copious.abundance wrote:U.S. stocks on Tuesday closed 2013 at records, with the S&P 500 posting its largest annual jump in 16 years and the Dow its biggest gain in 18

Yes, yes, we've already established your 5% recovery hypothesis.

As for the other 95% of Americans....

Many Americans feel economy isn't improving

Despite a recent string of positive economic news, Americans say they aren't feeling the improvements.

A new CNN/ORC poll released Friday showed people were pessimistic that the economy was improving. Nearly 70% said the economy is generally in poor shape, and only 32% rated it good.

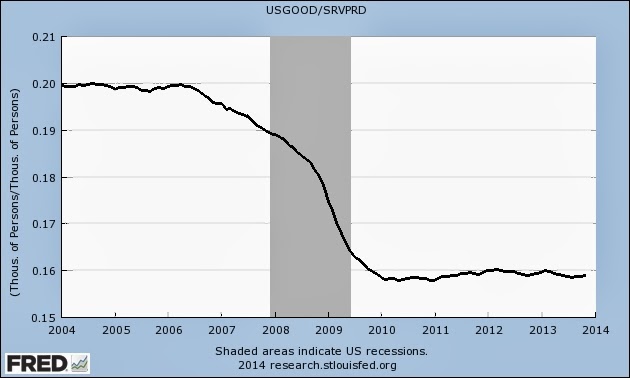

Comparative Indicators for the Recovery

Household Incomes Remain Flat Despite Improving Economy

WASHINGTON — Despite the addition of more than two million jobs last year, soaring corporate profits and continuing economic growth, income for the typical American household did not rise in 2012 and poverty failed to fall, new data from the Census Bureau show.

The poverty and income numbers are a metaphor for the entire economy,” said Ron Haskins of the Brookings Institution. “Everything’s on hold, but at a bad level.”

Over a longer perspective, the figures reveal that the income of the median American household today, adjusted for inflation, is no higher than it was for the equivalent household in the late 1980s.