BP review: U.S. tops global oil, gas production growth

BP review: U.S. tops global oil, gas production growth

I don't know what to say. If this is what some small, exceptional part of the world can do, just imagine what happens when the rest of the world imitates us. Let the Saudi's eat cake!

http://blogs.marketwatch.com/energy-tic ... on-growth/

http://blogs.marketwatch.com/energy-tic ... on-growth/

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: BP review: U.S. tops global oil, gas production growth

Great Post John_A!

"The human ability to innovate out of a jam is profound.That’s why Darwin will always be right, and Malthus will always be wrong.” -K.R. Sridhar

Do I make you Corny?

"expect 8$ gas on 08/08/08" - Prognosticator

Do I make you Corny?

"expect 8$ gas on 08/08/08" - Prognosticator

-

TheAntiDoomer - Heavy Crude

- Posts: 1556

- Joined: Wed 18 Jun 2008, 03:00:00

Re: BP review: U.S. tops global oil, gas production growth

On the gas side, Citi Research recently issued a report that would appear to be in substantial agreement with Art Berman's, Tad Patzek's and David Hughes' work.

I think that we have the RW (Real World) Wing of Citi and we have the FI (Fantasy Island) Wing of Citi (Ed Morse). The RW Wing estimates that we need about 17 BCF/day of new gas production every year to maintain the current level of production (66 BCF/day). This is equivalent to the three times 2011 peak rate of gas production from the Barnett Shale (5.5 BCF/day).

So, to maintain 66 BCF/day, over the next 10 years, we would only need 30 (peak production rate) Barnett Shale Plays.

An excerpt from a recent report by the RW Wing of Citi:

On the oil side, if we assume a 10%/year oil production decline rate, we would only need about 10 new Bakken Plays (based on current production) over the next 10 years, in order to maintain current US oil production. Following is a link to an essay I wrote on some decline rate scenarios for US oil and gas production. Interesting enough, my assumption for the decline rate for existing US gas production (20%/year) is below the Citi Research estimate.

http://www.resilience.org/stories/2013- ... l-exporter

In any case, no problemo. Based on above estimates (24%/year decline rate for existing gas, 10%/year for existing oil), we only need 30 new Barnett Shale plays and 10 new Bakken Plays in order to maintain current US oil & gas production for 10 years.[/quote]

I think that we have the RW (Real World) Wing of Citi and we have the FI (Fantasy Island) Wing of Citi (Ed Morse). The RW Wing estimates that we need about 17 BCF/day of new gas production every year to maintain the current level of production (66 BCF/day). This is equivalent to the three times 2011 peak rate of gas production from the Barnett Shale (5.5 BCF/day).

So, to maintain 66 BCF/day, over the next 10 years, we would only need 30 (peak production rate) Barnett Shale Plays.

An excerpt from a recent report by the RW Wing of Citi:

●Aggregated detailed well production data (HPDI) for nearly 100% of total U.S. natural gas volumes reveals that almost 2/3s of total current natural gas production is from wells drilled just in the past five years or since a host of shale plays really began to alter the U.S. natural gas landscape.

●Meanwhile, we would note that the overall U.S. natural gas production decline rate (Ex. Appalachia) accelerated in 2012 and averaged ~26% due to a higher ratio of new wells that came on line in 2011 and which posted high first-year decline rates of ~50%. With fewer new wells brought on line last year, we expect decline rates to moderate to ~24 % in 2013 and ~23% in 2014 due to a lower proportion of new wells in the U.S. natural gas production mix.

●Nevertheless, the ~23-24% decline rates imply that domestic natural gas production would need to grow by ~17 Bcf/day annually just to offset natural declines and keep current production flat.

On the oil side, if we assume a 10%/year oil production decline rate, we would only need about 10 new Bakken Plays (based on current production) over the next 10 years, in order to maintain current US oil production. Following is a link to an essay I wrote on some decline rate scenarios for US oil and gas production. Interesting enough, my assumption for the decline rate for existing US gas production (20%/year) is below the Citi Research estimate.

http://www.resilience.org/stories/2013- ... l-exporter

In any case, no problemo. Based on above estimates (24%/year decline rate for existing gas, 10%/year for existing oil), we only need 30 new Barnett Shale plays and 10 new Bakken Plays in order to maintain current US oil & gas production for 10 years.[/quote]

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: BP review: U.S. tops global oil, gas production growth

pstarr wrote:Isn't it wonderful? U.S. energy demand fell 2.8% last year, the largest decline in the world yet we still have an economy (albeit a crappy one.)

It is amazing, isn't it? People in America are making the decision to use less, the economy is certainly in the worst recovery ever but it is recovering, and why those wanting to save the world from fossil fuel emissions aren't screaming about it at the top of their lungs as to how this can be used as a model to save the entire planet is beyond me. You would think that the US drop in CO2 emissions combined with some 8 years now post demand peak would have them writing articles, showering Obama with campaign contributions (not that he had anything to do with it, but still), and trying to push this type of less CO2, less energy demand model across the entire planet, saving the world, American style!

And yet...silence. Are they so ashamed of being American that they can't open their mouths lest they reveal their country of birth?

pstarr wrote: But folks are fed, the lights are on, and some still have jobs at the Walmart. The plateau and sides of the itty-bitty peak ain't so bad afterall. How does it last?

Well, according to the IEA, we've got quite a ways to go before overall peak or decline becomes the issue.

As far as Walmart jobs, I recommend that Americans strive for better. For example, send in a resume for these, assuming you have appropriate skills of course (always a good idea, appropriate skills, otherwise...opportunity might be limited).

http://www.eia.gov/about/careers/

Not a cashier position in sight, but undoubtedly appropriate skills will be required.

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: BP review: U.S. tops global oil, gas production growth

pstarr – “The plateau and sides of the itty-bitty peak ain't so bad after all.” True. But for many of us…not all of us. And for a very few of us, like the Rockman, it has been great. Which is why I’ve never felt we were heading to an even a light version of a Mad Max world. The POD is a phenomenon that reaches almost every aspect of daily life but like a huge sea going vessel it changes course very slowly. One might argue whether we’ve reached the PO or not but it appears very clearly we’ve reached the POD. Excluding short terms spikes due to weather catastrophes and political upheavals the system keeps steaming on the same course with no significant factors to change its path very quickly. There will be worse times. And better times such as the US has seen with the uptick in oil production. But it pays to remember that uptick has come with a price: higher oil prices. I recently estimated the increase in gasoline/diesel prices in the last 10 years has cost Americans on the order of $250 billion MORE than they would have paid otherwise. Other factors have hurt the economy but it’s difficult to imagine higher energy prices haven’t taken their toll.

No cliffs, no more cheap oil, no magic technology to make electricity too cheap to meter, etc. We are living the future today. It will change significantly but over decades and not just a few years IMHO. But that change is inevitable

No cliffs, no more cheap oil, no magic technology to make electricity too cheap to meter, etc. We are living the future today. It will change significantly but over decades and not just a few years IMHO. But that change is inevitable

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: BP review: U.S. tops global oil, gas production growth

westexas wrote:In any case, no problemo. Based on above estimates (24%/year decline rate for existing gas, 10%/year for existing oil), we only need 30 new Barnett Shale plays and 10 new Bakken Plays in order to maintain current US oil & gas production for 10 years.

This same type of analogy was used for finding Saudi Arabias at the world level, and I'm not so sure it works. The rule was what, 1 every 3 years or some such?

74 million a day in conventional crude in 2005, exponential decline of 10%, 8 years, 74*EXP(-0.1*8) would be the Excel command for those interested, and presto! Todays conventional production rate should be 33 million a day which means...gulp....we have found 41 million barrels a day of new production! 4 new saudi arabias!! They were right! A new Saudi Arabia every (8/4 = 2) two years! We must tell the world!!

But wait...how about we check new OPEC countries since 2005 and discover.....no new folks.

Not so sure generalizing like this works very well...unless someone knows where that 41 million a day came from? Because I sure can't find it anywhere.

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: BP review: U.S. tops global oil, gas production growth

I can't wait till we find some more sludge to scrape out of the ground. Gas prices hit an all time high here locally in Michigan this week of $4.29/gal.

The things that will destroy America are prosperity-at-any-price, peace-at-any-price, safety-first instead of duty-first, the love of soft living, and the get-rich-quick theory of life.

... Theodore Roosevelt

... Theodore Roosevelt

-

Lore - Fission

- Posts: 9021

- Joined: Fri 26 Aug 2005, 03:00:00

- Location: Fear Of A Blank Planet

Re: BP review: U.S. tops global oil, gas production growth

I wouldn't celebrate the US decline of FF use too much- it is the result of the worst recovery ever recorded (and much number manipulation to make it even look that good). Fact is, the % of Americans working is in continual decline. Much fed printing and the power of the dollar as the world currency is keeping things much better than it would be in any other nation. We are buying imports with fantasy money the world is accepting for now.

But it is true that there is much fat in US energy use, SUV's, big houses, etc. We could lose even more weight and still be comfortable.

But what happens if there were only so many sweet spots of shale? At the decline rates recorded, overall production could drop in a hurry once the wall is hit- could kick off a major price spike and economic reaction. I am not relaxed about Bakken.

The worst thing about shale/gas is that is taking the focus off of more sustainable sources of energy (renewables, nukes). It is setting us up for a hard transition.

But it is true that there is much fat in US energy use, SUV's, big houses, etc. We could lose even more weight and still be comfortable.

But what happens if there were only so many sweet spots of shale? At the decline rates recorded, overall production could drop in a hurry once the wall is hit- could kick off a major price spike and economic reaction. I am not relaxed about Bakken.

The worst thing about shale/gas is that is taking the focus off of more sustainable sources of energy (renewables, nukes). It is setting us up for a hard transition.

-

C8 - Heavy Crude

- Posts: 1074

- Joined: Sun 14 Apr 2013, 09:02:48

Re: BP review: U.S. tops global oil, gas production growth

ROCKMAN wrote:No cliffs, no more cheap oil, no magic technology to make electricity too cheap to meter, etc. We are living the future today. It will change significantly but over decades and not just a few years IMHO. But that change is inevitable

Change always is. But the real question Rock is will we expect the same sort of slow, plodding change through transition we have been experiencing to date or more unsettling ones? For example, a young 18 year old graduating high school in 2005 who became a petroleum engineer in 2009 wouldn't think the world is a bad place. Someone wanting to bolt lug nuts onto the wheels of a GM truck in an assembly plant might have a different perspective. POD really helps one, but not the other. Is it because too many American children nowadays raised in a "teach to the test" environment aren't capable of handling what it takes for a real job in the oilfield, so we have an undersupply of the manly men (and women) types and too many pizza delivery types?

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: BP review: U.S. tops global oil, gas production growth

Lore wrote:I can't wait till we find some more sludge to scrape out of the ground. Gas prices hit an all time high here locally in Michigan this week of $4.29/gal.

Paid $4.20/gal last week. Indiana.

The good news is, the world has plenty of expensive oil, so while it is expensive, there is plenty of it.

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: BP review: U.S. tops global oil, gas production growth

C8 wrote:The worst thing about shale/gas is that is taking the focus off of more sustainable sources of energy (renewables, nukes). It is setting us up for a hard transition.

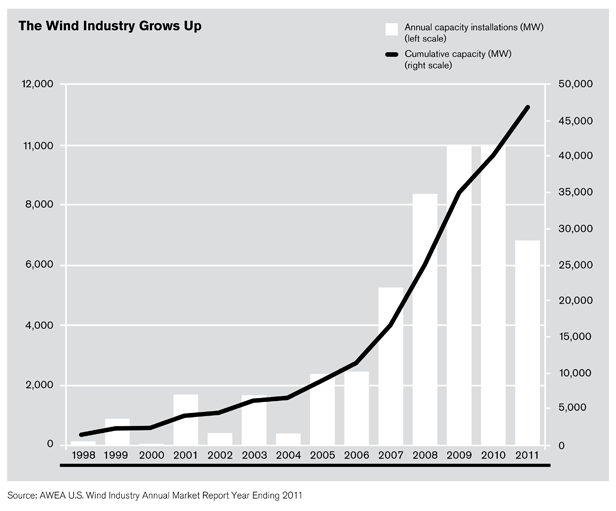

Actually, because of the price involved to access the stuff, it might be reasonable to say that it is helping us in the transition now. Certainly this wouldn't be going on if crude was still cheap. Ad this is just the Brits!

In the US, we are going absolutely whole hog!

http://www.bloomberg.com/news/2012-12-2 ... -2012.html

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: BP review: U.S. tops global oil, gas production growth

"The human ability to innovate out of a jam is profound.That’s why Darwin will always be right, and Malthus will always be wrong.” -K.R. Sridhar

Do I make you Corny?

"expect 8$ gas on 08/08/08" - Prognosticator

Do I make you Corny?

"expect 8$ gas on 08/08/08" - Prognosticator

-

TheAntiDoomer - Heavy Crude

- Posts: 1556

- Joined: Wed 18 Jun 2008, 03:00:00

Re: BP review: U.S. tops global oil, gas production growth

Re: John A

Of course, the global decline rate from existing wellbores is probably closer to ExxonMobil's estimate of 4% to 6% per year. And in fact since 2005, global Crude + Condensate production has barely increased. If we subtract out condensate, which is a byproduct of natural gas production, actual crude oil production (less than 45 API gravity) has probably not shown any material increase since 2005.

In any case, I don't see how anyone can argue that the overall decline rate from existing US wellbores has not dramatically increased, as more and more US oil and gas production comes from very high decline rate tight/shale plays.

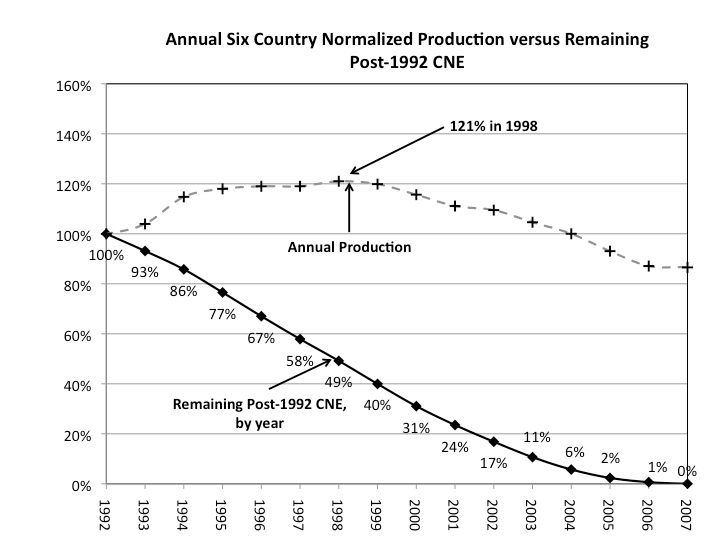

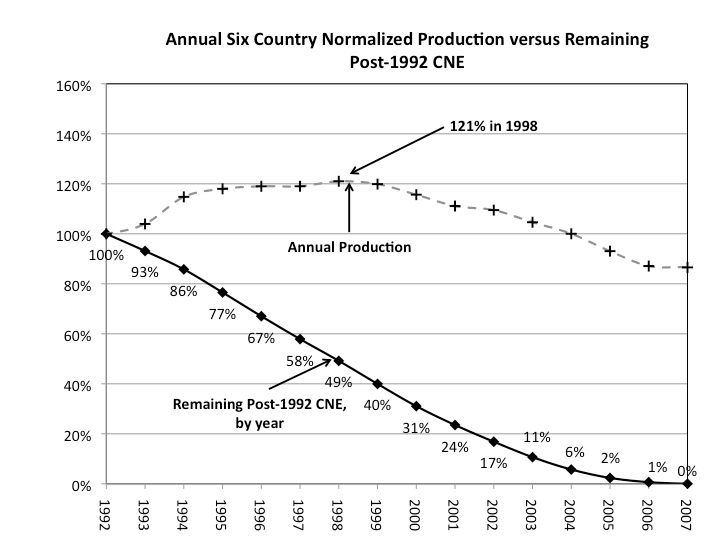

However, the truly dangerous threat facing developed net oil importing countries like the US is the catastrophically high post-2005 Available CNE depletion rate, i.e., the rate at which we are consuming the post-2005 cumulative supply of global net exports available to importers other than China & India. While Cornucopians are celebrating over what appears to be a continuing "Undulating Decline" in US crude oil production since 1970, for the average US consumer the reality is that global annual crude oil prices more than quadrupled from 2002 to 2012.

Info on CNE Depletion rates:

http://peak-oil.org/2013/02/commentary- ... ity-index/

In regard to rising production versus CNE depletion, from said article, combined normalized annual total petroleum liquids production (BP, 1992 rate = 100%) for the Six Country Case History* Vs. remaining post-1992 Six Country CNE (Cumulative Net Exports), by year:

*Six Country Case History: Indonesia, UK, Egypt, Vietnam, Argentina, Malaysia, which have all hit, or closely approached, zero net oil exports

Of course, the global decline rate from existing wellbores is probably closer to ExxonMobil's estimate of 4% to 6% per year. And in fact since 2005, global Crude + Condensate production has barely increased. If we subtract out condensate, which is a byproduct of natural gas production, actual crude oil production (less than 45 API gravity) has probably not shown any material increase since 2005.

In any case, I don't see how anyone can argue that the overall decline rate from existing US wellbores has not dramatically increased, as more and more US oil and gas production comes from very high decline rate tight/shale plays.

However, the truly dangerous threat facing developed net oil importing countries like the US is the catastrophically high post-2005 Available CNE depletion rate, i.e., the rate at which we are consuming the post-2005 cumulative supply of global net exports available to importers other than China & India. While Cornucopians are celebrating over what appears to be a continuing "Undulating Decline" in US crude oil production since 1970, for the average US consumer the reality is that global annual crude oil prices more than quadrupled from 2002 to 2012.

Info on CNE Depletion rates:

http://peak-oil.org/2013/02/commentary- ... ity-index/

In regard to rising production versus CNE depletion, from said article, combined normalized annual total petroleum liquids production (BP, 1992 rate = 100%) for the Six Country Case History* Vs. remaining post-1992 Six Country CNE (Cumulative Net Exports), by year:

*Six Country Case History: Indonesia, UK, Egypt, Vietnam, Argentina, Malaysia, which have all hit, or closely approached, zero net oil exports

Last edited by westexas on Thu 13 Jun 2013, 15:26:44, edited 2 times in total.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: BP review: U.S. tops global oil, gas production growth

John A, Anti-doomer, I think you guys know that those amazing increases in renewables are from ridiculously low base rates. Anything looks impressive when you are starting from nearly zero. Renewables are still a very, very, small fraction of total energy production and no where near on pace to make a major transition any time in the next 2-4 decades. If I knew how to post an image on this site I would show you a chart of the amount of US energy produced by renewables (but I don't  ). Nuclear production in the US is growing at a snails pace. tax credits for renewables are being allowed to expire in many places. The sense of urgency for an energy transition to non-fossil fuel sources has greatly diminished since the fracking/shale story hit.

). Nuclear production in the US is growing at a snails pace. tax credits for renewables are being allowed to expire in many places. The sense of urgency for an energy transition to non-fossil fuel sources has greatly diminished since the fracking/shale story hit.

). Nuclear production in the US is growing at a snails pace. tax credits for renewables are being allowed to expire in many places. The sense of urgency for an energy transition to non-fossil fuel sources has greatly diminished since the fracking/shale story hit.

). Nuclear production in the US is growing at a snails pace. tax credits for renewables are being allowed to expire in many places. The sense of urgency for an energy transition to non-fossil fuel sources has greatly diminished since the fracking/shale story hit.-

C8 - Heavy Crude

- Posts: 1074

- Joined: Sun 14 Apr 2013, 09:02:48

Re: BP review: U.S. tops global oil, gas production growth

John_A wrote:Lore wrote:I can't wait till we find some more sludge to scrape out of the ground. Gas prices hit an all time high here locally in Michigan this week of $4.29/gal.

Paid $4.20/gal last week. Indiana.

The good news is, the world has plenty of expensive oil, so while it is expensive, there is plenty of it.

That's really the problem of Peak Oil isn't it? Where it's expensive people are having a harder and harder time to be able to afford it.

The things that will destroy America are prosperity-at-any-price, peace-at-any-price, safety-first instead of duty-first, the love of soft living, and the get-rich-quick theory of life.

... Theodore Roosevelt

... Theodore Roosevelt

-

Lore - Fission

- Posts: 9021

- Joined: Fri 26 Aug 2005, 03:00:00

- Location: Fear Of A Blank Planet

Re: BP review: U.S. tops global oil, gas production growth

To post an image, first upload the image to a free image hosting site such as Postimage.org After your upload, the website will give you a link for your image. You can then copy the link and past it in your post inside an image tag(there is an Img button above the reply box that shows the format). I just did this yesterday for the same subject: total energy production from renewables. The fraction is not that small, 19% of global energy came from renewables. I posted on it here:C8 wrote:John A, Anti-doomer, I think you guys know that those amazing increases in renewables are from ridiculously low base rates. Anything looks impressive when you are starting from nearly zero. Renewables are still a very, very, small fraction of total energy production and no where near on pace to make a major transition any time in the next 2-4 decades. If I knew how to post an image on this site I would show you a chart of the amount of US energy produced by renewables (but I don't ).

Energy Infrastructure Progress Report

The oil barrel is half-full.

-

kublikhan - Master Prognosticator

- Posts: 5023

- Joined: Tue 06 Nov 2007, 04:00:00

- Location: Illinois

Re: BP review: U.S. tops global oil, gas production growth

westexas wrote:Re: John A

Of course, the global decline rate from existing wellbores is probably closer to ExxonMobil's estimate of 4% to 6% per year. And in fact since 2005, global Crude + Condensate production has barely increased. If we subtract out condensate, which is a byproduct of natural gas production, actual crude oil production (less than 45 API gravity) has probably not shown any material increase since 2005.

That was pretty much what I assumed, 2005 to 2013.

If we run the same calculation with 5% we have 74*EXP(-0.05*8)= 49 million a day, which means we have only discovered (74-49)/10 = 2.5 new Saudi Arabias. So 8/2.5 = a new Saudi Arabia every 3.2 years, which is the quote you often hear. But no new members to OPEC, so something is still terribly fishy in this kind of calculation.

westexas wrote:In any case, I don't see how anyone can argue that the overall decline rate from existing US wellbores has not dramatically increased, as more and more US oil and gas production comes from very high decline rate tight/shale plays.

Depends on when you measure it I guess. If you drilled all your Bakken wells in Year 1 and measured them, the declines would be different than if you waited a few years and measured them. Obviously you would have a lower overall rate, but also a lower decline rate. Found this publication recently and if I had the time I could pull the mean decline off the type curves provided by the USGS. Figures 5,6,7 and 8 appearing to be those of relevance.

http://pubs.er.usgs.gov/publication/ofr20131109

westexas wrote: While Cornucopians are celebrating over what appears to be a continuing "Undulating Decline" in US crude oil production since 1970, for the average US consumer the reality is that global annual crude oil prices more than quadrupled from 2002 to 2012.

Don't know if the BP review qualifies as cornucopian, but they certainly don't appear to be celebrating undulating decline, but rather, and I quote,

"Oil and natural gas production rose faster in the United States last year than anywhere in the world. It was also the biggest gain in oil production in the nation’s history, according to an annual review by BP PLC released Wednesday."

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: BP review: U.S. tops global oil, gas production growth

C8 wrote:John A, Anti-doomer, I think you guys know that those amazing increases in renewables are from ridiculously low base rates.

Absolutely. Just like oil and natural gas production. But that exponential function, we must not discount it, or Alberts Bartlett explaining how it works.

http://www.albartlett.org/

c8 wrote: The sense of urgency for an energy transition to non-fossil fuel sources has greatly diminished since the fracking/shale story hit.

It has. And it has also triggered the types of exponential growth in renewables necessary to put a real smackdown on the fossil fuel racket sometime in the not so distant future. And that surprises me, how when you hand the environmentalists exactly what they say they want, they say nothing on the topic. Suspicious. Makes me wonder if they don't all have stock in oil companies and are now getting nervous as to what exactly they have started here. Peak demand in the US is causing usage tax problems, dropping emissions, people happily doing staycations, almost like this calmness as we more firmly stride down the path of showing the world how developed countries can cast off the shackles of the old fuels and shoulder the burden of proving the new.

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

Re: BP review: U.S. tops global oil, gas production growth

Lore wrote:John_A wrote:Lore wrote:I can't wait till we find some more sludge to scrape out of the ground. Gas prices hit an all time high here locally in Michigan this week of $4.29/gal.

Paid $4.20/gal last week. Indiana.

The good news is, the world has plenty of expensive oil, so while it is expensive, there is plenty of it.

That's really the problem of Peak Oil isn't it? Where it's expensive people are having a harder and harder time to be able to afford it.

That would depend entirely on how they choose to spend their money. It isn't "harder" if you choose to skip the Starbucks latte, and suddenly have another gallon/day worth of fuel to decide to spend drag racing up and down Santa Monica. And when the time comes to trade in the monster truck, and they go efficient, suddenly, they are now part of the US post peak demand world which has been going on since 2007 or so. And good for them I say! About time Americans started doing something we can all be proud of. Michele wasn't proud of being American until the country had dumbed down enough to elect her husband, I say Americans choosing to create peak oil demand half a decade ago is a far better thing to be proud of than what we already knew, racism in america ain't what it used to be. I'm still irritated we had to wreck the economy and recovery to convince ourselves of this, but like us peak demand 5 or 6 years ago, he too shall pass.

45ACP: For when you want to send the very best.

- John_A

- Heavy Crude

- Posts: 1193

- Joined: Sat 25 Jun 2011, 21:16:36

67 posts

• Page 1 of 4 • 1, 2, 3, 4

Who is online

Users browsing this forum: No registered users and 28 guests