Cost of shale oil gasoline

First unread post • 17 posts

• Page 1 of 1

Cost of shale oil gasoline

Pretend that, in 2020, the United States gets 100% of its gasoline from American shale oil. Yes, I know that has implications and implausibilities galore, I'm just trying to get a hypothetical "perfect case" for fracking...like a vet saying "First, assume a spherical dog..."

How much would a gallon of gasoline cost, assuming no inflation?

How much would a gallon of gasoline cost, assuming no inflation?

- tmazanec1

- Tar Sands

- Posts: 506

- Joined: Tue 12 Oct 2004, 03:00:00

Re: Cost of shale oil gasoline

tmazanec1 wrote:Pretend that, in 2020, the United States gets 100% of its gasoline from American shale oil. Yes, I know that has implications and implausibilities galore, I'm just trying to get a hypothetical "perfect case" for fracking...like a vet saying "First, assume a spherical dog..."

How much would a gallon of gasoline cost, assuming no inflation?

OK pretend I know something about drilling costs and we can take a stab at it. Let's say that high prices have cut demand for gas down to four million barrels a day just to make it easier. Now lets assume that your average tight oil well produces 100,000 barrels of oil over it's lifetime of say ten years. So with a whole flock of them some new and some old they average 10,000 barrels per well per year. Crunch the numbers... 4,000,000 x365= 1,460,000,000 barrels per year demand. 1,460,000,000/ 10,000bpw=146,000 wells ( and the need to drill 14,600 replacement good wells each year). That,s a lot of holes and at about a half million a pop a lot of money. Then throw in three dry holes for every good one and your up to two million per good hole. That works out to just $20 per barrel at the well head so I'm way off in one of my assumptions here. Anybody see it?

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: Cost of shale oil gasoline

Yair . . . Ummm . . . two million per hole . . . ?

Cheers.

Cheers.

- Scrub Puller

- Lignite

- Posts: 296

- Joined: Sun 07 Apr 2013, 13:20:59

Re: Cost of shale oil gasoline

tmazanec1 wrote:Pretend that, in 2020, the United States gets 100% of its gasoline from American shale oil.....How much would a gallon of gasoline cost, assuming no inflation?

Some parts of the US ALREADY get 100% of their gasoline from American shale oil. We can use them as a "real-world" experiment to see how much gasoline from American shale oil costs.

Right now in Fargo North Dakota, which gets 100% of its gasoline from American shale oil, the average cost of a gallon of unleaded is $3.26. If you're willing to buy your gas at a mini-mart, you can get it for $3.20.

shale oil gasoline prices

Eyup. $3.20 a gallon in Fargo. And its 100% shale oil gasoline, too!

-

Plantagenet - Expert

- Posts: 26628

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Cost of shale oil gasoline

It's cheap enough to keep producing it.

It will be until it isn't.

It will be until it isn't.

Stop filling dumpsters, as much as you possibly can, and everything will get better.

Just think it through.

It's not hard to do.

Just think it through.

It's not hard to do.

-

MD - COB

- Posts: 4953

- Joined: Mon 02 May 2005, 03:00:00

- Location: On the ball

Re: Cost of shale oil gasoline

"...and at about a half million a pop a lot of money". Unfortunately you're not even in the same universe. The typical current completed Eagle Ford Shale well is running $5 million to $10 million and that doesn't include the land cost. But, more important, how much it cost to drill any oil well has no bearing on that we sell the oil for. Refiners buy our oil and they neither know nor care what we spent. Never have...never will. I've sold oil/NG for both more and less then it cost to get it out the ground. Oil/NG is priced by the market dynamics at the time it's being produced. Consider the recent shale gas play in East Texas. An operator puts his $6 million well on production and sells for $12/mcf. Two years later the NG market crumbles and he's selling NG from the same well for $5/mcf. And no: very few operators can afford cutting a well back to wait for higher prices. The cash flow, even at a reduced rate that means he'll never recover the total investment, is typically the priority and the profit margin isn't.

It's the anticipated price that oil/NG will be sold for that determines what gets drilled and thus how much of those commodities ultimately reach the market. Think about it: when you fill your car up in Michigan do you pay me my cost + profit for oil from my well in Texas or do you pay the max price for gasoline they can charge in Detroit?

It's the anticipated price that oil/NG will be sold for that determines what gets drilled and thus how much of those commodities ultimately reach the market. Think about it: when you fill your car up in Michigan do you pay me my cost + profit for oil from my well in Texas or do you pay the max price for gasoline they can charge in Detroit?

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Cost of shale oil gasoline

I don't doubt any of that. I did get that half million figure off the web and it was for wells a mile deep in Texas. Just shows that you cant believe everything you see on the web.ROCKMAN wrote:"...and at about a half million a pop a lot of money". Unfortunately you're not even in the same universe. The typical current completed Eagle Ford Shale well is running $5 million to $10 million and that doesn't include the land cost. But, more important, how much it cost to drill any oil well has no bearing on that we sell the oil for. Refiners buy our oil and they neither know nor care what we spent. Never have...never will. I've sold oil/NG for both more and less then it cost to get it out the ground. Oil/NG is priced by the market dynamics at the time it's being produced. Consider the recent shale gas play in East Texas. An operator puts his $6 million well on production and sells for $12/mcf. Two years later the NG market crumbles and he's selling NG from the same well for $5/mcf. And no: very few operators can afford cutting a well back to wait for higher prices. The cash flow, even at a reduced rate that means he'll never recover the total investment, is typically the priority and the profit margin isn't.

It's the anticipated price that oil/NG will be sold for that determines what gets drilled and thus how much of those commodities ultimately reach the market. Think about it: when you fill your car up in Michigan do you pay me my cost + profit for oil from my well in Texas or do you pay the max price for gasoline they can charge in Detroit?

So at what "anticipated price will we need to get 146,000 wells drilled in the US?

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: Cost of shale oil gasoline

Doesn't matter how it is extracted and as long as drillers can make a profit it doesn't matter how much it costs to extract, all that matters is how much there is, and how much buyers want and can pay.

Supply of course depends on whether the refiners are set up for whatever type of oil is being extracted. How far it is shipped and of course how much tax you pay locally (ND has low tax) is a fixed amount but mostly it is a matter of supply and demand.

If there is an increase in production to say 100Mb/d of oil and oilish stuff on the market in 2020 the price will probably be somewhere around where it is today - if the customers can pay that much. How much the customer can and is willing to pay of course is most important.

If the economy goes into overdrive and oil supply doesn't, the price will rise.

If on the other hand, the economy goes in the toilet and the production plateau continues, the price will likely fall.

Or maybe we all decide to carpool and ride bikes - the price falls

KSA & RU melt down the price spikes.

tight shale oil is found to be a ponzi - well ...

--

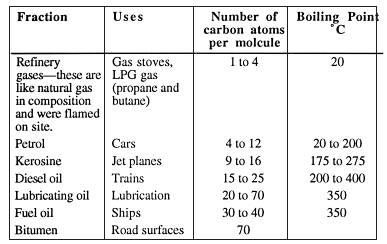

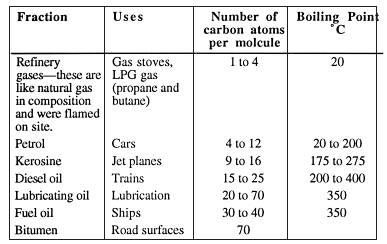

But having said all that, the "problem" with LTO as I see it, is that it contains a greater percentage of the lighter oil fractions: ethane to butane, and not so much of the heavier pentane+ fractions than refiners are used to processing into petrol and diesel and kero, at least here in the US. I posted elsewhere the makeup of the increase in US "oil" and a good percentage is those light factions. That pretty well argues that the volume of LTO extracted would need to increase dramatically in order to replace conventional crude.

Additionally the energy content is less in those light factions so there is simply less bang for the barrel. I'm no chemist but that is my take on the situation and why even with a great deal more LTO extraction the price of "oil" hasn't fallen much. In fact lots of LTO is being sent north to dilute tar so that the tar can be shipped and processed rather than the LTO being processed by itself, in that regard it is more a carrier of energy than a source - more like paint thinner than paint.

In the same vein, we all heard that the first shipment of "condensate" (read "frac oil") left port last week - I don't know for sure what the eventual destination is but the buyer owns a polypropylene plant and it makes sense to me that they will be making plastic rather than diesel with that shipment.

Or, to answer the question another way:

it depends

.

Supply of course depends on whether the refiners are set up for whatever type of oil is being extracted. How far it is shipped and of course how much tax you pay locally (ND has low tax) is a fixed amount but mostly it is a matter of supply and demand.

If there is an increase in production to say 100Mb/d of oil and oilish stuff on the market in 2020 the price will probably be somewhere around where it is today - if the customers can pay that much. How much the customer can and is willing to pay of course is most important.

If the economy goes into overdrive and oil supply doesn't, the price will rise.

If on the other hand, the economy goes in the toilet and the production plateau continues, the price will likely fall.

Or maybe we all decide to carpool and ride bikes - the price falls

KSA & RU melt down the price spikes.

tight shale oil is found to be a ponzi - well ...

--

But having said all that, the "problem" with LTO as I see it, is that it contains a greater percentage of the lighter oil fractions: ethane to butane, and not so much of the heavier pentane+ fractions than refiners are used to processing into petrol and diesel and kero, at least here in the US. I posted elsewhere the makeup of the increase in US "oil" and a good percentage is those light factions. That pretty well argues that the volume of LTO extracted would need to increase dramatically in order to replace conventional crude.

Additionally the energy content is less in those light factions so there is simply less bang for the barrel. I'm no chemist but that is my take on the situation and why even with a great deal more LTO extraction the price of "oil" hasn't fallen much. In fact lots of LTO is being sent north to dilute tar so that the tar can be shipped and processed rather than the LTO being processed by itself, in that regard it is more a carrier of energy than a source - more like paint thinner than paint.

In the same vein, we all heard that the first shipment of "condensate" (read "frac oil") left port last week - I don't know for sure what the eventual destination is but the buyer owns a polypropylene plant and it makes sense to me that they will be making plastic rather than diesel with that shipment.

Or, to answer the question another way:

it depends

.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Cost of shale oil gasoline

Pops you make it sound like tight light oil blended with tar sands bitumen to make it pump-able is then discarded when it reaches the refinery. My understanding is, it gets cracked and becomes part of the marketable products refined out of the syn-crude. So barrels in equals barrels out plus refinery gains. Do I have that wrong?

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: Cost of shale oil gasoline

I think that's right, vt.

But when it is cracked it is still light factions it doesn't chemically mix - I don't think. My point is that from a profit standpoint, it is worth more as a diluent, even with the cost of freighting it north, than as a feedstock in its own right because the refineries have switched to preferring heavy and x-heavy. I linked a story where the refiners were complaining that drillers were mixing so much condensate into the "regular" crude oil stream (to get an "oil" price from the condensate) that the refiners were getting jipped.

I think Rock actually dug up a plan to separate (boil) it (LTO) off once the tar gets to the gulf refineries and ship the LTO back north again?

But when it is cracked it is still light factions it doesn't chemically mix - I don't think. My point is that from a profit standpoint, it is worth more as a diluent, even with the cost of freighting it north, than as a feedstock in its own right because the refineries have switched to preferring heavy and x-heavy. I linked a story where the refiners were complaining that drillers were mixing so much condensate into the "regular" crude oil stream (to get an "oil" price from the condensate) that the refiners were getting jipped.

I think Rock actually dug up a plan to separate (boil) it (LTO) off once the tar gets to the gulf refineries and ship the LTO back north again?

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Cost of shale oil gasoline

Pops wrote:I think that's right, vt.

But when it is cracked it is still light factions it doesn't chemically mix - I don't think. My point is that from a profit standpoint, it is worth more as a diluent, even with the cost of freighting it north, than as a feedstock in its own right because the refineries have switched to preferring heavy and x-heavy. I linked a story where the refiners were complaining that drillers were mixing so much condensate into the "regular" crude oil stream (to get an "oil" price from the condensate) that the refiners were getting jipped.

I think Rock actually dug up a plan to separate (boil) it (LTO) off once the tar gets to the gulf refineries and ship the LTO back north again?

My grade school understanding of cracking is that if you just heat and distill crude you get a certain proportion of diesel, gasoline , propane etc. based on weight and quality of the crude but if you place the crude under pressure while you heat and distill it (ie. crack it) you can increase or control the ratio of diesel to gasoline within limits to meet market demands. That would imply that some molecules of hydrocarbon get either linked up or broken down during the process.

Actual results may vary. !!

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: Cost of shale oil gasoline

But if it takes more heat and pressure to turn the factions with lower energy content into those with higher content you aren't gaining anything. Well you are gaining the preferred form of liquid but not gaining energy. I'm guessing tho.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Cost of shale oil gasoline

You are correct, thermodynamic laws will not be denied or ignored. EROEI is lower for the shale oils than say light sweet Arabian crude.

KaiserJeep 2.0, Neural Subnode 0010 0000 0001 0110 - 1001 0011 0011, Tertiary Adjunct to Unimatrix 0000 0000 0001

Resistance is Futile, YOU will be Assimilated.

Warning: Messages timestamped before April 1, 2016, 06:00 PST were posted by the unmodified human KaiserJeep 1.0

Resistance is Futile, YOU will be Assimilated.

Warning: Messages timestamped before April 1, 2016, 06:00 PST were posted by the unmodified human KaiserJeep 1.0

- KaiserJeep

- Light Sweet Crude

- Posts: 6094

- Joined: Tue 06 Aug 2013, 17:16:32

- Location: Wisconsin's Dreamland

Re: Cost of shale oil gasoline

Pops wrote:But if it takes more heat and pressure to turn the factions with lower energy content into those with higher content you aren't gaining anything. Well you are gaining the preferred form of liquid but not gaining energy. I'm guessing tho.

What do they burn at the refinery to create the heat and pressure needed to do the cracking? Could that be done with excess volitols from the light oil fraction of the syn-crude?

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: Cost of shale oil gasoline

vt - First, your $1 million per mile deep hole is a good number but for a straight hole with a conventional completion. But not for a horizontal hole that might be at the same vertical depth but could be 2X to 3X as long and frac’d 20+ times. So the web was correct but for the wrong type of hole.

Refinery energy: NG is a common component which is one of the reasons refineries tend to be located in the Gulf Coast where supplies tend to be abundant. As I just point out elsewhere it looks like we’re getting about the same refined product yields today as we were before the shale/condensate boom. But we can make high value motor fuels etc. out of any hydrocarbon…even NG. It just costs more to do so. I’m not a refinery expert but I don’t think we’re any less capable of producing the products we need because the “oil”, however it might be defined today, is still yielding what we require. It just costs more to get it to that finished product.

Refinery energy: NG is a common component which is one of the reasons refineries tend to be located in the Gulf Coast where supplies tend to be abundant. As I just point out elsewhere it looks like we’re getting about the same refined product yields today as we were before the shale/condensate boom. But we can make high value motor fuels etc. out of any hydrocarbon…even NG. It just costs more to do so. I’m not a refinery expert but I don’t think we’re any less capable of producing the products we need because the “oil”, however it might be defined today, is still yielding what we require. It just costs more to get it to that finished product.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Cost of shale oil gasoline

Speaking of refinery capabilities and shale oil. BTW though not as recognizable as Chesapeake EOG is one of the major shale oil players:

Reuters - EOG Resources Inc, which produces oil and natural gas in North Dakota and Texas, said on Wednesday that while it supports U.S. exports of crude oil, it believes the North American refining market can absorb the production from shale formations. "Even without exports, we still see several years of headroom in the North American refining market," Chief Executive Officer William Thomas said on a conference call with investors. Several companies have begun exporting so-called "stabilized condensate," a lightly processed form of ultra-light crude oil, although it is unclear how much processing is required to legally sell U.S. crude oil abroad. The U.S. Commerce Department is studying the matter now.

Separately, EOG said it plans to use newer rail cars to ship its crude oil as its leases for existing DOT-111 models end. The DOT-111 tank car, the model used almost exclusively to ship oil by rail, has been criticized as not strong enough after a string of recent derailments and explosions, and many in the industry have pushed for updated models. "We will be going with the cars of the future," Thomas said.

Reuters - EOG Resources Inc, which produces oil and natural gas in North Dakota and Texas, said on Wednesday that while it supports U.S. exports of crude oil, it believes the North American refining market can absorb the production from shale formations. "Even without exports, we still see several years of headroom in the North American refining market," Chief Executive Officer William Thomas said on a conference call with investors. Several companies have begun exporting so-called "stabilized condensate," a lightly processed form of ultra-light crude oil, although it is unclear how much processing is required to legally sell U.S. crude oil abroad. The U.S. Commerce Department is studying the matter now.

Separately, EOG said it plans to use newer rail cars to ship its crude oil as its leases for existing DOT-111 models end. The DOT-111 tank car, the model used almost exclusively to ship oil by rail, has been criticized as not strong enough after a string of recent derailments and explosions, and many in the industry have pushed for updated models. "We will be going with the cars of the future," Thomas said.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

17 posts

• Page 1 of 1

Who is online

Users browsing this forum: No registered users and 9 guests