommended drilling a well anywhere let alone putting their ass (and money) on the line.

And then there’s the geologic unknown. Is the performance of the next 10,000+ wells going to match those of the last few years? Or be better…or worse? Lots of vertical holes drilled in the Bakken the last 50 years so there is some knowledge as to where the better undrilled locations are. But there are usually some undiscovered sweet spots in all trends. OTOH there are some horrible sour spots yet to be discovered: about 6 months ago there was a well drilled in an area where little Bakken penetrations have occurred. Presumably this is one of the areas folks are projecting some new oil to be developed. Not only did this well not find commercial oil production in the Bakken but the formation itself wasn’t even present in this area. Opps. LOL.

Now try to integrate the non-linear decline you mention with an equally non-linear drill rate looped with variations in local production character, oil prices and financial capabilities. This makes it very difficult IMHO to accept anyone’s estimate (optimistic or pessimistic) as very credible. Of course, given we live in a free society, there’s nothing to stop anyone from trying. Especially when they are “experts”…despite never having ever recommended drilling a well anywhere let alone putting their ass (and money) on the line.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: PHILADELPIA - THE NEW CUSHING, OK?

ROCKMAN wrote:John – Yep…very tricky. Within certain limits the assumptions made can produce a wide range of outcomes. Initially any projections have to make an accurate y-by-y forecast of oil prices for the next 20 years. Have you seen such forecast that you believe will be accurate?

Define accurate? It is like trying to predict the stock market on a daily basis, this guessing what might be, what can be, what will be, somewhere down the road. I'm happy to predict my paycheck will hit the bank and not bounce. Count on it as a matter of fact. Much beyond that, strikes me as a crap shoot.

It is amazing that there are people, people paid good wages, sitting around right now trying to lay down an estimate of the future based on other estimates of the future, including, as you have mentioned, what the price might be. Whoever is paying those people does so for a reason, I assume the reason being that they believe such estimates have some validity. Maybe they are just more comfortable when a bunch of "experts" agree on something, rather than being handed the same answer from just one.

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: PHILADELPIA - THE NEW CUSHING, OK?

John - "It is like trying to predict the stock market on a daily basis". Heck...that's easy compared to predicting what the market will close at on Sept 21, 2024, eh? LOL. I try not to be too preachy (though I probably fail often in the eyes of some) but to be more blunt then you: such projections are utterly useless. And guess what? IMHO most of the folks making these projections, as well as the folks paying these folks, know they are almost certainly incorrect. But notice I said "incorrect" this time and not "useless". They folks paying to have such forecast made do have specific uses for these efforts…correct or not.

IOW have you ever talked to a stock broker who didn't know of a number of stocks that he was very sure would go up in value? After all, if he didn’t he wouldn’t be able to make a commission, would he?

And accurate? IMHO it is when you're correct enough to have made money on that call. Which is exactly why you wouldn't see many of these folks who claim to be 'accurate' backing their call up with their own money.

IOW have you ever talked to a stock broker who didn't know of a number of stocks that he was very sure would go up in value? After all, if he didn’t he wouldn’t be able to make a commission, would he?

And accurate? IMHO it is when you're correct enough to have made money on that call. Which is exactly why you wouldn't see many of these folks who claim to be 'accurate' backing their call up with their own money.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: PHILADELPIA - THE NEW CUSHING, OK?

ROCKMAN wrote:. I try not to be too preachy (though I probably fail often in the eyes of some) but to be more blunt then you: such projections are utterly useless.

Hubbert's wasn't. Isn't that a key point? Some projections suck, some are close, some are pretty good. But picking the person or organization who can do this, versus those who can't, is just as bad as guessing at the thing yourself. I like the crapshoot analogy.

ROCKMAN wrote:IOW have you ever talked to a stock broker who didn't know of a number of stocks that he was very sure would go up in value? After all, if he didn’t he wouldn’t be able to make a commission, would he?

Quite true.

ROCKMAN wrote:IMHO it is when you're correct enough to have made money on that call. Which is exactly why you wouldn't see many of these folks who claim to be 'accurate' backing their call up with their own money.

There is a concept which says the LAST people you want spending their own money on a future call are those making the projections. Pump and dump anyone?

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: PHILADELPIA - THE NEW CUSHING, OK?

John - And what's makes it all the more difficult is when folks really believe they are making the right call. I've said it many times before: there is nothing in the oil patch that will kill you faster than a geologist who believes his own crap. We will flood you with supporting data, put our reputations on the line and swear to you that we know exactly what they were talking about. The persuasiveness of a true believer can be very powerful…especially when they are wrong. LOL.

Trust me…I know what I talking about and I'm absolutely positive I’m correct.

Trust me…I know what I talking about and I'm absolutely positive I’m correct.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: PHILADELPIA - THE NEW CUSHING, OK?

ROCKMAN wrote:Trust me…I know what I talking about and I'm absolutely positive I’m correct.

ROFL that is the same logic Used Car Salesmen have tried on me for a few decades now :D

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17059

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: PHILADELPIA - THE NEW CUSHING, OK?

Just to broaden this discussion a little:

1. am I correct to assume that land transport is more expensive than by pipeline or water?

2. if, so- by how much- on average (land, pipeline and water) for the same distance?

3. the fact that oil is being found in new places without as much infrastructure and that the wells deplete quickly would lead me to think a flexible system (land transport) is preferred over an expensive fixed pipeline by the tight oil people- is this correct?

4. As less oil comes out of the old locations near pipes and refineries- and more and more new oil comes from land transport sites- the extra costs would start to accumulate as the transition proceeds- these extra land transport costs will amount to an invisible tax of sorts so that even though the amount of oil being extracted seems the same- the costs will keep rising as more and more of it is hauled. Is there any sign this is already happening?

5. won't this process lead to tight oil wells being abandoned sooner as land transport costs add to EROEI?

6. Are there any solutions? (flexible- reusable pipelines?)

thanks

1. am I correct to assume that land transport is more expensive than by pipeline or water?

2. if, so- by how much- on average (land, pipeline and water) for the same distance?

3. the fact that oil is being found in new places without as much infrastructure and that the wells deplete quickly would lead me to think a flexible system (land transport) is preferred over an expensive fixed pipeline by the tight oil people- is this correct?

4. As less oil comes out of the old locations near pipes and refineries- and more and more new oil comes from land transport sites- the extra costs would start to accumulate as the transition proceeds- these extra land transport costs will amount to an invisible tax of sorts so that even though the amount of oil being extracted seems the same- the costs will keep rising as more and more of it is hauled. Is there any sign this is already happening?

5. won't this process lead to tight oil wells being abandoned sooner as land transport costs add to EROEI?

6. Are there any solutions? (flexible- reusable pipelines?)

thanks

-

C8 - Heavy Crude

- Posts: 1074

- Joined: Sun 14 Apr 2013, 09:02:48

Re: PHILADELPIA - THE NEW CUSHING, OK?

C8 – Don’t have time to summarize but you might find some enlightenment here:

http://online.wsj.com/article/SB1000142 ... 11090.html

One very dramatic chart: crude oil shipment by rail jumped from about 30k carloads to 200k carloads in just the last 2 years. In ’06 it got down to only 5k carloads. So a 4,000% increase in just 6 or 7 years.

And wells don’t get abandoned because of the EROEI of transportation or LOE (Lease Operating Expense). As a general rule they get abandoned when the cash flow goes negative which is usually determined more by the price of oil/NG than transportation/LOE.

http://online.wsj.com/article/SB1000142 ... 11090.html

One very dramatic chart: crude oil shipment by rail jumped from about 30k carloads to 200k carloads in just the last 2 years. In ’06 it got down to only 5k carloads. So a 4,000% increase in just 6 or 7 years.

And wells don’t get abandoned because of the EROEI of transportation or LOE (Lease Operating Expense). As a general rule they get abandoned when the cash flow goes negative which is usually determined more by the price of oil/NG than transportation/LOE.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: PHILADELPIA - THE NEW CUSHING, OK?

Los Angeles…the next Cushing?

Maybe Icahn and Buffett do know something about investing…especially in the rail biz. Similar to the movement of Canadian oil to the east coast via rail let’s look at the west coast. From http://www.downstreamtoday.com/news/art ... a_id=39604

A $2 billion pipeline project intended to ship oil from West Texas's booming oil fields to California has failed to pique the interest of several big refiners in the Golden State. The culprit: the growing popularity of railroads.

(KMP) 277,000-barrel-a-day Freedom pipeline would be the first to bring light, sweet oil produced in Texas's Permian Basin to the fuel-hungry Los Angeles market. That would give refiners in California, which now partly supplements with expensive crude imports from Alaska, Ecuador and other far-flung nations, a direct shot at the relatively cheap crude. But refiners Valero, Tesoro and Phillips 66 have all said they won't sign contracts to take crude from Freedom and will instead continue to use rail cars and barges to deliver more oil from North Dakota, Canada and even Texas to the gates of their California refineries.

Their lack of interest in the pipeline underscores how these other modes of oil transport are becoming a permanent fixture of the North American energy landscape. More than 200,000 rail carloads of oil were shipped in the U.S. last year, more than three times the amount in 2011. Each rail car can hold more than 700 barrels of crude.

Relying on train shipments allows refiners to access crude from different regions at different prices, a flexibility not always found in long-term pipeline contracts. The proposed fee of about $5 per barrel for using Freedom isn't low enough to woo many refiners. The cost of Texas crude plus shipping on Freedom would be nearly the same as a cheaper barrel of North Dakota crude brought to California via a train ride that costs $12 a barrel. Counting shipping costs, West Texas oil sent via Freedom and North Dakota crude sent by rail would both run about $5 below that for Brent crude, the benchmark price for waterborne crude. With those costs working out to be the same, refiners have said they prefer not to be tied down with long-term pipeline contracts.

Maybe Icahn and Buffett do know something about investing…especially in the rail biz. Similar to the movement of Canadian oil to the east coast via rail let’s look at the west coast. From http://www.downstreamtoday.com/news/art ... a_id=39604

A $2 billion pipeline project intended to ship oil from West Texas's booming oil fields to California has failed to pique the interest of several big refiners in the Golden State. The culprit: the growing popularity of railroads.

(KMP) 277,000-barrel-a-day Freedom pipeline would be the first to bring light, sweet oil produced in Texas's Permian Basin to the fuel-hungry Los Angeles market. That would give refiners in California, which now partly supplements with expensive crude imports from Alaska, Ecuador and other far-flung nations, a direct shot at the relatively cheap crude. But refiners Valero, Tesoro and Phillips 66 have all said they won't sign contracts to take crude from Freedom and will instead continue to use rail cars and barges to deliver more oil from North Dakota, Canada and even Texas to the gates of their California refineries.

Their lack of interest in the pipeline underscores how these other modes of oil transport are becoming a permanent fixture of the North American energy landscape. More than 200,000 rail carloads of oil were shipped in the U.S. last year, more than three times the amount in 2011. Each rail car can hold more than 700 barrels of crude.

Relying on train shipments allows refiners to access crude from different regions at different prices, a flexibility not always found in long-term pipeline contracts. The proposed fee of about $5 per barrel for using Freedom isn't low enough to woo many refiners. The cost of Texas crude plus shipping on Freedom would be nearly the same as a cheaper barrel of North Dakota crude brought to California via a train ride that costs $12 a barrel. Counting shipping costs, West Texas oil sent via Freedom and North Dakota crude sent by rail would both run about $5 below that for Brent crude, the benchmark price for waterborne crude. With those costs working out to be the same, refiners have said they prefer not to be tied down with long-term pipeline contracts.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: PHILADELPIA - THE NEW CUSHING, OK?

Mile-Long Crude-Laden Trains Ride Rails Toward Delaware City. From: http://www.downstreamtoday.com/news/art ... a_id=39475

“Mile-long trains, sometimes two a day, carrying brand-new tankers filled with crude oil from the tar sands region of Canada have begun snaking along the Susquehanna River through Lancaster County. The trains, usually carrying about 118 tankers of crude, are beating a path to the Delaware City Refinery in Delaware, one of the largest refineries on the East Coast. And then the empty trains head back to the oil fields on the same route, usually the next day.”

Heck! Not only are the dang Chinese trying to steal “our” Canadian oil but so are some Yankees!

“Mile-long trains, sometimes two a day, carrying brand-new tankers filled with crude oil from the tar sands region of Canada have begun snaking along the Susquehanna River through Lancaster County. The trains, usually carrying about 118 tankers of crude, are beating a path to the Delaware City Refinery in Delaware, one of the largest refineries on the East Coast. And then the empty trains head back to the oil fields on the same route, usually the next day.”

Heck! Not only are the dang Chinese trying to steal “our” Canadian oil but so are some Yankees!

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

45 posts

• Page 1 of 3 • 1, 2, 3

Return to North America Discussion

Who is online

Users browsing this forum: No registered users and 7 guests