A new multi-disciplinary study led by the University of Maryland calls for immediate action by government, private and commercial sectors to reduce vulnerability to the imminent threat of global peak oil, which could put the entire US economy and other major industrial economies at risk.

The peer-reviewed study contradicts the recent claims within the oil industry that peak oil has been indefinitely offset by shale gas and other unconventional oil and gas resources. A report by the World Energy Council (WEC) last month, for instance, stated that peak oil was unlikely to be realised within the next forty years at least. This is due to global reserves being 25 per cent higher than in 1993. According to the WEC report, 80% of global energy is currently produced by either oil, gas or coal, a situation which is likely to continue for the foreseeable future.

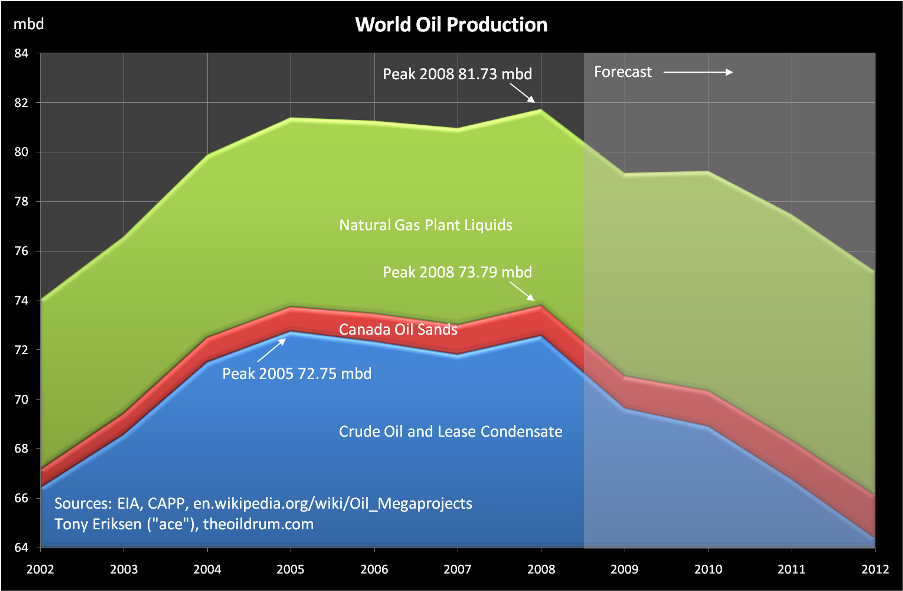

The new University of Maryland study, in contrast, conducts a review of the scientific literature on global oil production and argues that the bulk of independent, credible studies indicate that a "production peak for conventional oil [is] likely before 2030", with a "significant risk" it could occur "before 2020." Unconventional oil such as Canadian tar sands is "unlikely to expand enough to fill the gap", and this also applies to "shale oil and gas." Shale wells, the study argues, "reach their maximum production levels (peaks) much earlier than conventional ones and are therefore difficult to operate profitably."

guardian

On the other hand that is why they can respond so quickly when asked.

On the other hand that is why they can respond so quickly when asked.