by MonteQuest » Sat 09 May 2020, 09:15:58

by MonteQuest » Sat 09 May 2020, 09:15:58

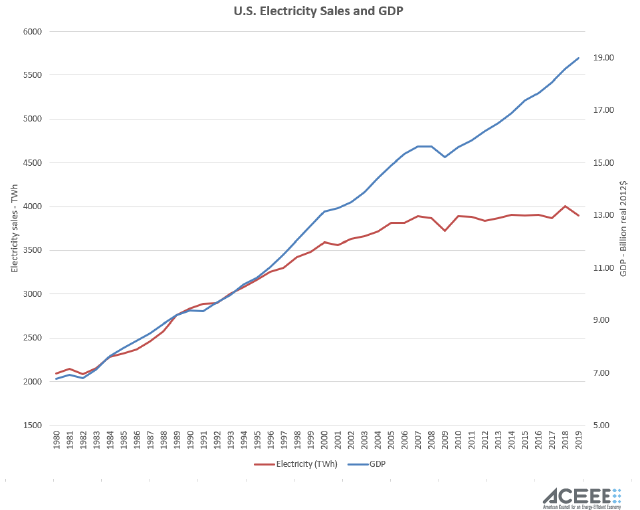

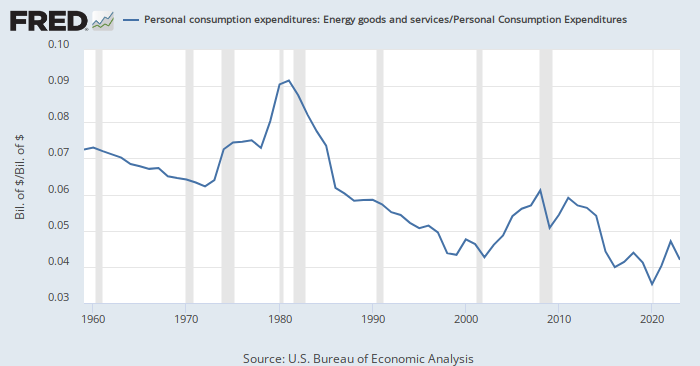

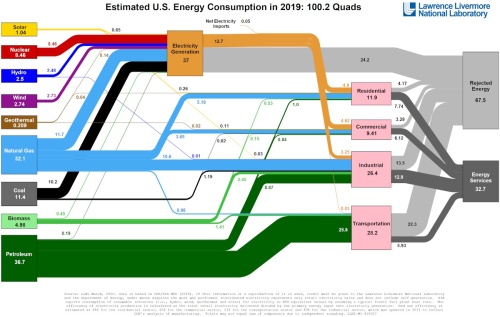

After considering Kub's arguments and reviewing the facts presented, I'll concede the following: Since U.S. GDP has grown over the last decade, yet energy per unit of GDP has declined, something must be happening beyond just declining GDP growth. It’s obvious that renewables have done little to displace FF energy use with their minuscule capture of the energy pie. And even if they did, they are still part of our primary energy supply. In fact, with a lower EROEI, modern renewables are less efficient by producing less net energy. That leaves us with the conclusions that the EIA cites:

“Worldwide energy intensity, measured as energy consumption per unit of gross domestic product (GDP), decreased by nearly one-third between 1990 and 2015. Within a region over time, several factors contribute to rising energy productivity:

• Structural changes in production and consumption (from manufacturing to service economies)

• More efficient use of resources

• Outsourcing energy-intensive activities

Between 1990 and 2015, U.S. energy productivity rose by 58%, with improvements in every sector.”—Source: EIA July 2016

So, the flattening of energy demand in the US is due to a shift to less energy-intensive activities like service industries, efficiency gains, and the outsourcing of energy-intensive activities. But since “worldwide energy intensity” has declined, where have energy-intensive activities been outsourced to? While many countries have shifted to service industries, somewhere, manufacturing is still taking place. This disparity leaves a lot of questions.

Then I found this: “The AEO2020 Reference case projects domestic energy demand to grow 0.3% per year on average through 2050, slower than the average annual growth of 1.9% in U.S. gross domestic product. This projection is largely driven by continued increases in energy efficiency in the end-use sectors.”

Then the paragraph continues and refutes the first part that claims “largely driven.”

“Gains in appliance efficiency in the residential and commercial sectors, increases in efficiency of new capital equipment in the industrial sector, and increases in fuel economy partially offset the growth in the number of households, industrial activity, and vehicle-miles traveled.”—EIA January 2020.

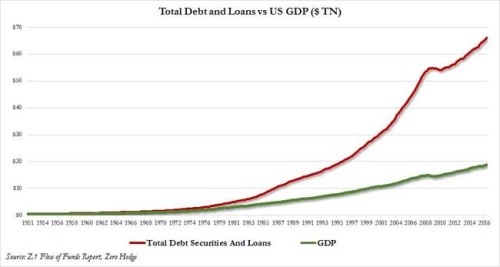

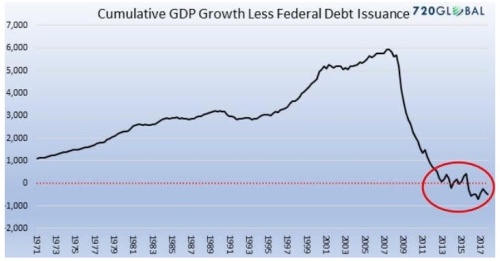

Thus efficiency gains going forward are only enough to “partially offset” new energy demand. What accounts “largely” for most of the decline in energy demand growth? Something is missing from the equation to account for the decline in energy consumption in the face of growing GDP, now, and into the future. Is it the continuing migration of economic activity away from making tangible things and toward providing services and virtual products such as games and binge-watchable TV series driving the decline? Is GDP being measured differently or factoring in debt-driven and speculative assets like real-estate sales that are spent not on goods and services, but on more speculation? Efficiency gains can't seem to account for the decline in aggregate demand, and if they did in the last decade, they won't going forward. The Law of Diminishing Returns at play.

A Saudi saying, "My father rode a camel. I drive a car. My son flies a jet-plane. His son will ride a camel."

I think that 25% would also closely apply to the US. I don't have the exact figure. Renewables have only captured a small portion of US primary energy over the last decade. The earlier charts showed that.

I think that 25% would also closely apply to the US. I don't have the exact figure. Renewables have only captured a small portion of US primary energy over the last decade. The earlier charts showed that.