Conclusions

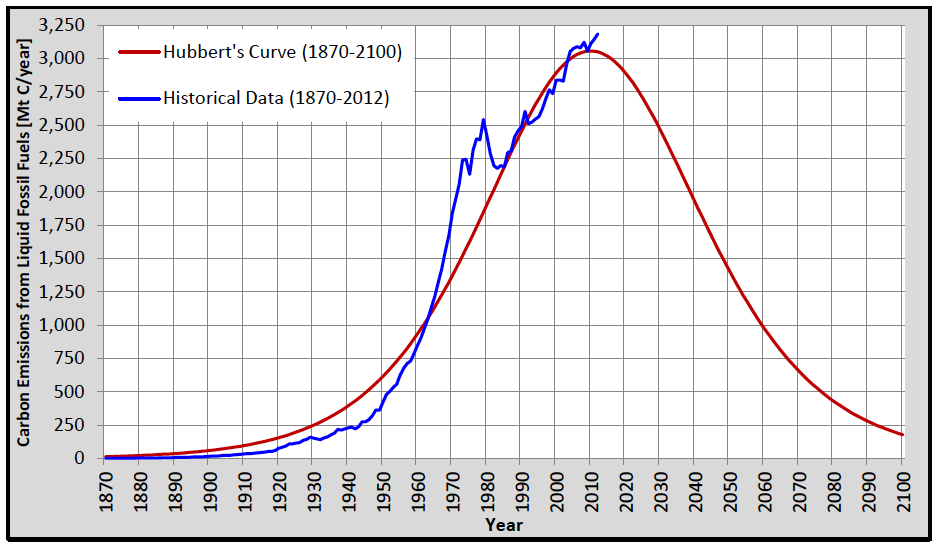

Based on CDIAC’s global data of carbon emissions from liquid fossil fuels (i.e. predominantly petroleum) and Marion King Hubbert’s method of calculating the oil production curve, we have arrived at a theoretical emissions peak of carbon from liquid fossil fuels (i.e. oil production peak) in 2010.

Compared to earlier forecasts of oil-geologists and other experts using Hubbert’s methodology, the calculations based on CDIAC data get quite close to the mark. Most of these experts (like Collin Campbell, Jean Laherrère, Kenneth Deffeyes and Matthew Simmons) forecast peak-oil between 2005 and 2010, so the CDIAC data turn out to be a fairly reliable source for this purpose.

Theoretically, we’re already 4 years past the peak, although historical data still show growth. This is very well possible for a limited period of time. Given the frantic drilling and fracking spree we’ve seen since about 2007, it’s not even surprising. Extraction methods have improved as well over the last decade or so: horizontal drilling, hydraulic fracturing, deep-sea drilling, more accurate 3D soundings of geological formations, etc. The much higher oil price has also made it worthwhile to drill for harder-to-get oil. So, the ultimately recoverable amount of oil has increased indeed (though I don’t know by how much) and this is not (yet) reflected in the historical data.

Recent Developments

Since a few years, there has been a lot of talk that there are so much fossil fuel reserves left that we can only responsibly burn about one third of them (leaving two-thirds in the ground) in order to keep global warming below 2°C (IEA, 2012). This also implies that the shares of fossil fuel companies are over-valued by up to 80% (Carbon Tracker, 2012; Carbon Tracker, 2013). However, there are several caveats against this analysis:

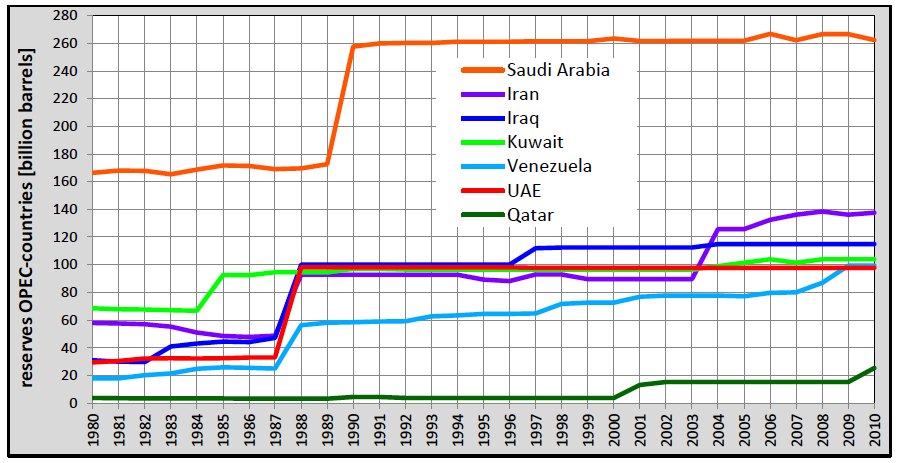

The reserves are based on stated reserves of fossil fuel companies and governments, but we don’t know to what extent these reserves are overstated. Of the OPEC-countries it’s quite obvious that (for political motives) they overstated their reserves dramatically between 1987 and 1990. The sudden jumps in stated reserves were not accompanied by announcements of newfound oil fields. Also, it doesn’t add up that oil reserves have remained virtually constant during decades of high rates of oil production and low rates of new discoveries:

Source: own compilation of U.S. Energy Information Administration data (EIA, 2013)

- It’s not the amount of fossil fuel reserves that counts; it’s the rate at which they can be extracted. The big oilfields with high quality and easy to get petroleum are mostly depleted. We are now looking for ever smaller fields in ever harder to reach locations, like the ocean floors and the arctic. When it’s ever harder to get the oil, this will result in a slowdown of the rate of extraction (i.e. going down the other side of Hubbert’s curve).

- The Energy Return on Energy Invested (EROEI) has already gone down seriously. The EROEI is an analysis of how much energy it takes to produce fossil energy (produce materials and operate machinery needed to construct the facilities to drill for oil and get it to the market, like drilling rigs, pipelines, oil tankers, refineries, etc.) and how much energy you get from all this. The EROEI used to be 100:1 in the 1930s – 1950s. Talking about tar sands the EROEI is already down to something like 5:1. This means that for every 5 barrels of oil (equivalent) one has to be invested into getting it, 4 are left as “profit”. Once it takes one barrel of oil to get one barrel of oil, there won’t be any profit left and it’s pointless to continue. Actually well before this point (say 2:1) because an oil company needs to sell at least some oil to pay for the investments in wages and equipment.

- The cost of oil extraction is already such that the oil price has to be above $100/barrel in order to be profitable. On the other hand, how high a fossil fuel price can the world economy afford in order to function healthily? We’ve seen the world economy crash into the Great Recession in 2008, when the oil price soared to $147/barrel (I daresay it wasn’t exactly a housing bubble…) and the price is again hovering around $100/barrel. No wonder economic growth doesn’t want to pick up! Oil consumption simply responds to the economic law of supply and demand. When oil gets too expensive, people will turn to cheaper alternatives and oil consumption goes down (the other side of Hubbert’s curve) just the same.

So there are many ways to look at peak-oil (environmental, geological, economical, social, etc.). One way doesn’t exclude the other, so I surely don’t want to contribute to infighting between peak-oilists and environmentalists. Both are right and allies to the same cause: we have to think hard and take swift action to create a sustainable way of living in harmony with the world wide web of life on our planet, in order to prove that human intelligence was not an evolutionary error.

Read full essay here:

http://collapseofindustrialcivilization ... -yourself/