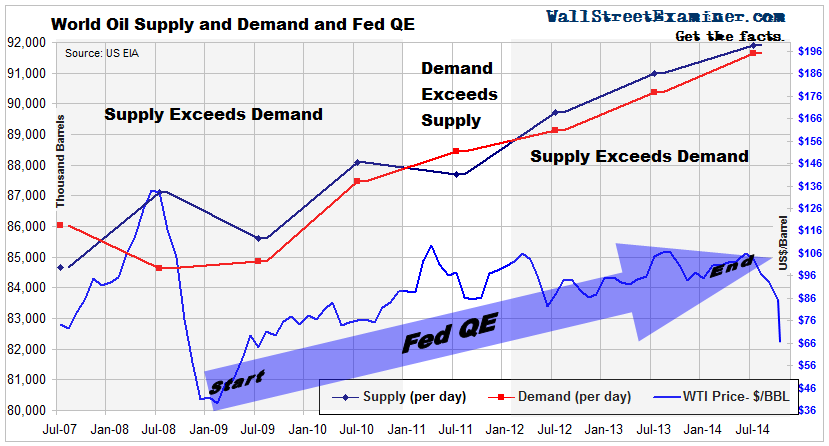

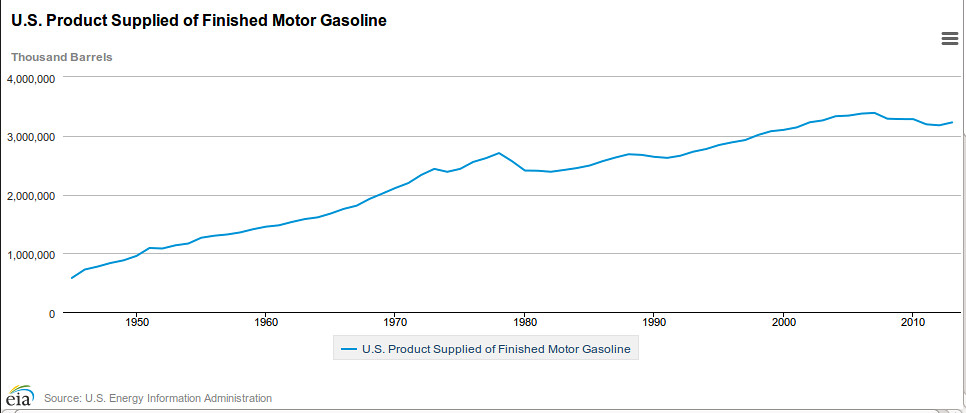

The price of oil has finally started to obey the law. What law is that? The Law of Supply and Demand. Thanks to the US fracking boom that has done this (see chart) to US production, the supply of oil worldwide has outstripped demand since 2012. So why haven’t prices fallen before this summer? And are falling oil prices now a good thing? Or not?

While US production was exploding, other countries had level or declining production. Meanwhile consumption was falling in developed nations, but the developing world more than made up for that. Worldwide consumption has been steadily increasing since 2009. However, because of the US fracking boom, with the exception of 2011 supply has exceeded demand. Prices should have been declining since 2012, right?

[snip]

The oil price experience is a perfect illustration of what happens when central banks promote over speculation in commodities and commodity production. As the lifeblood of both industrial production and transportation, and as a money substitute, oil is the most important commodity in the world. A bubble economy built on the back of oil price speculation and production is placed at enormous risk when the price of the underlying good collapses. A boom built on virtually free and unlimited financing becomes a ticking time bomb when the value of the collateral collapses. The only policy solution offered is extend, pretend, and pray. How many times that will work, and for how long is anyone’s guess.

We got an object lesson from the collapse of the housing bubble. Clearly central bankers did not learn the lesson. They are about to get taught again. No doubt the mass of middle class workers and consumers will again become collateral damage as central bankers seek first and foremost to preserve their constituents, the banks and bankers who feed at the central bank trough.

Read it all here: http://davidstockmanscontracorner.com/w ... -disaster/