.

Lawrence Summers , once mentioned to be Fed Chairman

and one of the most eminent establishment economist ,

is throwing a stone into to pond

http://blogs.reuters.com/lawrencesummer ... tagnation/

He point out the lack of growth in advanced economies and the futility of

continuing with quantitative easing

"Some have suggested that a belief in secular stagnation implies the desirability of bubbles to support demand. This idea confuses prediction with recommendation. It is of course far better to support demand by supporting productive investment or highly valued consumption than by artificially inflating bubbles. On the other hand, it is only rational to recognize that low interest rates raise asset values and drive investors to take greater risks, making bubbles more likely. The risk of financial instability provides yet another reason why preempting structural stagnation is so profoundly important."

Secular stagnation

First unread post • 16 posts

• Page 1 of 1

Re: Secular stagnation

He talks all sorts of gibberish yet neglects to mention energy costs for the average American have gone from 7-12% of disposable income even with the drop in nat gas and declining miles driven.

http://www.csmonitor.com/USA/2011/0518/ ... ergy-costs

http://www.citibank.com.au/global_docs/ ... sp_aus.htm

http://www.csmonitor.com/USA/2011/0518/ ... ergy-costs

http://www.citibank.com.au/global_docs/ ... sp_aus.htm

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Secular stagnation

+1 on 'gibberish' Pops

The heading I thought may lead to something interesting- but...

To assume 'Secular stagnation', one would have to assume a thoroughly secular state- something which doesn't actually exist. Our news and our politics are controlled by an oligarchy, we have fake secularism- another personality cult- whilst true secularism only exists, like true democracy- in a scattered form on the internet.

The heading I thought may lead to something interesting- but...

To assume 'Secular stagnation', one would have to assume a thoroughly secular state- something which doesn't actually exist. Our news and our politics are controlled by an oligarchy, we have fake secularism- another personality cult- whilst true secularism only exists, like true democracy- in a scattered form on the internet.

- SeaGypsy

- Master Prognosticator

- Posts: 9285

- Joined: Wed 04 Feb 2009, 04:00:00

Re: Secular stagnation

.

It's written in code

let me translate , imperfectly

"Some

[ .....Martin Wolf ]

have suggested that a belief in secular stagnation implies the desirability of bubbles to support demand.

[ if you let the market run on its own there will be bubbles which is fine followed by banks bankruptcies

which is bad for the bankers ]

This idea confuses prediction with recommendation.

[ maybe bankers should be more careful and cut the crap ]

It is of course far better to support demand by supporting productive investment or highly valued consumption than by artificially inflating bubbles.

[ throwing money at financial institutions has zero result on making a country run better ]

On the other hand, it is only rational to recognize that low interest rates raise asset values and drive investors to take greater risks, making bubbles more likely.

[ All the free money is not used for factories but for bidding madly in the gambling casino of the stock exchange

The risk of financial instability provides yet another reason why preempting structural stagnation is so profoundly important."

[ Anyone ( Martin Wolf ) who think getting the stock market index up by 50% with ZERO real wealth increase

is building a house of cards sure to collapse ]

It's written in code

let me translate , imperfectly

"Some

[ .....Martin Wolf ]

have suggested that a belief in secular stagnation implies the desirability of bubbles to support demand.

[ if you let the market run on its own there will be bubbles which is fine followed by banks bankruptcies

which is bad for the bankers ]

This idea confuses prediction with recommendation.

[ maybe bankers should be more careful and cut the crap ]

It is of course far better to support demand by supporting productive investment or highly valued consumption than by artificially inflating bubbles.

[ throwing money at financial institutions has zero result on making a country run better ]

On the other hand, it is only rational to recognize that low interest rates raise asset values and drive investors to take greater risks, making bubbles more likely.

[ All the free money is not used for factories but for bidding madly in the gambling casino of the stock exchange

The risk of financial instability provides yet another reason why preempting structural stagnation is so profoundly important."

[ Anyone ( Martin Wolf ) who think getting the stock market index up by 50% with ZERO real wealth increase

is building a house of cards sure to collapse ]

-

sparky - Intermediate Crude

- Posts: 3587

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Sydney , OZ

Re: Secular stagnation

SG, the term “secular” in econospeak means long-term, decadal-scale (10-30 years or more). In the OP's article, Summers is putting forth what he calls a “secular stagnation thesis,” i.e., decades of stagnation. This is not all that different from what we here on PO.com call economic decline, and only a small step above what we call economic collapse.

It's interesting to see Summers, about as mainstream a financial/economic policy figure as you get, arguing that we may very well see economic stagnation for decades to come. I know the feminists and leftists have all sorts of issues with this guy, but given the post in the OP's link, maybe he wouldn't have made such a bad Fed chair after all. We could use a few more doomers in high places.

Balls-to-the-walls emergency economic policy actions will be required for the indefinite future if we're to avoid a death spiral.

There has been no recovery despite massive interventions in the market.

Economic growth has been slowing for a long time, even with the overheated housing market prior to the pop of '08.

We can't cut interest rates lower than zero. Borrow, damn it, why won't you people just borrow?!?!

Inflation is not the problem, deflation is. People just aren't borrowing and spending enough. This is making the maldistribution of wealth of our society even worse.

A return to BAU is fantasy. Japan has paved the way. Decadal-scale stagnation is not only possible, it's been proven.

More bubbles---and associated pops---are likely due to the emergency actions governments and central banks around the world have been taking.

I can't disagree with any of this. I doubt that “preempting structural stagnation” is within our power, but I'd like to read Summers' thoughts on the subject.

It's interesting to see Summers, about as mainstream a financial/economic policy figure as you get, arguing that we may very well see economic stagnation for decades to come. I know the feminists and leftists have all sorts of issues with this guy, but given the post in the OP's link, maybe he wouldn't have made such a bad Fed chair after all. We could use a few more doomers in high places.

Summers wrote:Some time ago speaking at the IMF, I joined others who have invoked the old idea of secular stagnation and raised the possibility that the American and global economies could not rely on normal market mechanisms to assure full employment and strong growth without sustained unconventional policy support

Balls-to-the-walls emergency economic policy actions will be required for the indefinite future if we're to avoid a death spiral.

First, even though financial repair had largely taken place four years ago, recovery since that time has only kept up with population growth and normal productivity growth in the United States, and has been worse elsewhere in the industrial world.

There has been no recovery despite massive interventions in the market.

Second, manifestly unsustainable bubbles and loosening of credit standards during the middle of the last decade, along with very easy money, were sufficient to drive only moderate economic growth.

Economic growth has been slowing for a long time, even with the overheated housing market prior to the pop of '08.

Third, short-term interest rates are severely constrained by zero lower bound and there is very little scope for further reductions in either term premia or credit spreads, and so real interest rates may not be able to fall far enough to spur enough investment to lead to full employment.

We can't cut interest rates lower than zero. Borrow, damn it, why won't you people just borrow?!?!

Fourth, in such a situation falling wages and prices or inflation at slower-than-expected rates is likely to worsen economic performance by encouraging consumers and investors to delay spending, and to redistribute income and wealth from higher spending debtors to lower spending creditors.

Inflation is not the problem, deflation is. People just aren't borrowing and spending enough. This is making the maldistribution of wealth of our society even worse.

The implication of these considerations is that the presumption that runs through most policy discussion — that normal economic and policy conditions will return at some point — cannot be maintained. The point is demonstrated by the Japanese experience,

A return to BAU is fantasy. Japan has paved the way. Decadal-scale stagnation is not only possible, it's been proven.

On the other hand, it is only rational to recognize that low interest rates raise asset values and drive investors to take greater risks, making bubbles more likely. The risk of financial instability provides yet another reason why preempting structural stagnation is so profoundly important.

More bubbles---and associated pops---are likely due to the emergency actions governments and central banks around the world have been taking.

I can't disagree with any of this. I doubt that “preempting structural stagnation” is within our power, but I'd like to read Summers' thoughts on the subject.

A garden will make your rations go further.

-

Loki - Expert

- Posts: 3509

- Joined: Sat 08 Apr 2006, 03:00:00

- Location: Oregon

Re: Secular stagnation

.

it certainly point out that not every economist is a parrot to unlimited growth on demand

to call the present situation a stagnation is too benign a term

there has been trillions of dollars shifted from taxpayers pocket present and to come

then transferred to the very richest ,

the total aggregate looks the same but they got the money and you got the debt

to convince you of this , consider the general assault on pension funds

with a stubborn refusal to raise the ( miserable ) minimum wage by a few bucks

I would have though they would spend their wages back in the economy ,not on the stock market

the billionaires got trillions ,the poors got a kick in the face and the bill for the boot

it certainly point out that not every economist is a parrot to unlimited growth on demand

to call the present situation a stagnation is too benign a term

there has been trillions of dollars shifted from taxpayers pocket present and to come

then transferred to the very richest ,

the total aggregate looks the same but they got the money and you got the debt

to convince you of this , consider the general assault on pension funds

with a stubborn refusal to raise the ( miserable ) minimum wage by a few bucks

I would have though they would spend their wages back in the economy ,not on the stock market

the billionaires got trillions ,the poors got a kick in the face and the bill for the boot

-

sparky - Intermediate Crude

- Posts: 3587

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Sydney , OZ

Re: Secular stagnation

good job you two.

Here is a chart I've been meditating over recently:

From the end of WWII until the end of US domination of oil markets in the 70s it was all about energy too-cheap-to-meter and the surpluses they brought. The expectation was for continuing growth in the economy to infinity and beyond. The gov had to pay higher and higher interest rates to borrow money (sell bonds) because there was lots of money to be made investing elsewhere - anywhere!

But after the US peak and the first repricing of oil by OPEC, unlimited expansion changed to the drive for efficiency and cost cutting. Efficiency reduces expenses and increases profit (to a point) but one man's expense is anothers income. Personally I think Reagan's Trickle Up was the signal to many that the jig was up.

Around these boards, talking about all the folks who are less insightful than we few is fashionable. But, since the 70's, people have become more and more fearful about the future and increasingly want to invest their money where they know to a certainty that it will paid back. And where better than the place that literally prints money.

The chart shows that since the late '70s the rate the government pays to borrow money has fallen steadily; to the point it actually has become negative when you consider inflation. Really it can't fall further without acknowledging deflation, it is already the lowest in history. Why do people keep buying US bonds? Because the dollar is the safest bet out there.

The constant boogieman in places like this is hyperinflation, I guess because like gas line shootouts and boiling in your skin and food riots; wheeling barrows of dollars to buy bread seems dramatic. But the fact is, for the last 40 years people have given Uncle Sugar more and more of their money to hold because they are increasingly fearful. To the point now, rates are effectively negative and any increase in those rates would decimate the value of Treasuries (the cash value of a bond in your hand falls when interest rates rise). Still the demand has not diminished.

People have intuited that the peak is in, growth is done and the future is deflation. As Loki points out, the only thing propping the appearance of the economy now is the illusion of bubbles.

I gotta laugh, that reminds me: when I was a kid we'd swim in an irrigation ditch at a place called The Bubbles. It was where a concrete lined canal below a reservoir dam ended and became a dirt ditch. The concrete stopped and the drop to the eroded ditch caused the water to foam up - The Bubbles. Standing on the weir over the drop you'd look down and the foam was maybe 10 feet down but when you jumped in, the thrill was that the water wasn't just below the foam where you thought it would be, it was actually another 5 or 10 feet lower.

http://www.businessinsider.com/what-the ... ans-2012-5

Here is a chart I've been meditating over recently:

From the end of WWII until the end of US domination of oil markets in the 70s it was all about energy too-cheap-to-meter and the surpluses they brought. The expectation was for continuing growth in the economy to infinity and beyond. The gov had to pay higher and higher interest rates to borrow money (sell bonds) because there was lots of money to be made investing elsewhere - anywhere!

But after the US peak and the first repricing of oil by OPEC, unlimited expansion changed to the drive for efficiency and cost cutting. Efficiency reduces expenses and increases profit (to a point) but one man's expense is anothers income. Personally I think Reagan's Trickle Up was the signal to many that the jig was up.

Around these boards, talking about all the folks who are less insightful than we few is fashionable. But, since the 70's, people have become more and more fearful about the future and increasingly want to invest their money where they know to a certainty that it will paid back. And where better than the place that literally prints money.

The chart shows that since the late '70s the rate the government pays to borrow money has fallen steadily; to the point it actually has become negative when you consider inflation. Really it can't fall further without acknowledging deflation, it is already the lowest in history. Why do people keep buying US bonds? Because the dollar is the safest bet out there.

The constant boogieman in places like this is hyperinflation, I guess because like gas line shootouts and boiling in your skin and food riots; wheeling barrows of dollars to buy bread seems dramatic. But the fact is, for the last 40 years people have given Uncle Sugar more and more of their money to hold because they are increasingly fearful. To the point now, rates are effectively negative and any increase in those rates would decimate the value of Treasuries (the cash value of a bond in your hand falls when interest rates rise). Still the demand has not diminished.

People have intuited that the peak is in, growth is done and the future is deflation. As Loki points out, the only thing propping the appearance of the economy now is the illusion of bubbles.

I gotta laugh, that reminds me: when I was a kid we'd swim in an irrigation ditch at a place called The Bubbles. It was where a concrete lined canal below a reservoir dam ended and became a dirt ditch. The concrete stopped and the drop to the eroded ditch caused the water to foam up - The Bubbles. Standing on the weir over the drop you'd look down and the foam was maybe 10 feet down but when you jumped in, the thrill was that the water wasn't just below the foam where you thought it would be, it was actually another 5 or 10 feet lower.

http://www.businessinsider.com/what-the ... ans-2012-5

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Secular stagnation

Pops wrote:People have intuited that the peak is in, growth is done and the future is deflation. As Loki points out, the only thing propping the appearance of the economy now is the illusion of bubbles.

Paul Krugman discussed Summers' secular stagnation thesis in his NYT blog last month. Here's what he has to say about bubbles being the main driver of growth since the 1980s:

Paul Krugman wrote:2. An economy that needs bubbles?

We now know that the economic expansion of 2003-2007 was driven by a bubble. You can say the same about the latter part of the 90s expansion; and you can in fact say the same about the later years of the Reagan expansion, which was driven at that point by runaway thrift institutions and a large bubble in commercial real estate.

So you might be tempted to say that monetary policy has consistently been too loose. After all, haven’t low interest rates been encouraging repeated bubbles?

But as Larry emphasizes, there’s a big problem with the claim that monetary policy has been too loose: where’s the inflation? Where has the overheated economy been visible?

So how can you reconcile repeated bubbles with an economy showing no sign of inflationary pressures? Summers’s answer is that we may be an economy that needs bubbles just to achieve something near full employment – that in the absence of bubbles the economy has a negative natural rate of interest. And this hasn’t just been true since the 2008 financial crisis; it has arguably been true, although perhaps with increasing severity, since the 1980s.

http://krugman.blogs.nytimes.com/2013/1 ... mers/?_r=0

It seems Daniel Plainview's single-minded obsession with bubble blowing wasn't without merit

I think where folks like Summers and Krugman fall short is understanding how their economic theories interact with physical reality. Seems to me that "secular stagnation" is a best-case scenario when we consider peak oil, climate change, and the like. No amount of bubble blowing will mitigate resource scarcity and ecological collapse.

A garden will make your rations go further.

-

Loki - Expert

- Posts: 3509

- Joined: Sat 08 Apr 2006, 03:00:00

- Location: Oregon

Re: Secular stagnation

.

Thanks for the link Loki , the comments on the article also are enlightening ,

even if one doesn't agree , they make one think

that's a debate at the highest level

Thanks for the link Loki , the comments on the article also are enlightening ,

even if one doesn't agree , they make one think

that's a debate at the highest level

-

sparky - Intermediate Crude

- Posts: 3587

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Sydney , OZ

Re: Secular stagnation

Another view on the secular stagnation thesis, this one from Steve Keen, one of my favorite economists. His thing is private debt, he argues that the Great Recession, which he predicted several years before it happened, is a deflationary depression triggered by excessive private debt.

His argument is kind of convoluted, and focused on his obsession with disproving neoclassical economics. Boiled down, he doesn't put much stock in Summers' secular stagnation thesis, particularly the notion that bubble blowing will be the only thing keeping us from permanent stagnation. Keen thinks we need to fix our balance sheet and deal with the motherload of bad debt we've accumulated the last couple decades.

Follow up article here with more on Keen's view of the role of private debt in explaining our current economic stagnation.

The decline in the population growth rate in developed countries is one of the main factors in Summers' secular stagnation thesis. This is something Keen does not adequately address. Demographics isn't destiny, but it's damn close. But Summers' notion that permanent bubble blowing is our only hope to achieve “full employment” strikes me as insane.

His argument is kind of convoluted, and focused on his obsession with disproving neoclassical economics. Boiled down, he doesn't put much stock in Summers' secular stagnation thesis, particularly the notion that bubble blowing will be the only thing keeping us from permanent stagnation. Keen thinks we need to fix our balance sheet and deal with the motherload of bad debt we've accumulated the last couple decades.

Steve Keen wrote:Larry Summers’ speech at the IMF has provoked a flurry of responses from New Keynesian economists that imply that Summers has located the “Holy Grail of Macroeconomics” – and that it was a poisoned chalice.

“Secular stagnation”, Summers suggested, was the real explanation for the continuing slump, and it had been with us for long before this crisis began. Its visibility was obscured by the subprime bubble, but once that burst, it was evident.

So the crisis itself was a sideshow. The real story is about inadequate private sector demand, which may have existed for decades. Generating adequate demand in the future may require a permanent stimulus from the government – meaning both the Congress and the Fed.

What could be causing the secular stagnation – if it exists? Krugman noted a couple of factors: a slowdown in population growth (which is obviously happening: see Figure 1); and “a Bob Gordon-esque decline in innovation” (which is more conjectural).

http://www.businessspectator.com.au/art ... sion-never?

Follow up article here with more on Keen's view of the role of private debt in explaining our current economic stagnation.

The decline in the population growth rate in developed countries is one of the main factors in Summers' secular stagnation thesis. This is something Keen does not adequately address. Demographics isn't destiny, but it's damn close. But Summers' notion that permanent bubble blowing is our only hope to achieve “full employment” strikes me as insane.

A garden will make your rations go further.

-

Loki - Expert

- Posts: 3509

- Joined: Sat 08 Apr 2006, 03:00:00

- Location: Oregon

Re: Secular stagnation

Two more views, the first from Mario Seccareccia, Professor of Economics, University of Ottawa.

The second from Gavyn Davies in the Financial Times:

Hence, the explanation offered by Summers, Krugman et al., is nothing more than what neoclassical economists were saying over half a century ago: because of the crisis, the expectations-determined Wicksellian “natural” rate remains persistently negative, but the money rate has a zero lower bound, which implies that the economy remains stuck in a Patinkinesque disequilibrium state. Indeed, one wonders what the controversy is really all about since, except for the use of the “secular stagnation” words, which, by the way, had been used by Great Depression economists, such as Alvin Hansen during the late 1930s, there is nothing new that Summers is saying. This is all déjà vu not only from before the financial crisis, but actually ever since the 1940s! Our economics profession appears to be stuck in a time warp or has succumbed to some sort of collective amnesia by continuing to repeat the same old controversies!

Within this neoclassical theoretical box, there is only one solution offered to move the economy out of secular stagnation. One must boost the Wicksellian “natural rate” by strengthening expectations of return. More precisely, the solution offered by both Summers and Krugman is to promote asset bubbles. Hence, instead of aborting the bubble that will ineluctably end in a crisis, we are told that we should be sustaining these bubbles and keeping them aloft. It is truly ironic that, while these economists would probably never recommend wage inflation (because it would supposedly cause unemployment), they have no problem in promoting sustained asset price inflation that would redistribute wealth towards those who already own too much of it!

http://www.nakedcapitalism.com/2013/11/ ... model.html

The second from Gavyn Davies in the Financial Times:

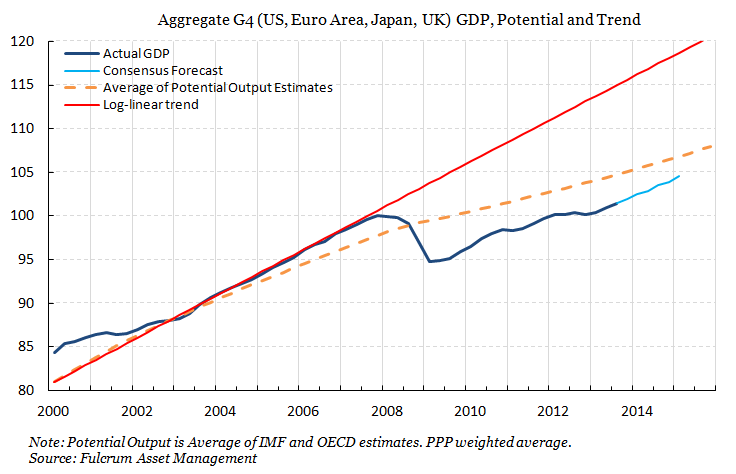

The latest evidence on secular stagnation is reflected in the graph below:

...

With wage and price inflation continuing to hover close to zero, and with global bond yields still so low, the secular stagnationists currently appear to be having the better of the debate. But, of course, there is a counter case. They may not be right that real GDP can return to the long term (red) trendline, or even the more pessimistic potential output (orange) line. Attempts to get there would then be followed not only by asset bubbles, but also by rising inflation, and then a massive economic correction.

Concerns about these risks appear to be winning the argument on the fiscal side, which is still tightening by a little under one percentage point of GDP per annum in the developed world. They also hold sway in much of the ECB Governing Council. But the Fed, the BoE and the BoJ seem to be leaning in the other direction [4].

Essentially, this comes down to the oldest macro-economic question of all: where do policy makers want to take risks, with higher inflation or lost output and employment?

Paul Samuelson, once said that “good questions outrank easy answers”. His nephew, Larry Summers, has certainly asked a very good question on this occasion.

http://blogs.ft.com/gavyndavies/2013/11 ... tagnation/

A garden will make your rations go further.

-

Loki - Expert

- Posts: 3509

- Joined: Sat 08 Apr 2006, 03:00:00

- Location: Oregon

Re: Secular stagnation

Thanks Loki. I notice that each of those economists agree on the trend but each wants to hitch it to their particular hobby horse; personal debt, monetary policy, public debt etc.

I'm no economist and don't play one on the internet but my horsey says much of the product measured by official GDP numbers now isn't "product" at all but just froth, balance sheet croupiers profiting from the movement of bytes here to there. An increasing portion of the economy is just churn, trading on the margin, profiting from the difference in a price quote between this market and that at millisecond clock speed. That isn't over exuberance, intentional or otherwise, it's simply froth - or maybe a better analogy is cavitation, the faster the prop spins the more little bubbles you make but because the bubbles consist of nothingness no actual work gets done and the slower you go . . . you'll churn up a big head of froth though.

The latest real estate bubble for example was only extraordinary in size, not in precedent, real estate values move in a cycle somewhere around a 15 years going back to the 40's. What was different this time was no one had to take responsibility for making crappy loans like they did in the S&L Crisis. And because these loans had a life of their own separate from the institutions that originated them it took much longer for their crappiness to come to light. They were sliced and diced and tranched into Black Box CDOs, CDSs ETCs and given a rosy risk assessment by ratings agencies on the banks' payroll. Those and all their derivatives (more nothingness) were then sold, only to be chopped up some more, re-bundled and sold again. The buyers, ratings agencies and maybe even some of the people selling had no idea what they actually contained, much less their actual risk. They were churned into an unrecognizable, unknowable froth - but they sure were profitable . . . if you trade in froth and don't plan to try and hold onto it.

But to get back to my whipping pony, the reason GDP has become less a measure of "Product" than of Froth is that tangible products require material resources, labor and energy to produce and all three are becoming more expensive. Look at this chart and imagine the gap between the red and blue line as froth, just the churning of chips as the gamblers bet against one another.

Link

I think it is no coincidence that both of our largest modern bank crises came within this period of rising froth and were based on making loans to people who were not qualified, on properties that were overvalued in a market that was intentionally under-regulated. And not coincidentally, all 3 big bank crisis including the Great Depression occurred in a period of big changes in energy. The GD when cheap oil was changing everything, the S&L crisis after the US peak and subsequent glut of new supplies; and of course the Last Depression resulting in part from the peak of cheap oil and the end of Drive-'Til-You-Qualify home buyers.

One of Gail's best posts I think . .

Gail does some fancy math in her post showing the correlation between energy per capita and growth but that shouldn't come as a real surprise. What is a surprise, is how few economists seem to even consider energy as part of the equation or that the decoupling of energy from GDP actually has created the decoupling of "Product" from GDP and created GDF (Gross Domestic Froth).

I'm no economist and don't play one on the internet but my horsey says much of the product measured by official GDP numbers now isn't "product" at all but just froth, balance sheet croupiers profiting from the movement of bytes here to there. An increasing portion of the economy is just churn, trading on the margin, profiting from the difference in a price quote between this market and that at millisecond clock speed. That isn't over exuberance, intentional or otherwise, it's simply froth - or maybe a better analogy is cavitation, the faster the prop spins the more little bubbles you make but because the bubbles consist of nothingness no actual work gets done and the slower you go . . . you'll churn up a big head of froth though.

The latest real estate bubble for example was only extraordinary in size, not in precedent, real estate values move in a cycle somewhere around a 15 years going back to the 40's. What was different this time was no one had to take responsibility for making crappy loans like they did in the S&L Crisis. And because these loans had a life of their own separate from the institutions that originated them it took much longer for their crappiness to come to light. They were sliced and diced and tranched into Black Box CDOs, CDSs ETCs and given a rosy risk assessment by ratings agencies on the banks' payroll. Those and all their derivatives (more nothingness) were then sold, only to be chopped up some more, re-bundled and sold again. The buyers, ratings agencies and maybe even some of the people selling had no idea what they actually contained, much less their actual risk. They were churned into an unrecognizable, unknowable froth - but they sure were profitable . . . if you trade in froth and don't plan to try and hold onto it.

But to get back to my whipping pony, the reason GDP has become less a measure of "Product" than of Froth is that tangible products require material resources, labor and energy to produce and all three are becoming more expensive. Look at this chart and imagine the gap between the red and blue line as froth, just the churning of chips as the gamblers bet against one another.

Link

I think it is no coincidence that both of our largest modern bank crises came within this period of rising froth and were based on making loans to people who were not qualified, on properties that were overvalued in a market that was intentionally under-regulated. And not coincidentally, all 3 big bank crisis including the Great Depression occurred in a period of big changes in energy. The GD when cheap oil was changing everything, the S&L crisis after the US peak and subsequent glut of new supplies; and of course the Last Depression resulting in part from the peak of cheap oil and the end of Drive-'Til-You-Qualify home buyers.

One of Gail's best posts I think . .

Gail does some fancy math in her post showing the correlation between energy per capita and growth but that shouldn't come as a real surprise. What is a surprise, is how few economists seem to even consider energy as part of the equation or that the decoupling of energy from GDP actually has created the decoupling of "Product" from GDP and created GDF (Gross Domestic Froth).

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Secular stagnation

.

Yes I am constantly surprised by macro economists treating coal or oil as a commodity like coffee .

As for GDP , it's an index with plenty of failings , not least that it doesn't measure the "invisible" economy

the treatment of debt as asset is a minefield ,some "assets" are wrongly priced

the theory is that it balance itself in the long run

.....that's why crashes are good by the way , preventing them only let a sickness fester

but all in all it's as good a metric as one can get ,useful as an indication , not as gospel truth

Yes I am constantly surprised by macro economists treating coal or oil as a commodity like coffee .

As for GDP , it's an index with plenty of failings , not least that it doesn't measure the "invisible" economy

the treatment of debt as asset is a minefield ,some "assets" are wrongly priced

the theory is that it balance itself in the long run

.....that's why crashes are good by the way , preventing them only let a sickness fester

but all in all it's as good a metric as one can get ,useful as an indication , not as gospel truth

-

sparky - Intermediate Crude

- Posts: 3587

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Sydney , OZ

Re: Secular stagnation

It took some searching, but I found one economist who isn't a complete idiot on the subject of secular stagnation and biophysical limits. This paper sheds some more light on the theoretical assumptions being made by Summers and Krugman, plus adds a dose of peak oil

Secular Stagnation and the Failed Growth Economy [PDF] by Kent Klitgaard, Professor of Economics, Wells College

I added some paragraph breaks to deal with the text wall

Secular Stagnation and the Failed Growth Economy [PDF] by Kent Klitgaard, Professor of Economics, Wells College

I added some paragraph breaks to deal with the text wall

Economic Growth is the Holy Grail of mainstream macroeconomic theory. Although a focus on accumulation has existed since the inception of economics as a discipline, the current emphasis on growth was developed in the years following the Great Depression of the 1930s. Growth developed as an explicit strategy to meet the social need for employment and an increase in material standards of living without

confronting the politically unpopular (at least in the United States) strategy of income redistribution from the wealthy to the poor.

Unfortunately the growth economy is subject to three sets of limits, and there is increasing evidence that human economies are presently facing these limits. The first set of limits are internal and are found in the dynamics of capital accumulation, specifically as regards investment. When these limits are reached the economy stagnates, either cyclically or over the long term (secularly).

A second set of biophysical limits exist, manifest on the supply side as peak oil and on the sustainability or assimilation side as human induced climate change. In addition a host of other adverse growth-generated phenomena such as mass extinction, acidification of the oceans, and an ecological footprint that exceeds biocapacity are appearing on a world scale.

A final set of limits exists in the political process. The post World War II years in the United States witnessed the construction of a series of growth coalitions, whose political agendas of acquiring more for their constituents required economic growth to maintain their legitimacy. As the capacity for growth declines so too does the ability to grow one’s way out of social dilemmas. The inability to grow compromises business-as-usual politics as well as economics.

...

When long-term strategies for growth succumb to internal or biophysical limits they do not immediately give way to superior strategies. Instead the nation often becomes mired in a period of political impasse. The twentieth century in the United States was dominated by periods of impasse. The accepted vision of the self-regulating economy was dashed by the severity of the great depression, and after nearly half a decade a new vision emerged in the form of the New Deal. This vision of a managed economy and a positive state survived until the limits of effectiveness were reached in the early 1970s.

The liberal growth agenda, driven by increasing household incomes, could not survive the peak of US oil production, the beginning of the decline of US political power, and the onset of stagflation. A long period of impasse followed, only broken in the early 1980s with the election of Ronald Reagan to the presidency and the implementation of a conservative (neoliberal) growth agenda grounded in the reduction of production costs and the expansion of unregulated financial markets.

We are currently witnessing another such period of political impasse. Unregulated financial markets collapsed in a global financial meltdown in 2008. However providers of financial services are not yet ready to abandon business as usual. A restructuring of global rules languishes as the pressure on economies of the Eurozone to reduce debt threatens, once again, the stability of the world economy.

The result of the historical conjuncture of these limits results in The Failed Growth Economy: an economy that must produce growth in order to provide for profits and employment yet at the same time simply cannot produce this requisite growth.

...

So the coming of peak oil may have the same type of dual effect that Domar posed as a problem as regards investment. If a country adapts an easy money policy the risk of system-wide financial collapse increases as does the marketing of increasing quantities of lower quality securities spreads. If the nation runs a contractionary monetary policy the risk of stagflation becomes more probable. Furthermore, especially in the United States, peak oil threatens the demand side of the equation by reducing discretionary income....

Clearly the intersection of internal and biophysical limits will impact not only the growth possibilities of the system but also adversely affect the lives of everyday citizens, especially the most vulnerable.

A garden will make your rations go further.

-

Loki - Expert

- Posts: 3509

- Joined: Sat 08 Apr 2006, 03:00:00

- Location: Oregon

Re: Secular stagnation

Pops wrote:I'm no economist and don't play one on the internet but my horsey says much of the product measured by official GDP numbers now isn't "product" at all but just froth, balance sheet croupiers profiting from the movement of bytes here to there.

True of course, divorces, chemo sessions, auto accidents, liar loans, morbid obesity, killer drones, foot fungus, Rush Limbaugh, etc., are all good for GDP. Not to mention innovative financial products and robot traders. Those are GREAT for GDP.

Still, the chart I posted above displaying the expected GDP vs. the actual GDP shows why the mainstream macroeconomists are so worried. Even by their own deeply flawed metric the growth requirements of our economy are not being met. Secular stagnation is a serious threat to our current economic paradigm, and it's making Summers et al. squirm in their pants.

Just imagine if Summers knew about peak oil. He might go full-blown Savinar

ETA: Just found this chart showing what Summers et al. are seeing in our future. Japan.

LINK

A garden will make your rations go further.

-

Loki - Expert

- Posts: 3509

- Joined: Sat 08 Apr 2006, 03:00:00

- Location: Oregon

Re: Secular stagnation

Excellent Loki, if I'd have known about Professor Klitgaard, I could have C&Ped, saving myself composing about 5,000 posts - I'd still have skin on my typing finger!

Getting from here to there...

Unemployment and trickle up cash surplus:

FIRE economy

More of the same from degrowth.org

http://www.degrowth.org/publications

Getting from here to there...

But if a system is in overshoot already that system cannot grow its way into steady-state equilibrium. But a reduction in growth plunges the economy into recession. One cannot grow and shrink at the same time. Rational behavior on the individual level is irrational at the systemic level, just as rational behavior on ecological level is irrational on the economic level.

Unemployment and trickle up cash surplus:

The fundamental economic problem in the era of monopoly capitalism is the inability to absorb, or find adequate spending outlets for, the rising economic surplus. In other words, surplus that is not absorbed [today] is not produced [tomorrow]. This rising surplus leaves its statistical trace as excess capacity and unemployment.

FIRE economy

y. Instead of being a parasitical usurper of funds that would naturally lead to productivity increases when invested in productive capacity, Magdoff and Sweezy assert that the rise of the financial services sector has been the primary means by which the stagnation of the real economy has been kept at bay

More of the same from degrowth.org

http://www.degrowth.org/publications

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

16 posts

• Page 1 of 1

Who is online

Users browsing this forum: No registered users and 34 guests