theluckycountry wrote:careinke wrote:Hey All,

BTC has started it's bull run today... BTC jumped 12% so far today.

One day's action signals a bull run? Ok, that sounds like a crypto analysis. Lets say the run lasts 5 days, then we enter a new bear market for 3 weeks, sound about right?

BTC Oct 2021 $62,000

BTC Oct 2023 $35,000 (Down by 44% in 2 years)

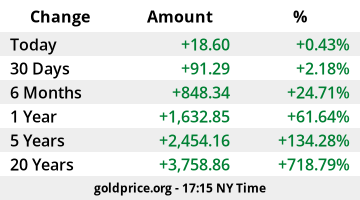

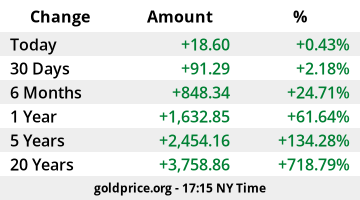

while major banks are dropping and Gold has not really moved in the last five years.

So an increase of 60% is not really moving? You see. This is the problem I have with crypto. No one involved with it has a

clue what they are talking about.

Lucky,

Sorry I was very tired when I wrote that and posted based on my unreliable memory. I'll try and do better.

What I was thinking about with the gold prices for the last three years, taking into account our inflation rate.

I asked Bard to figure this one out. Here is its response.

To calculate the current gold price using the 2021 dollar, we need to divide the current gold price by the inflation rate since 2021.

The current gold price is $1,975.70 per ounce. The inflation rate since 2021 is 14%.

Therefore, the current gold price using the 2021 dollar would be:

$1,975.70 / (1 + 14%) = $1,722.29

In other words, gold would be about $253 cheaper per ounce today if we were using the 2021 dollar.

(Note: This is just a rough estimate, as inflation rates can vary depending on the specific goods and services being measured.)

As far as the 44% BTC drop from all time to Yesterday is a big improvement over the drop from BTCs ATH to this cycles actual low.

Bard says:

According to my knowledge, Bitcoin dropped from its all-time high of $68,789.63 on November 10, 2021 to a low of $15,682.69 on November 9, 2022. This represents a drop of 77.3%.

Here is a shorter version in three sentences:

Bitcoin dropped from its all-time high of $68,789.63 to a low of $15,682.69 in 2022, a drop of 77.3%.

This is a lower drop than any previous Havening cycle, but that is expected as BTC users expand.

YTD BTC is up over 100%.

Bard Says:

According to MarketWatch, Bitcoin has increased by 106.27% year-to-date as of October 24, 2023.

This means that Bitcoin has outperformed the S&P 500 by a significant margin in 2023 so far.

Part of the recent rise, is expectations of a spot BTC ETF coming within the next 3-4 months (based on comments from the CEO of Blackrock). This will allow Boomer investors and most retirement plans the legal ability to add BTC to their portfolios.

Since the first Gold ETF, (congrats to Australia), in 2003, followed by the US in 2004, Gold prices increased significantly.

Of course I have no plans to buy any BTC ETFs. I prefer buying actual BTC.

I'm actually into BTC not for profit but to Separate Money and State as was envisioned by our founding fathers. I'm currently reading "The Sovereign Individuals" first released in 1997.

More details from Bard:

The Sovereign Individual was first published in 1997, under the title "The Sovereign Individual: How to Survive and Thrive During the Collapse of the Welfare State". It was republished in 1999 under its current title, "The Sovereign Individual: Mastering the Transition to the Information Age".

It's uncanny how accurate a lot of their predictions have played out, with more to come.

Once again I apologize for my previous post. I'll try harder.

PEACE