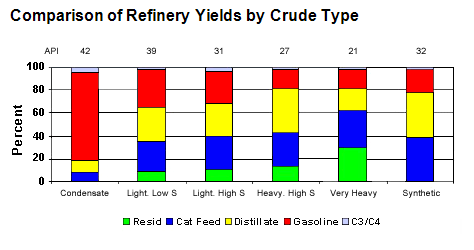

If actual crude oil in storage (45 and lower API gravity) is reaching catastrophically high levels, why are we still importing about 44% of the crude oil feedstock for refineries?

I looked up some US Crude + Condensate (C+C), US C+C refinery input and net C+C import numbers for comparison (all four week running average data), with the same C+C refinery inputs (15.4 mbpd):

Week ending:

7/3/08

US C+C Production: 5.1 mbpd

US C+C Refinery Inputs: 15.4

US Net C+C Imports: 10.0

1/30/15:

US C+C Production: 9.2 mbpd (Up 4.1)

US C +C Refinery Inputs: 15.4 (Flat)

US Net C+C Imports: 6.9 (Down 3.1)

Note the gap between the increase in production (4.1) and the decline in net imports (3.1).

Another way to view it is as the sum of US C+C production and net C+C imports as a percentage of C+C inputs, 98% for early July, 2008 (15.1/15.4), versus 105% for late January, 2015 (16.1/15.4). Note that the net C+C import number would take into account gross C+C exports.

As the Pemex CEO said in the article linked below, they need crude, not condensate.

So, if the total data for the past few years show a sustained excess of C+C production plus net C+C imports versus C+C refinery inputs (and said excess would presumably be mostly condensate), where would the excess domestic production be going?

Just as we don’t know for sure what the Condensate to C+C Ratio is for production, we don’t know what that ratio is for storage, and there does seem to be a mismatch between US crude oil import numbers and storage levels.

If actual crude oil in storage (45 and lower API gravity) is reaching catastrophically high levels, why are we still importing about 44% of the crude oil feedstock for refineries?

Recall what the CEO of Pemex said last year about their need for light crude oil imports, because of declining production, “Condensate is not necessarily what Mexico needs. It needs crude.”

I would argue that this statement is probably true for most refiners around the world.

Reuters: Mexico’s Pemex aims to start importing light crude this year (2014)

http://uk.reuters.com/article/2014/08/2 ... TL20140828

Aug 28 (Reuters) – Mexican state-owned oil company Pemex wants to launch light crude oil imports later this year, potentially reaching up to 70,000 barrels per day (bpd) and aimed at boosting refinery output, the head of its commercial arm said.

The imports would mark an abrupt shift from a decades-old devotion to crude oil self-sufficiency in Mexico, long a major exporter to the United States. It also comes after a sweeping energy sector overhaul which seeks to reverse many years of declining output and export volumes.

“Our objective is that (crude imports) will begin this year,” said Jose Manuel Carrera, chief executive officer of PMI Comercio Internacional, Pemex’s oil trading arm. His comments are the strongest signals to date on both the timing and potential volumes of light crude imports to Mexico. . . .

While U.S. companies Pioneer Natural Resources and Enterprise Products Partners have secured permission to ship a type of ultralight oil known as condensate to foreign buyers, Carrera all but ruled out the possibility.

“Condensate is not necessarily what Mexico needs. It needs crude,” he said.

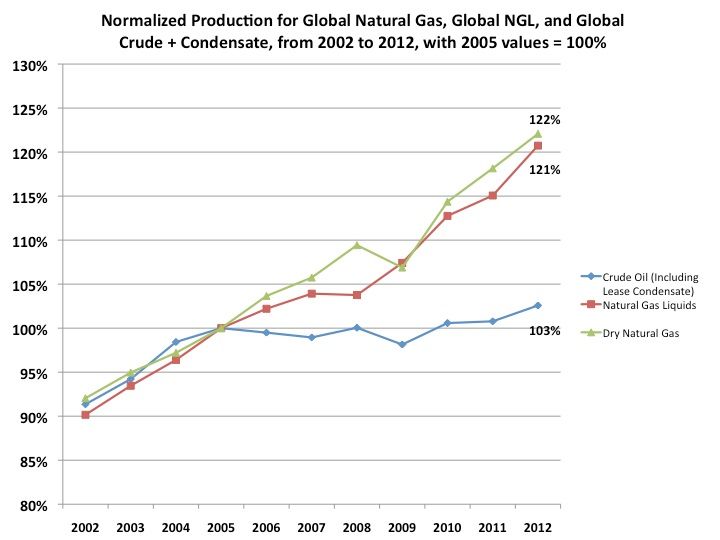

I think that the following chart showing normalized global gas, global NGL and global C+C from 2002 to 2012 really tells the tale, and I suspect that a significant portion of the global build in “Crude oil” inventories may be rising condensate levels.

Peak (Crude Oil) in Rear View Mirror?

OPEC dry gas production increased from 41 BCF/day in 2005 to 62 BCF/day in 2012 (EIA, complete 2013 data not yet available), an increase of 21 BCF/day.

Comparing OPEC (crude only) and EIA data bases (C+C) implies that OPEC condensate production increased from 1.2 mbpd in 2005 to 2.3 mbpd in 2012, an increase of 1.1 mbpd.

This was be an observed increase of 52,000 barrels of condensate (BC) per BCF/day increase in gas production, for OPEC.

The EIA shows that global dry gas production increased from 270 BCF/day in 2005 to 325 BCF/day in 2012, an increase of 55 BCF/day.

If we use the OPEC condensate to gas ratio as a guide, this implies that global condensate production rose by about 3 mbpd from 2005 to 2012. The EIA shows that global C+C rose by 2 mbpd from 2005 to 2012, which of course would imply a decline in actual global crude oil production (45 and lower API gravity crude oil).

Note that the high volume of US condensate would fall in the non-OPEC data set, so in reality the non-OPEC BC to BCF/day ratio is probably higher than the OPEC data set.

In any case, the foregoing analysis is additional support for the premise that actual global crude oil production (45 and lower API gravity crude oil) probably peaked in 2005, while global natural gas production and associated liquids, condensate and NGL, have (so far) continued to increase.