Loki wrote:Point #2: “Not trusting government statistics” means you're a conspiracy theorist or too stupid/lazy to examine the primary data yourself.

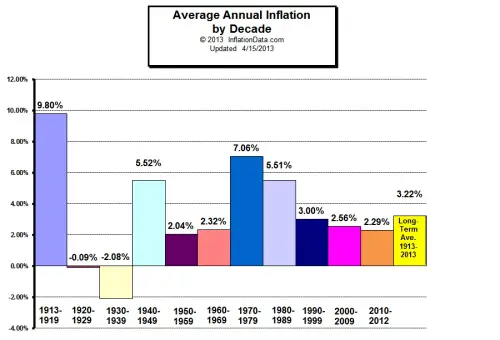

The shadowstats alternate chart is based on how the government measured inflation up until 1980. That's when they began taking some things out. Government changed it again in 1990. I'm not an economist, I just know government changed how they measure inflation, they took out food and energy etc. Government changed the metric twice, 1980 and 1990. Why do you think they would do that? I'm not a conspiracy theorist I'm a realist.

I would presume they've been taking things out of the inflation metric so that inflation doesn't look so high. And now government wants to make ANOTHER change -- the "chained" CPI. Again, I'm not an economist, I just read things. For example, I read Bernanke (I think it was him) say that because the new iphone has more features than the last iphone for about the same price then that should somehow affect how we measure inflation.

Now to my common sense ears, that's a bunch of bs. Government can keep taking things out of the CPI all they want, and do more "chained" CPI's, so inflation won't "look" as bad. But if everything an average person needs to buy in an average day keeps going up then I'm sorry that's inflation -- you can't eat an iphone, and it's really only electronic luxuries that have become more feature rich and to some extent deflated in price over time.

Do I enjoy my smartphone more than my old phone? Well sure, yes, but you can't eat a phone and a phone doesn't provide heating and cooling and food and water to the home, or gas for the truck. Look at things like healthcare and the cost of education, *it's through the roof" compared to the early 90's. The basic things that people *need* are all inflating, and that is not offset by a new iphone having a screen that can read your thumbprint.

This is a deflationary depression, marked by deleveraging and a lack of access to money.

I agree this is a depression, where we disagree (apparently) is that the rich are sitting on hoards of cash -- and more to the point, American business is hoarding billions. They refuse to pay their workers more than poverty wages. If you want to get into this, we can talk about cash on hand for Walmart and Apple, McDonalds, all of them. They're doing very well. Their workers are not. (in the case of Apple they employ Chinese).

American working man has a depression going on, but Loki, the rich and corporations do not. Do you want to debate that point?Inflation is not the bugaboo the interwebs makes it out to be, at least not QE-induced inflation.

You and me disagree. I contend that that a lot of this qe money has runup commodity futures, and commodity prices. There are hedge funds who hire fleets of oil tankers to sail in circles. One example after another like that -- if you'd like to debate that point, we can.

Please refer to my previous statement re. hard resource limits and their effect on price.

Resource bottleneck is part of it. But so is the QE and all the money pouring into commodities and inflating them, it's a bubble.

Anyhow, nobody can use peak oil and peak resources to convince me that the American worker couldn't be paid a bit better when you've got the rich having guilded-age levels of national income and wealth, and American corporations sitting on so much cash. For one thing the rich need to be paying more taxes, we're out of line with every other western democracy. Taxes on the rich need to go way up back to Clinton levels (that was considered moderate at the time, now those tax rates are somehow anathema).

Six, you're very emotionally volatile, all over the map, like a monkey jumping frantically from branch to branch, you don't seem to have a center.

I'm not emotional, I just write that way. Trying to wake people up. Middle and working class in America vote against their own interests, and they vote for the elites, they buy into all the conservative arguments (even Democrats), year after year. We've got no real labor party in this country anymore. Nobody to stand up for average folks. Democrats are the party of hedge funds, the rich and banksters as much as Repubs are.

You should calm down and dig into the data, move beyond conspiracy websites, and maybe read some Epictetus.

Shadowstas isn't a conspiracy site, he's an economist and he's just provided data from 1980 and 1990 government metrics. It's just as if they hadn't started taking things out of the CPI, that's all.

From shadowstats:

Walter J. "John" Williams was born in 1949. He received an A.B. in Economics, cum laude, from Dartmouth College in 1971, and was awarded a M.B.A. from Dartmouth's Amos Tuck School of Business Administration in 1972, where he was named an Edward Tuck Scholar.

One of my early clients was a large manufacturer of commercial airplanes, who had developed an econometric model for predicting revenue passenger miles. The level of revenue passenger miles was their primary sales forecasting tool, and the model was heavily dependent on the GNP (now GDP) as reported by the Department of Commerce. Suddenly, their model stopped working, and they asked me if I could fix it. I realized the GNP numbers were faulty, corrected them for my client (official reporting was similarly revised a couple of years later) and the model worked again, at least for a while, until GNP methodological changes eventually made the underlying data worthless.

That began a lengthy process of exploring the history and nature of economic reporting and in interviewing key people involved in the process from the early days of government reporting through the present. For a number of years I conducted surveys among business economists as to the quality of government statistics (the vast majority thought it was pretty bad), and my results led to front page stories in 1989 in the New York Times and Investors Daily (now Investors Business Daily), considerable coverage in the broadcast media and a joint meeting with representatives of all the government's statistical agencies.

Nonetheless, the quality of government reporting has deteriorated sharply in the last couple of decades. Reporting problems have included methodological changes to economic reporting that have pushed headline economic and inflation results out of the realm of real-world or common experience.http://www.shadowstats.com/

P.S. I don't even know why you're arguing with me, if I came at you too strongly and that's what it's about then I apologize. I simply strongly disagree with your general assertion that "qe for the rest of us" would be the real problem, and that somehow qe for the rich is ok. I just disagree. Screw this QE oligarch monetary inflation. I'd rather see inflation from an overheating economy full of people working full time jobs making good wages. THEN that inflation can be tackled with higher interests rates.

Back to Janet Yellen, she's the first Democrat fed chair since Volcker. Maybe she'll wind up doing some good, though post banking de-regulation there's not much the Fed can do for Main Street.